About Us

My Mission

To empower your financial decisions with actionable, relatable, and affordable advice that always puts your best interests first.

My Philosophy

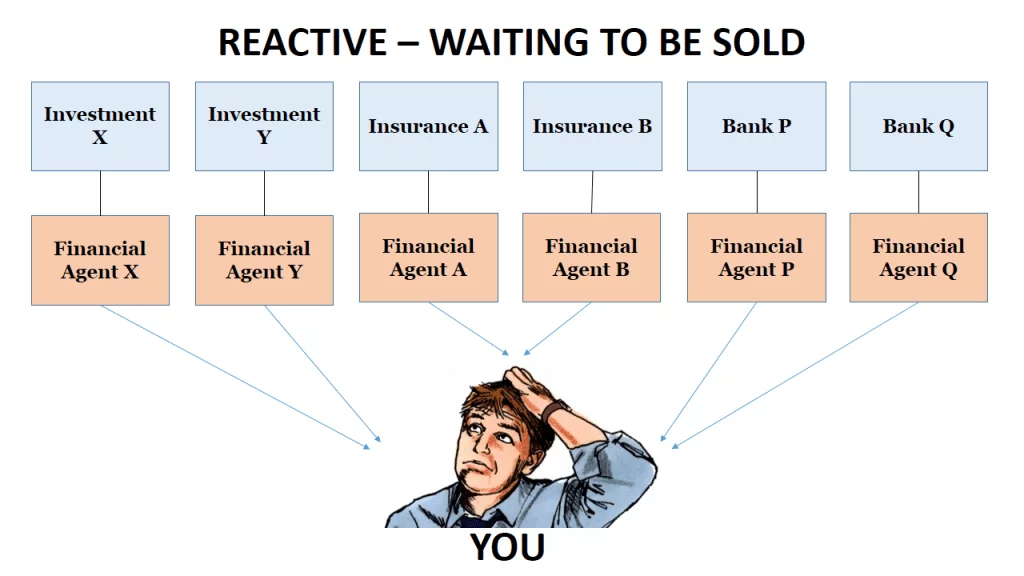

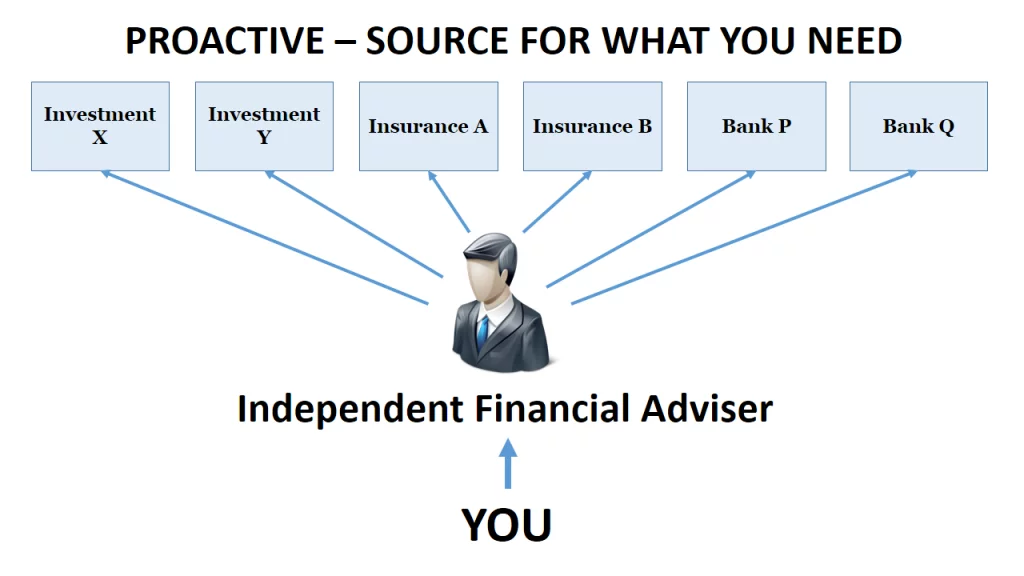

You should be the one actively making decisions to shape your financial future instead of letting life just happen to you.

My Beliefs

True wealth is measured in time freedom and peace of mind, supported by adequate financial resources to achieve & sustain that.

Why CF Lieu?

As my client, you are afforded a distinct privilege: the absolute assurance that our financial advice is driven by one thing—your best interest. My entire practice is founded on the unwavering principle that guidance must be pure advice, completely untainted by a motive to earn sales commissions or transaction fees. This means when you engage me, we don’t just sit on the same side of the table; I act as your dedicated advocate, ensuring every strategy I develop is transparent, free from conflict, and exclusively focused on achieving your success.

My Experience, Your Advantage

Since 2014

Consult Sessions

Consult Hours

Capital Markets Services Representative’s License (CMSRL): CF Lieu operates as a practice office under CC Advisory, which is a holder of a Capital Market Services License (CMSL). This license is issued by the Securities Commission Malaysia and is essential for firms providing financial planning and investment advice.

Financial Adviser’s Representative (FAR) by Bank Negara Malaysia: CF Lieu is also an approved financial advisor by the central bank of Malaysia. This approval allows them to offer advice on insurance products and other financial services regulated by Bank Negara.

Certified Financial Planner (CFP®): CF Lieu is a “CFP CERT TM holder.” This is an internationally recognized certification for competency in personal financial planning—wealth protection, wealth accumulation, and wealth preservation.

The Difference That Matters to You

Join 80,000 + Followers

Every day, CF Lieu tells relatable stories and share his experience advising clients similar to you, across all these social media channels.

Your Next Step

Whether you’re seeking clarity, planning ahead, or simply exploring your options, we are here to help — no pressure and zero jargon.