How to really Invest in Stocks in Malaysia?

For your information, this is the most practical and highly actionable guide on the planet investing in Malaysia stocks.

The best part?

In short, if you want to get a consistent and predictable return from the Malaysia stocks market , you will love this guide.

Let’s get started.

Table of Contents

This is truly your fast-track guide to profitable stocks investing. Packed with actionable tips to invest in stocks, including opening a brokerage account & buying the best dividend stocks.

In addition to investing directly by buying shares in the stock market, there are other ways to invest into stocks indirectly in any stock market.

You see, there are a lot of misconceptions around because many newbies are taking stocks investing advice from all the unproven stocks investment gurus or trainers out there, telling you the only way to make big + fast money…

…is to invest directly into stock markets.

But NOT in this guide. Read more below to understand why.

Truth be told…

Some of these trainers probably made more money from promoting their stocks investment course/stock market course/stock trading course, rather than actually hands-on investing or managing million of clients money in the stock market.

Worse, some of them are only bloggers who only know how to write fantastic articles, feeding you with theories and their own narrow one-man experience, rather than practical, diverse experience from a broad perspective.

My credibility in stock market investing comes from the fact that in addition to managing multi-millions equity investment portfolio for clients as an independent financial adviser (not a stock advisor or a value investing guru), I’m also sought after by corporate financial organizations (like fund houses, financial associations and reputable banks) for my investment expertise, to conduct workshops & seminars for their internal staff

How to Select Stocks to Invest into

Start within your circle of competency – what you are good at and have interest in. That could be your job or business. For example, if you work in the retail industry, start with Fu0026amp;B or consumer goods shares like Nestle, Padini, Berjaya Food, Starbucks etc

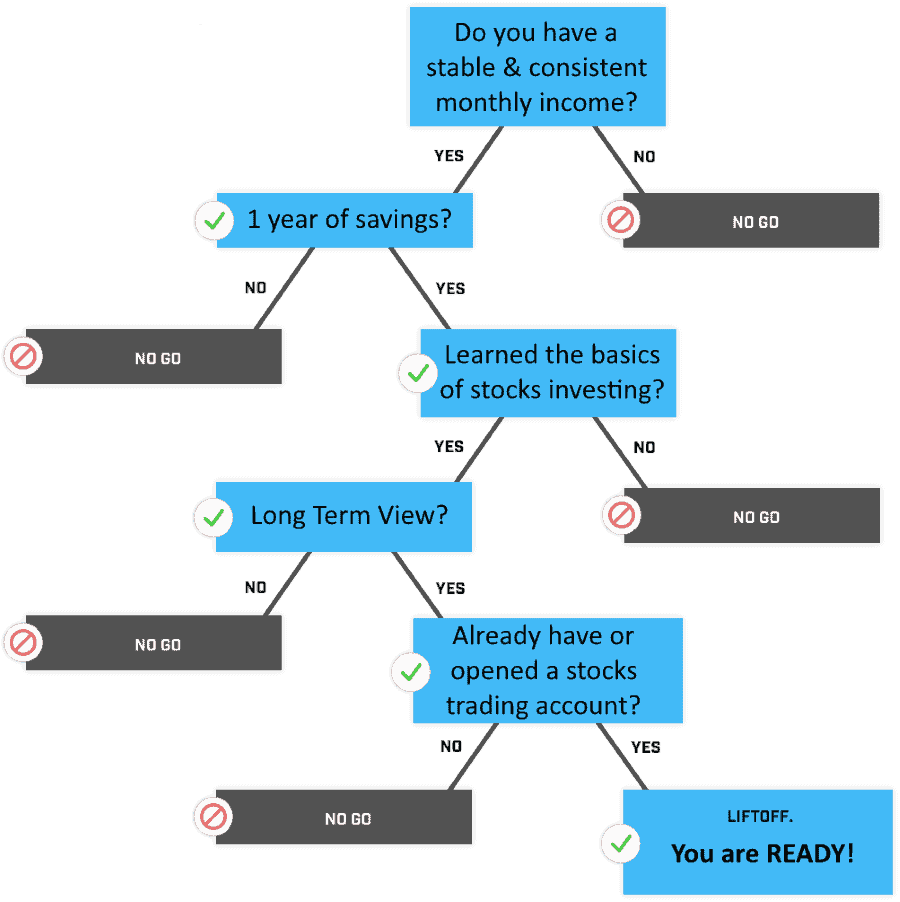

How can I Easily Start Investing in Stocks?

Start by opening a stocks brokerage online like Rakuten Trade, Once your account is verified and then funded, you can buy stock right away using the broker website or app in a matter of minutes.

How to Invest into the Most Profitable Stocks?

The most profitable stocks are companies that consistently distribute growing dividend year over year, such as REIT counters. Over long term holding period, getting extra capital gains will further boost your total profits.

i) What does it mean to invest money in stocks

Imagine you run a nasi lemak stall. Business is doing well, but you desire to expand.

The only problem?

You lack sufficient money to expand. (thank you Captain Obvious!)

The solution?

Raise money la by prospecting to qualified investors who are willing to give you money, in exchange for parts of your nasi lemak stall ownership.

Let’s say you retain enough stake so that you still have the final say on how to run your business, if no single investor or group of investors buy and hold sufficient ownership in your nasi lemak stall to boss you around.

After all, your investors aren’t looking to run your business, they just want to share the proportionate profits you generate from your nasi lemak stall, in return for the capital invested.

Now, you reverse the role, imagine you ARE the investor of the nasi lemak stall.

That is the position you are in when you are a stocks investors.

The fact is…

For many people, buying shares is the #1 thing they think of when it comes to investing and making fast cum easy money in Malaysia.

But they lack the how-to’s, assuming it’s rocket science or treat it as gambling.

Not to mention, getting into stocks investing with the wrong mindset.

The other thing I perhaps can relate to what you are thinking is that when you first started…

I can bet you 100 ringgit that you feel stuck now is NOT due to….

…lack of information, but rather, you are overloaded by a barrage of messy web of information or misinformation…

…some of which are free, some paid,

…that you don’t know how to or where to start.

Here’s the truth:

What’s really lacking is good, concise and actionable information you can use in the next 24 hours.

Fast.

But not lose money (not that much, if ever).

Who has time to save up a few thousands ringgit to register for that 3 days stock investing seminar which is going to be conducted 3 weeks from now?

Correct?

Don’t get me wrong, I am a huge proponent of learning the proper stocks investing how-to’s and methodology…

But I believe more in ongoing hands-on learning by starting small today and get better along the way.

If you agree, read on.

Question: How much do you need to start investing in stocks? What is the minimum amount to invest in stocks?

ii) Understand the category of stocks you can invest into

- By geographical region: Local (Malaysia), US, Singapore, Asia Pacific, Japan, Euro, Emerging Market

- By size (market capitalization of the stocks): Large Cap, Mid Cap, Small Cap

- By sector: Consumer, Industrial, Finance, Plantation, Property, Services, Technology

Due to the liquid nature of stocks investing, you can

- Day trade (buy & sell within the same day)…

- Be a short term trader (buy & sell within a week, for example)

- Buying and holding for a couple of years with or without reaping the dividend profits throughout your holding period

Here’s a frank comment:

It is stupid to be a day trader or a short term ‘investor’ (aka speculate on the stocks price) because if your intention is to invest and make money fast,

…then stocks market investing is a terrible, terrible way to do so it.

…because currency trading (be if FOREX or crypto-currency) is faster, without the home work needed.

iii) How to open trading account in Malaysia

How can I start buying stocks in Malaysia?

Where do I buy stocks?

How do you buy your first stock?

How do beginners invest in stocks?

How to open stock trading account?

How to open share trading account in Malaysia?

Steps to open a stock trading (CDS) account in Malaysia?

Here, you will learn how to invest in stocks, from start to finish, even if you have never done so before. I will walk you through 5 simple steps of opening an account, doing research, buying, holding and selling your stocks profitably.

-

Open a CDS cum brokerage account and fund it

The easiest way is to open an online stocks trading account, get your identify verified and pay RM 10 fee account opening fee. u003cbru003eTransfer money into it and you are ready to invest.

-

Do fundamental value investing analysis

This is your research stage to determine the intrinsic value (aka fair value) of any listed company in a sector that is within your area of competency and interest. You want to pick undervalued stocks.

-

Buy low at the right market timing

Spot or wait for any stocks in your watch list that is below or within its fair value range. Or at least, great companies at a fair price.u003cbru003eBuy in one tranche or separate into a few tranches.

-

Monitor stocks price and hold for dividends

Pay attention the stocks price movement every now and then, while keeping up-to-date with any news or recent developments related to the company you are invested into.

-

Sell High then Reinvest

A company stocks with growth prospects should appreciate in price over time. Once it is fairly or over-valued, sell it to reap the profit. May need to sell at a loss too if fundamentals deteriorate.

-

Rinse and Repeat

Use the same stocks investing strategy to continuously make consistent u0026amp; compounded returns to grow your net worth.

Any authorized depository agents such as stocks brokerage firms or banks can help you open a Central Depository System (CDS) account. A trading account with stockbroker or banks will usually be opened simultaneously when you open the CDS account.

If you have multiple trading account, you have to open separate CDS account for each trading account. Sharing CDS account is prohibited

In short, a CDS account is an electronic account which is maintained by Bursa Depository. It is used to keep track or your shares or stocks movement. Shares will be credited to your account when you buy and debited from your account when you sell on due date.

Consideration #1: Online versus offline

Online: It’s no surprise that today you can enroll into some stock market courses online, at the same time, stock trading itself has long been done online via self service trading platform. It has now evolved into apps form, where we reckon that is the way to go here rather than going through the offline way (through phone call with remisiers or dealer).

The main advantage of online trading Account over offline trading account is lower brokerage fee (transaction cost). For online trading account, you may call help-desk to start trading but they may impose high brokerage fee. Also note there is stamp duty and clearing fee involved for each stocks buy or sell transaction.

Offline (Manual): Please be expected to fill and sign in CDS Opening Account Form. At the same time you have to sign two copies of specimen cards.

Your stock broker will have a collection account for you to deposit your money into your stock broking account. Use online transfer of FPX payment via online banking. Easy peasy.

Consideration #2: Cash or Margin Account

Most brokers have an option for you to choose between Cash or Margin Account (aka Collateralized account).

For Cash account, total trading limit of the day is equal to the amount of cash you have in your trust account. The advantage of Cash account is lower brokerage fee.

How much lower?

It could be 2x to 4x lower, for example…

0.1% per trade transaction (excluding GST) for Cash account, versus 0.2% to 0.4% per trade transaction for Margin account.

For some stock brokers, the higher brokerage fees is only charged if margin is actually used in a Margin account, otherwise the fee defaults to lower cash account rate even though it is a Margin account.

For Margin Account, you are allowed to trade beyond the amount of cash that you have in trust account. Normally, broker allows at least 2 times the amount cash that you have.

On top of that, if you have shares in the attached CDS account, they also can be used as collateral to increase your trading limit.

I highly recommend you go for cash account for a start because as Warren Buffett said, you should not borrow money to invest.

Note:

Trust account is an account where your broker keep cash that you deposited. They may pay interest on the money keep in this account.

Consideration #3: Direct Accounts versus Nominee Account

For Nominee trading account, you appoint your broker to hold shares on your behalf.

It means that, when you are buying stocks of public listed entities and holding them, your name will not show on the registration book of existing shareholders directly, instead it will show your stock broker name.

The advantage is, you do not need to do any paperwork such as fill up forms for bonus issue, right entitlements and others.

The most important is your broker have to remember the dateline for all the paperwork, not you. But you still need to instruct them on what to do.

However, the disadvantage of nominee account are you are not eligible to apply for IPO and you may not receive the annual report or some gift vouchers easily.

Recommendation: Direct Accounts to keep things simple and be hands-on as a beginner.

Online Brokerage Fees Comparison in Malaysia

For Malaysia stock market

For Overseas stock markets

| Stock Broker | Stock Markets | Trading Fees | Minimum Req | Regulated by |

|---|---|---|---|---|

| FSMOne/iFast | US, Singapore, Hong Kong, China | 0.08% | RM 100 | SC, MAS |

| MIDF Invest | US | USD 0.015/share subject to USD 8 minimum | nil | SC |

| M+ Global | US, Hong Kong | As low as 0.10% of trade value, commission charge as low as USD 3 | nil | SC |

| moomoo | US, Singapore, Hong Kong, China | 0% commission, platform fee USD 0.99 per transaction (US), 0.03% and above for others | nil | MAS |

| Rakuten Trade | US, Hong Kong | RM 1 to RM 100 | nil | SC |

| Tiger Brokers | US, Singapore, Hong Kong, China, Australia | USD 0.01/share, subject to minimum USD 1 per transaction | nil | SEC, MAS |

By the way, do NOT even think of opening a stocks trading account with platform like eToro or WeBull which are not licensed and not registered for regulated stocks investing activities in Malaysia.

iv) How to start selecting the right stocks to invest into

You can shortlist by asking yourself:

What is my interest and/or circle of competence?

Trust me,

You might be tempted to be the Jack of all trades and try to tackle all sectors are there in the stock market…for the sake of picking the most profitable or undervalued sectors and stocks…

But this indiscriminate stocks picking approach will kill your you faster than you give up waking up 530 am every morning to run 10 km.

It’s a very long run, like a marathon, NOT a 100 meters sprint.

Due to the above, you will start to feel stocks investing is a chore (it shouldn’t), and making matters worse, you will get frustrated when things didn’t work (especially the profit or returns went below your expectation)

You don’t have to believe me, so I welcome you to try to be ‘Jack of all Trades’

(then revisit this article after you give up in 1-2 years time)

The reality is – most of us already have limited time for the thing that we know (or we think you know) in our lives (like our career, etc)

So from prudent personal finance management perspective, I don’t see why we should burden ourselves with more things that is beyond our circle of competency for now, when you are just starting.

With that being said, if you still have zero clues, then you don’t need to have a crystal ball to make predictions. Pick your poison from these 2 sectors:

Consumer Goods and Industrial Goods/Services

…in any stock market, regardless of market cap.

Then niche down to micro sector, just like when I pick Padini Holdings using Equities Tracker.

Why Consumer Goods and Industrial Goods/Services sectors?

Because they are tied to 2 major components in Maslow’s hierarchy of needs, and that is food, clothing and shelter.

Regardless of economic or financial markets conditions or , company that produces boring goods for our day to day usage or consumption like eggs, coffee and other form of beverages (even alcohol or tobacco, although they are not Shariah compliant).

Same goes for industrial goods or services utilized in commercial settings for constructing our homes, like steel, pipes, rubber gloves, parts of electrical appliances, etc.

In Malaysia though, when people asked: “what growth stocks to invest into?”

My answer would be – look in ACE market for small-mid cap stocks. For example:

| Company stocks | Stock price | Year to Date Capital Growth |

|---|---|---|

| SMRT Holdings | 0.73 | 414% |

| TT Vision Holdings | 1.23 | 262% |

| NationGate Holdings | 1.33 | 255% |

| Catcha Digital | 0.55 | 208% |

| Wellspire Holdings | 0.69 | 204% |

| Oppstar | 1.48 | 137% |

| DC Healthcare Holdings | 0.49 | 96% |

| Autocount Dotcom | 0.65 | 94% |

| Edelteq Holdings | 0.46 | 93% |

| Volcano Bhd | 0.89 | 84% |

v) Fundamental Analysis is of utmost importance to invest profitably in stocks

Fundamental analysis with the end goal of computing a listed company intrinsic value (and to some extent, the Price-Earnings or P/E ratio) is the core of long term value investing strategy or criteria.

With this informed estimation, you can determine if stocks is undervalued, fairly valued or over-valued.

Undervalued stock is one that is selling at a discounted price, relative to its ‘intrinsic value’ and vice-versa.

Veteran or aspiring stock investors always want to look for undervalued stocks in the hopes that they will eventually rise to reflect their intrinsic value. These are some of the metrics.

- Price-to-Earnings Ratio (P/E ratio): measures the price paid for a share relative to its trailing 12-month net profit. A higher PE means that investors are paying more for each unit of net profit and vice versa. The trick here is to invest in companies with a P/E Ratio of 9.0 or less. Companies that sell for low prices compared to EPS are often undervalued, meaning the value should increase. Note: This criterion doesn’t take into account high-growth companies and that P/E ratios differ by sectors/industries. Hence, always look at the P/E ratios of the company’s competitors before deciding.

- P/E-to-Growth Ratio (PEG ratio): the lower a PEG ratio, the more the stock may be undervalued given its net profit growth. PEG = P/E divided by net profit growth in the trailing 12 months.

- Price-to-Book Ratio (P/BV ratio): compares a company’s book value to the current market price. Book value refers to shareholders’ funds, which is equivalent to total assets less liabilities and that provides a good indication of the underlying value of a company. Investing in stocks selling near or below their book value makes sense from a value investing perspective. The trick here is to invest in companies with a P/BV ratio of 1.20 or less

- Current Ratio (Liquidity Ratio): Value investing encourages you to select a company with current assets at least 1.50 times its current liabilities. The ratio indicates the company’s ability to pay short-term liabilities.

However, without fundamental analysis, you are driven by 2 primitive things, just like most people are, the moment you step into the share market:

GREED & FEAR

Why?

When the economy improves, people become bullish about the market.

Greed will cause 3 things in most people:

- Boost their confidence to the point of arrogance

- Stimulate risk-seeking behavior,

- Motivate them to chase the winners

If you are one of the people affected by these, it will blind your judgement and subsequently result in poor decision making.

As most people are fixated to short term gains when prices are rising, they are more than willing to purchase stocks overpriced.

…which results in the prices of the stocks being bid up to an overvalued level.

You mustn’t fall into this trap.

How NOT to fall into such psychological trap?

Well, one major factor why people are vulnerable to losing money in the share market is that they use emotion in their decision making process.

Compared to systematic and logical approach, this method requires no work.

It’s effortless.

Instead of performing due diligence, such as analyzing the underlying business performance, profit growth prospects and value of the business, emotional decision-making uses some mental short-cuts based on similarity & familiarity to judge what the market will do next.

For example, when you receive some negative news of a stock, it will link the news to price falling and will trigger the fear of loss. In such case, the most natural reaction is to sell the stock without investigating further.

The massive disposal of a stock will then lead to its price plunging. Likewise, the fear of loss also causes people to ignore bargain.

See the downfall of NOT doing any fundamental analysis?

Your mind have not information it needs to think clearly, and as a result, you tend to sell stocks in panic when prices crash.

Here’s a fact

When stocks price nosedive, the innate fear of losing in human will be triggered.

The self-defense mechanism then kicks in immediately.

People will suddenly become risk averse.

In addition, the exaggerated bad news cast over the media will result in extreme stress, further triggering the fight or flight response in that primitive reptile part of your brain .

When the emotions are combined with the herding mental shortcut (belief of following other people selling is safer than doing it differently), it leads to panic selling, as the depressed investors unwittingly allow their emotion to overcome rational thinking in the decision-making process.

This explains why the speed of stock price falling is much faster than that of its price rising.

This matter is compounded when most of the investors do not like to read financial reports; many of them do not even bother to understand the companies’ businesses

…and hence do not know the actual worth of the businesses when they bought the stocks.

They buy the stocks solely based on hype and hope that the stocks price will double in 12 months.

During economic crisis, when everyone rushes to sell the stocks and analysts also give strong sell recommendations; whatever you fear will be validated and therefore you will rush to liquidate their positions hastily to prevent further loss.

In a book titled The Little Book of Value Investing, Christopher Browne stated that

“Most people seek immediate gratification in almost everything they do including investing. When most investors buy a stock, they expect it to go up immediately. If it doesn’t, they sell it and buy something else.”

This statement is further supported by Robert Cialdini that

“Quite frequently the crowd is mistaken because they are not acting on the basis of any superior information, but are reacting, themselves, to the principle of social proof.”

The myopia always leads to ignorance of the underlying business and overemphasis of short-term gain.

In summary, when the hot stocks lose their momentum and heading south, uninformed investors will be spooked by the selloff and tend to sell immediately at a loss.

Therefore, it is hardly surprising that most people have never even won a cent in their investments.

vi) How to invest into the best dividend paying stocks

A newbie misconception that you probably have to go through is –

The more research or homework you do in your share market investing, the better you are to get the results (return) that you desire.

Nah.

If you are thinking of (KLSE) value investing in Malaysia ala Warren Buffett, you got to apply what I call as ‘strategic value investing’.

It means, not being a value investing 101 professor who only knows value investing formula or theories but instead, being a practical world-view investor who also knows business trends and globalization.

Knowing all the stock investing or trading strategies in the stock market can only get you so far.

In other words,

You need to realize that despite all hard work put in, you may still suffer short term paper losses.

And it’s not because you are dumb, lazy or not trying hard enough,

It’s because there are factors beyond your control, like geopolitical risks and black swan events.

But if you are patient, deliberate, methodical with a long term time horizon…

Then the stock market will reward you many folds with multibagger stocks.

Watch this lesson below.

By the way, here’s an example of a negative Black swan events affecting your stocks investing returns.

Black swan events that happened to stocks investing in Bursa Malaysia: Case study #1

Imagination Technologies Group, a UK-based designer of mobile graphics processors suffered massive stocks price drop in April 2017 and subsequently put itself up for sale in June 2017, soon after Apple, its largest customer and one of its biggest shareholders, said it would phase out use of its technology in products including the iPhone.

No amount of studying its annual reports (aka stocks fundamental analysis) or doing technical analysis for the sake of determining the stocks is a good buy could have prevented calamity.

In other words, even if you are so sure that the stocks is undervalued at the point you bought it, you will still be subject to huge, unexpected financial loss.

Another example of a black swan event, but a positive one, coupled a hint of geopolitical element (note: political risks had always been the major driver of stock price in short term)

Black swan events that happened to stocks investing in Bursa Malaysia : Case study #2

Thai’s apology to Najib lifts Supermax

Former Supermax Corporation Bhd managing director Datuk Seri Stanley Thai has apologised to Prime Minister Datuk Seri Najib Razak for his involvement in Malaysian politics.

Again, no amount of analyzing annual reports or financial reports or technical analysis could have predicted this.

Black swan events that happened to stocks investing in Bursa Malaysia : Case study #3

RPT erases RM 2.6b from Genting Malaysia market cap in one day

Corporate actions such as Related Party Transactions which does not benefit minority shareholders will send stocks price tumbling like no end. Even if you are a conglomerate like Genting (the only casino operator in Malaysia)

vii) How to Invest during Recession

viii) Best Stocks to Buy during a Stock Market Crash / Crisis / Recession

Truth be told,

The pain of waiting your paper-loss investment to go back up without the ability to do anything productive is excruciating.

Except doing something, anything stupid like panic or depression-induced selling.

Which is why most people does exactly that, because there’s nothing else to do!

If you think a stock is undervalued, it could just be what you think. If everyone else agree with you at a later date, you win. But if everyone else disagree with you after you bought in, you lose, BIG TIME. So sometimes it really doesn’t matter what you think, and in stocks investing, you just have to live with the fact that sometimes, you win some, and at other times, you lose some. What matters is to learn whatever which has occurred, move on and hopefully make better stocks investment decision going forward. Make it part of your life, not your entire life.

The solution the the conundrum of stocks investing above?

Cushion your stocks investment portfolio with consistent and guaranteed dividends (cash flow), even in the worst of times.

Treat it like a consolation price, if you may.

But Why Dividend Paying Stocks?

There are a few reasons WHY:

1: Investing in Dividends Paying Stocks provides High Certainty & Predictability

Dividend income is more predictable than projecting capital gains. After all, dividends are realized cash whereas capital gains are merely on unrealized paper gains and they are subjected to changes on a daily basis.

In other words, your investment returns would not fluctuate depending on the mood or sentiment of Mr Market.

Instead, you’ll reap the certainty of hard cold cash flowing into your bank account regularly if you choose to invest for dividends.

2: Investing in Dividends Paying Stocks Pay Your Monthly Bills

This is true and logical.

Regular dividends stream pay your fixed bills. This includes your rent, mortgage, car loan, utility bills, Astro, insurance and grocery.

After you had the above covered, it is nice to have the dividends cover your discretionary expenses like dining at fancy restaurant, going to movies, dating, or an overseas vacation.

Again, this is only applicable for investors who are receiving dividend income regularly, not one who is for capital gains where their gains are mostly on ‘paper’, if any.

#3: Investing in Dividends Paying Stocks Boasts Your Confidence

It is customary to receive your first dividend income into your bank accounts within 3 – 6 months after purchasing a dividend paying stocks.

Subsequently, based on the amount of stocks unit purchased, you would continue to receive dividends either on a quarterly or semi-annually basis.

Picture this.

If you are a beginner investor and had started to receive cash returns every 3 months once from your portfolio, you would probably get a fine dose of ego boast about it regardless even if the price of your stock is down.

Psychologically speaking, the stock you bought is ‘good for something’ and it incentivizes you to keep it over the long-term.

#4: Investing in Dividend Paying Stocks comes with much Lower Risk

A quick definition of a good stock investment is when the stock has great fundamentals coupled with an undervalued price.

Often, stocks which are consistent in their dividend payouts possess great fundamentals.

These include:

- Resilient business model,

- Competent management team,

- Healthy balance sheet

- Strong cash flow

- Proven track record of growing profits consistently.

As a result, you minimize your risk or chances of making poor investment decisions if you just stick to stocks that have the qualities above.

With lesser investment risks, it ensure your long term financial plan and post-retirement financial independence is intact amidst the volatility in the financial markets.

#5: Investing in Dividends Stocks Builds Up Your Portfolio

Now if you are currently making tons of money and do not need to rely on dividends to fund your current lifestyle, then it could accelerate your wealth accumulation.

WHY?

Because you could reinvest your dividend income into another dividend stock, and this enables you to further expand your portfolio (aka the ‘stacking’ effect).

In other words, over time, you may not need to save money to invest, but instead, using more dividends to fund your future investment. It works like a flywheel effect where you use profits to generate more profits.

#6: Investing in Dividend Stocks removes the need for Capital Gains?

Does it mean that investing for capital gains is no longer relevant once you receive good dividends from your stocks investing?

Of course no.

Investing for stocks capital gains is great if you are more sophisticated as an investor.

This means, if you are a skilled stocks investor (like Koon Yew Yin), then, your chances of achieving capital gains will be greater than one who has no skill at all.

In most cases, people who are into quick capital gains but without any sort of fundamental and/or technical analysis skills are often gamblers and speculators in the stock market.

They are often thrill-seekers who treat any stock market a big legal casino.

They are absolutely not long term profit-driven, which is completely a different mindset with stock investors as they are very short term profit-driven.

#7: Investing in Stocks is Investing with Clarity

How differentiate between an investor and a speculator?

It is shockingly but incredibly easy.

If you interrogate a person who claimed he is investing for capital gains, then probe further:

‘How much capital gains are you expecting?’

If his reply is: ‘As high as possible la, abuden!’

..which is quite a norm reply, coming from a stocks ‘investor’ with a speculative mindset.

On the contrary, true investors had already calculated and possess reasonable goal for their expected returns before buying into a stock or any investment.

For instance, if you ask a dividend guy what he is investing for, you are likely to hear him say:

‘I’m expecting to make at least 5-8% annually from this stock investment over a period of 5 years or more’

Definitely, he is investing with clarity and with purpose, not so much into luck, rumours, random tips, or hear says.

A speculator becomes an investor when the trades are not working out. As a result, he holds on and assumes himself an investor.

An investor becomes a speculator when he invests in companies not because of the company’s fundamentals but because of potential quick gains.

#8: Investing in Dividend Stocks does NOT require you to be a Rocket Scientist

Dividend investing helps beginner investors to make stock investment decisions easier, faster and better.

These decisions made are mostly based on facts and figures, logic, and common sense.

Thus, if you can do some simple mathematical calculation, you can become successful in dividend investing – easy peasy.

Here’s a quick way to determine whether a stock is undervalued or overpriced.

Obviously, the reason why people invest in stocks market is to earn more than how much banks are promising in Fixed Deposits, which is around 3%.

Put simply, any stock with dividend yields below 3% is overpriced. On the flip side, if the dividend yield of a stock is 5% and above, stocks investors may look into it as it is considered to be undervalued at its current price.

In a nutshell, dividend investing is a simple but the best stock trading strategy which promotes investor, even the new ones, to ‘Buy Low, Hold for Dividends, and Sell High.’

#9: Dividend Investing is Investing for Capital Gains

What? This seems like contradicting statement.

No, there’s no typo here.

Stocks with consistent dividend payouts are in demand by a larger pool of investors.

Institutional investors like KWSP, pension funds, Tabung Haji, insurers and mutual funds literally need dividend paying stocks in their portfolio for long term stability.

It’s simple economics – anything that is in demand by many, including stocks, will appreciate both in price & value.

These institutions have billions and are still receiving billions of dividends from the amount invested.

In times when the markets are uncertain and volatile, institutional investors need to adopt a defensive stance to their portfolio but they are expected to still deliver returns to their stakeholders.

It may explain why dividend stocks tend to achieve sustainable capital appreciation over the long-term.

That being said, the best way to cushion your stocks investment portfolio is via exposure to the REIT sector in the stock market.

Why?

Compared to conventional dividends from any public listed companies, stocks dividends (distributions) from real estate investment trusts possess these traits unavailable in any other stocks sectors

- Guaranteed consistency

- Guaranteed high payout ratio

- Inflation hedged

- High Pricing power

What is Malaysia Best Investment Returns?

Malaysia’s best investment return over the long term definitely lies in the form of consistent dividend paying stocks.

Whatever happens to your investment capital, you are still getting your returns in the form of dividends.

The best dividend paying stocks are Malaysian REIT stocks, because it is the only stocks sector which can guarantee a quarterly or half yearly dividend payouts regardless of bull or bear markets.

I will also consider the best investment return is the an investment that does not risk of dropping as much as the broader market.

For example, an investment which drops 50% needs 100% gain just to break-even. But an investment which drops 25% just needs 33% gain to break-even.

The only way to reduce downside risk is by having a guaranteed dividends attached to an investment even if it is affected by market drop. And the only investment that comes with guaranteed dividends in Malaysia or anywhere in the world are REIT stocks.

ix) List of the Best & Worst Bursa Malaysia Stocks

| Company Stock | Stock Ticker | Annual Returns % | Call? |

|---|---|---|---|

| AMMB | AMBANK | 34 | S |

| Sime Darby Plantation | SIMEPLT | 30 | S |

| QL Resources | QL | 21 | S |

| RHB Bank | RHBBANK | 15 | S |

| Petronas Dagangan | PETDAG | 13 | H |

| Hong Leong Bank | HLBANK | 12 | S |

| IOI Corp | IOICORP | 12 | S |

| Maybank | MAYBANK | 12 | S |

| CIMB Bank | CIMB | 11 | S |

| MISC BHD | MISC | 11 | H |

| Hong Leong Financial Group | HLFG | 10 | S |

| Public Bank | PBBANK | 8 | S |

| Tenaga Nasional | TENAGA | 8 | S |

| Kuala Lumpur Kepong | KLK | 7 | S |

| Nestle M’sia | NESTLE | 7 | B |

| PPB Group BHD | PPB | 4 | B |

| Sime Darby BHD | SIME | 2 | H |

| Petronas Chemicals | PCHEM | 2 | H |

| Telekom M’sia | TM | 1 | H |

| Genting BHD | GENTING | 0 | B |

| Petronas Gas | PETGAS | 0 | H |

| Genting M’sia | GENM | -1 | B |

| DiGi.COM BHD | DIGI | -5 | B |

| Dialog Group | DIALOG | -5 | B |

| IHH Healthcare | IHH | -14 | B |

| Press Metal Aluminum | PMETAL | -15 | H |

| Mr DIY | MRDIY | -16 | B |

| Maxis | MAXIS | -17 | B |

| Axiata (Celcom) | AXIATA | -22 | B |

| Inari Amertron | INARI | -32 | H |

| Company Stock | Stock Ticker | Annual Returns % | Call? |

|---|---|---|---|

| Hektar Technologies | HEXTECH | 652 | S |

| Hektar Industries | HEXIND | 381 | S |

| Chin Hin Group | CHGP | 148 | S |

| Coastal Contracts | COASTAL | 145 | S |

| PMB Technology | PMBTECH | 73 | S |

| Dayang Enteprise | DAYANG | 65 | S |

| Rapid Synergy | RAPID | 60 | S |

| YNH Property | YNHPROP | 59 | S |

| Gamuda BHD | GAMUDA | 49 | S |

| Hextar Global | HEXTAR | 46 | S |

| Bermaz Auto | BAUTO | 46 | B |

| Oriental Holdings | ORIENT | 40 | S |

| Affin Bank | AFFIN | 37 | S |

| Alliance Bank | ABMB | 36 | S |

| Magnum | MAGNUM | -30 | B |

| Scientex | SCIENTX | -30 | H |

| Unisem | UNISEM | -31 | H |

| Dagang NeXchange | DNEX | -32 | H |

| VS Industry | VS | -34 | B |

| UWC | UWC | -36 | H |

| Supermaxx | SUPERMX | -36 | S |

| Kossan Rubber | KOSSAN | -39 | S |

| Malaysian Pacific Industries | MPI | -41 | S |

| SP Setia | SPSETIA | -53 | S |

| Mi Technovation | MI | -61 | S |

| Top Glove | TOPGLOV | -65 | S |

| Hartalega | HARTA | -69 | S |

| Hap Seng Consolidated | HAPSENG | -84 | S |

| Company Stock | Stock Ticker | Annual Returns % | Call? |

|---|---|---|---|

| Computer Forms | CFM | 303 | S |

| Pertama Digital | PERTAMA | 203 | S |

| Shin Yang Shipping Corp | SYSCORP | 129 | S |

| Perak Transit | PTRANS | 120 | S |

| Kotra Industries | KOTRA | 120 | S |

| Teladan Setia | TELADAN | 102 | S |

| Fiamma Holdings | FIAMMA | 90 | S |

| Karex BHD | KAREX | 80 | S |

| Signature International | SIGN | 70 | S |

| Power Root | PWROOT | 65 | S |

| Kejuruteraan Asastera | KAB | 55 | S |

| Malaysia Marine and Heavy Engg | MMHE | 51 | S |

| Microlink Solutions | MICORLN | 49 | S |

| Innoprise Plantations | INNO | 41 | S |

| Tanco HOLDINGS | TANCO | 40 | S |

| Muda HOLDINGS | MUDA | -30 | S |

| P.I.E. INDUSTRIAL | PIE | -30 | S |

| Sapura Energy | SAPNRG | -30 | S |

| Solarvest | SLVEST | -31 | S |

| MSM Malaysia | MSM | -31 | S |

| Eastern & Oriental | E&O | -32 | S |

| AME Elite Consortium | AME | -33 | S |

| Ann Joo Resources | ANNJOO | -38 | S |

| Hiap Teck Venture | HIAPTEK | -41 | S |

| JF Technology | JFTECH | -43 | S |

| GDEX BHD | GDEX | -47 | S |

| GHL Systems | GHLSYS | -49 | S |

| Malaysia Smelting CORP | MSC | -52 | S |

| Kobay Technology | KOBAY | -54 | S |

| Dufu Technology | DUFU | -57 | S |

| Company Stock | Stock Ticker | Annual Returns % | Call? |

|---|---|---|---|

| Propel Global | PGB | 1950 | S |

| Comintel | COMCORP | 800 | S |

| South Malaysia Industries | SMI | 205 | S |

| Harn Len | HARNLEN | 193 | S |

| Bonia | BONIA | 157 | S |

| SDS GROUP | SDS | 156 | S |

| Progressive Impact | PICORP | 155 | S |

| Imaspro CORP | IMASPRO | 140 | S |

| Meta Bright | MBRIGHT | 139 | S |

| APB Resources | APB | 129 | S |

| CYL CORP | CYL | 128 | S |

| KECK SENG MSIA | KSENG | 116 | S |

| Kein Hing | KEINHIN | 108 | S |

| Priceworth International | PWORTH | 100 | S |

| Econframe | EFRAME | 99 | S |

| Careplus | CAREPLS | -54 | S |

| JCY International | JCY | -55 | S |

| Destini | DESTINI | -55 | S |

| Ta Win HOLDINGS | TAWIN | -56 | S |

| Revenue GROUP | REVENUE | -57 | S |

| JHM Consolidation | JHM | -57 | S |

| Vinvest Capital HOLDINGS | VINVEST | -59 | S |

| Aemulus HOLDINGS | AEMULUS | -61 | S |

| Pestech INTL | PESTECH | -62 | S |

| ATA IMS | ATAIMS | -63 | S |

| KNM GROUP BHD | KNM | -67 | S |

| One Glove | ONEGLOVE | -71 | S |

| Dataprep HOLDINGS | DATAPRP | -72 | S |

| Euro Holdings | EURO | -75 | S |

| Country Heights HOLDINGS | CHHB | -79 | S |

Now It’s Your Turn

Phew! I put A TON of work into this guide. So I hope you enjoyed it.

Now I’d like to hear what you have to say.

What’s the sector you prefer investing in Malaysia and why?

Is it Consumer Goods stocks? Industrial goods stocks? or REIT stocks?

Let me know by leaving a comment below.

Related resources (but not comprehensive enough):

Beginner’s Guide to Investing in Malaysia

Why Invest in Stocks? Money tips from Bursa Malaysia

What can you invest with RM1000? – A quick guide

How to buy shares in Malaysia and open a Malaysian brokerages

Stock Investment Course Malaysia

The Best Stock Trading & Stock Investment Books (also for stock market beginners)

Great share! Thanks for the information. Keep sharing!

Hi CF thank you much for such an impressive guide.

I have recently invested in some gloves stock and it’s been disastrous. What’s your comment on the gloves stock ahead? Or it’s it undervalue now? Many thanks!

You bet!

Glove stocks – it’s not undervalued now (2021), it is back to normalization phase

Informative lovely article.

Thank you very much for this beautiful article. This is really great & innovative. I read it from top to bottom & learn many things from it. This is really praiseworthy. Great article.

Comments are closed.