Insurance Advisory

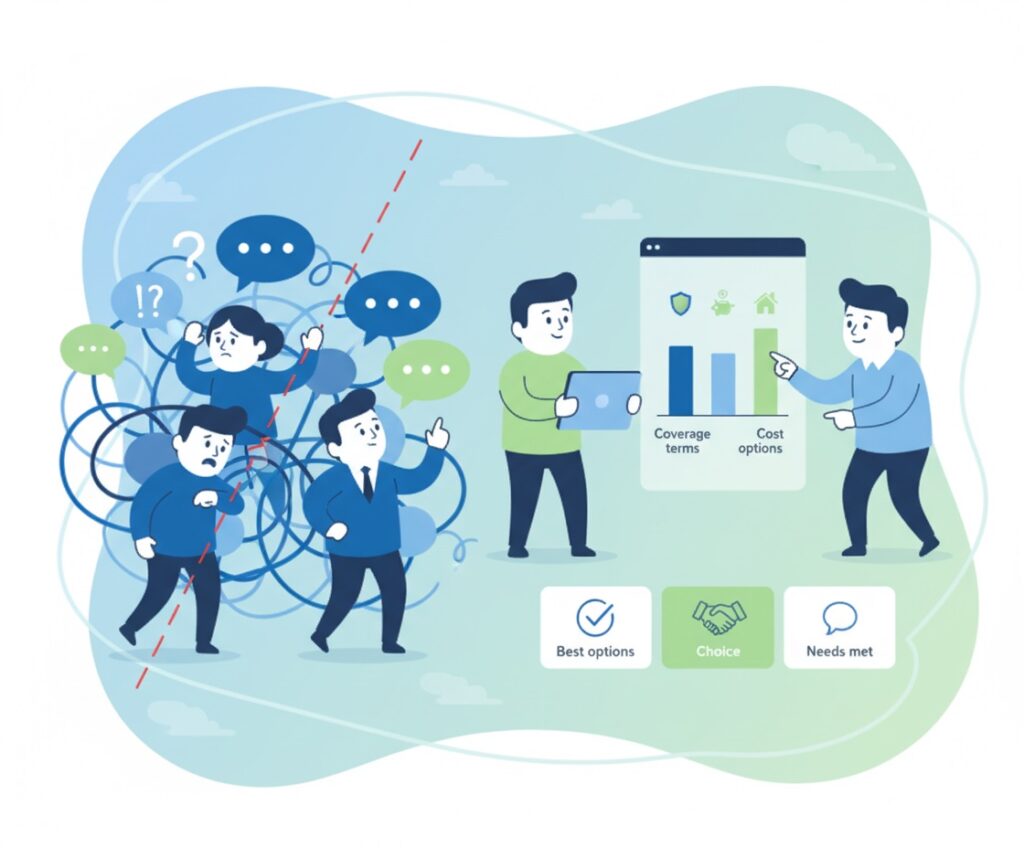

Our clients approach us to get unbiased advice before they decide to buy any insurance solution, particularly medical & health insurance. We work for you, not the insurance companies.

Our role is to be your unbiased advocate, providing the expert analysis and transparent guidance you need to make informed decisions.

We cut through the noise, compare the market on your behalf, and demystify the fine print so you can secure maximum coverage at the lowest possible cost.

Comprehensive & Unbiased Market Comparison

Stop wasting time talking to multiple agents. We provide a single point of contact to analyze and compare coverage terms and direct quotes from various insurers. You get a clear, side-by-side view of your best options, minus the sales pressure, ensuring you choose the right plan for your needs and budget.

Strategic Policy Optimization & Restructuring

Your life changes, and your insurance should too. We conduct a in-depth review of your existing policies to identify critical gaps, redundancies, or opportunities for improvement. Our goal is to restructure your coverage to achieve higher benefits and better protection, often for the same or even a lower premium.

“Claim-Proof” Your Coverage

The true value of insurance is a successful claim. We specialize in clarifying the often-overlooked terms and conditions that can lead to future claim rejections. By understanding the fine print before you buy, you gain the confidence that your policy will perform exactly as expected when you need it most.

“Being a clinical professor myself, Lieu’s 1on1 ‘lecture session’ was all well done because it met what I wanted to know. It has helped me to discover a number of things about my insurance policies that I was not even aware of in the first place.

For example, managing insurance coverage sustainability so I know what to expect 20-30 years now, instead of being faced with a rude, shocking discovery of policy lapse or premium spike.

The other important thing is that I am now able ask way better critical questions when any insurance product is recommended to me , instead of just settling for whatever is being offered.

Personally, I do appreciate and understand that good, no conflict-of-interest advice which comes with a fair professional fee is worth it.“

“The only regret I have when I engaging CF Lieu is NOT seeking his advice earlier pertaining to my family insurance matters.

Lieu has delivered precisely the the answers I am seeking to solve the insurance issues I had for more than 1 year, which I can’t seem to get straight answers from insurance agents.

The advisory sessions had been exceedingly useful in clearing all my doubts on the nitty-gritty stuff and showed me the exact approach to pay less while getting increase coverage.

I am satisfied and extremely thankful to Lieu – the advisory fees is indeed well spent.”

Anesthesiologist, KPJ Klang Specialist Hospital

“I engaged Lieu all the way from Singapore at the moment where I was almost blindsided by an insurance agent. Lieu’s advice has ‘saved’ me in the nick of time for me to fix the matter I overlooked.

As an analytical professional lacking time and practical exposure to the many aspects of personal finance, I often times feel I can’t connect the dots. However, Lieu’s process-oriented advisory approach has given me the utmost clarity I need to untangle a web of complications, giving me the confidence to move forward with an actionable strategy.

Also, I actually casually ‘verified’ his recommendations with the Finance director friend and he concurred that Lieu’s advice does make sense and hold water.

It has been a great experience for me engaging him and I’d vouch for his client-centric approach.”

Front Line Leader (Team Manager) at Abbott Singapore

“Gained so much clarity on my overall financial health and saved me a significant amount of money for the things inside my insurance & personal tax which I don’t think I will ever find out by myself.”

“We probably saved RM 4,000 to RM 5,000 insurance premiums a year from needlessly buying another insurance policy when we bought a second property in JB – if we had not known this until CF highlighted it to us. Throughout our engagement, CF patiently answered even the most unintelligent questions from us without contempt.”

(Johor Bahru)

Business Owner & Dental Surgeon

“Lieu has given me a level of clarity I’ve never thought possible for my insurance policies – but most importantly, his 1on1 advisory helped me to significantly reduce my financial commitment so that I can focus on what really matters to achieve my early ‘retirement’ and self-sufficiency goal.

I was skeptical at first, but by the end of the five 1on1 sessions with him, I was delighted – it simply exceeded my expectations.

Ready for Real Clarity on Your Insurance?

Stop navigating the complex world of insurance alone. Our unbiased assessment is your first step towards a clear, cost-effective strategy. In this no-pressure session, we’ll review your needs and show you how to build a protection plan that truly serves you.