Advisory Services

Our Outcome-Oriented Advisory approach places you at the center of everything we do.

We focus on the positive outcomes you wish to see and feel, moving beyond generic products to address your unique financial needs and challenges. We thoughtfully engage with you to explore various opportunities and discover the most effective solutions together.

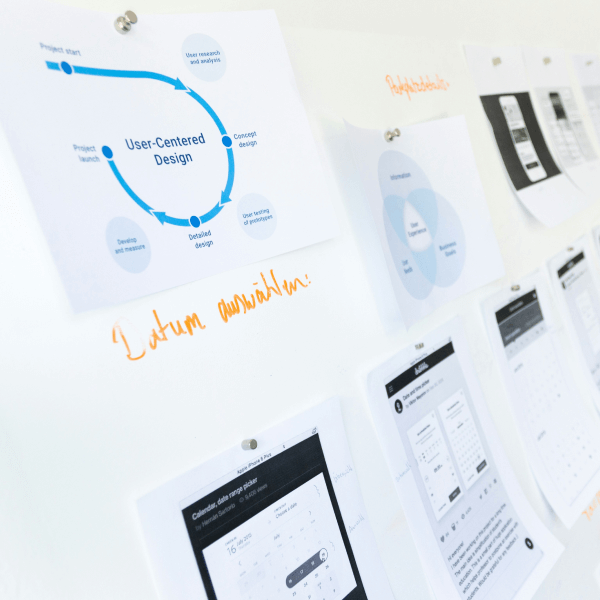

Our commitment is to use our applied knowledge and practical experience to deliver analysis, insights, and answers that are actionable, relatable, and custom-tailored to you. This ethos is the foundation for all our services—from investment and retirement planning to risk management and business tax strategy—ensuring that every piece of advice is designed to achieve your best possible outcome.

Ready to Focus on Your Outcomes?

Move beyond generic advice. Contact us today to schedule an assessment and take the first step toward achieving the financial clarity and success you deserve.