This article is about the medical insurance premium increase in Malaysia and how it is connected and will affect your financial directly. Since health care costs are looming higher, determining your options and doing preemptive actions are the two things that can aid you to overcome this issue proficiently.

Table of Contents

- 🏥 Introduction to Medical Insurance Challenges

- 📈 Impact of Post Pandemic Year on Claims and Costs

- 🧓 Long-term Considerations for Retirement and Insurance

- ❓ FAQ

🏥 Introduction to Medical Insurance Challenges

The medical insurance sector in Malaysia is facing frequent challenges. In addition to the growing medical care costs and the feared hike in medical insurance premiums many people have to deal with a difficult situation. The advancement of technology is of the utmost importance, and it is also necessary to know and understand the insurance policy and the health care system rules and regulations for one to be able to manage them properly.

The serious issue that policyholders hassle mainly with is the unpredictability of the premium prices. The medical insurance premium raise in Malaysia is not just a small problem but a major burden financially for many. In the face of the ongoing increase in healthcare expenses, one has to weigh the different alternatives of insurance coverage very carefully.

Also, the concern is not only related to the increase in prices; it is also the question of the adequacy of coverage. A lot of individuals navigate through having inadequate cover because of choosing lower premiums which in turn, reduce their benefits. For financial security, proper weight should be given to both affordability and full-scale coverage.

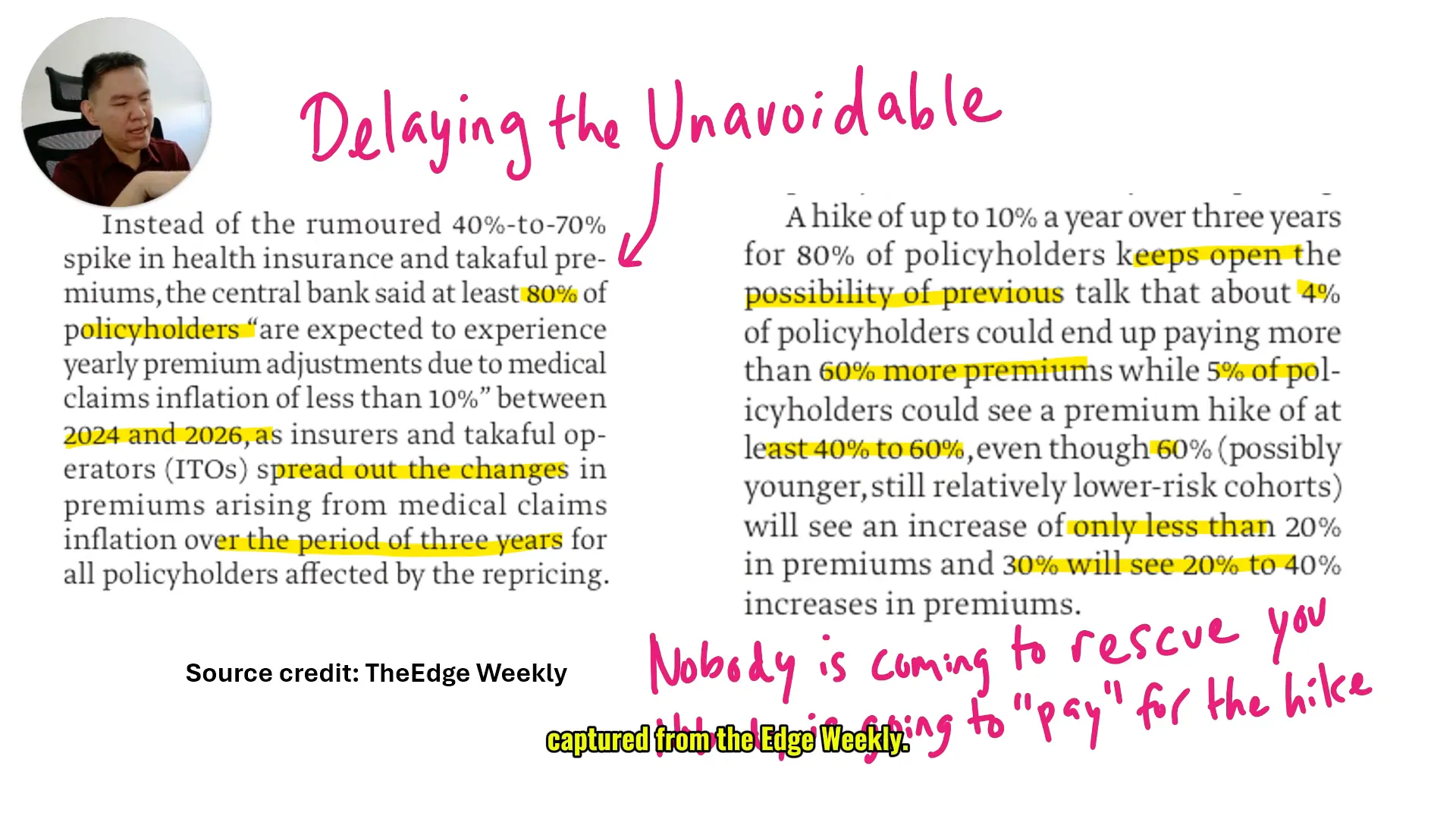

Understanding the Regulatory Landscape

It is impossible to ignore the importance of regulatory bodies particularly Bank Negara Malaysia. They have taken steps such as regulating the premium but the effect of their action is usually taken as short-lasting rather than as a matter of course. For example, the regulation which restricts premium increases at the rate of ten percent a year acts as a buffer for the time being but is of no help to the real factors causing the healthcare costs to go up.

Additionally, insurers are generally thought to be less than completely forthcoming concerning their pricing guidelines. A lot of the holders of insurance policies feel misled through abrupt hikes so it is understandable that the consumers lose confidence in the trustful relationship. It is essential for consumers to be well-informed and take the initiative to understand not only their policies but also the probability of future increases.

Key Factors Influencing Premium Increases

- Inflation in Healthcare Costs: The rising costs of medical services directly impact insurance premiums.

- Increased Claims Frequency: The number of claims submitted has surged, leading insurers to raise premiums to cover these costs.

- Regulatory Approaches: While regulations exist to manage premium hikes, they often fall short of addressing the root causes of rising costs.

📈 Impact of Post Pandemic Year on Claims and Costs

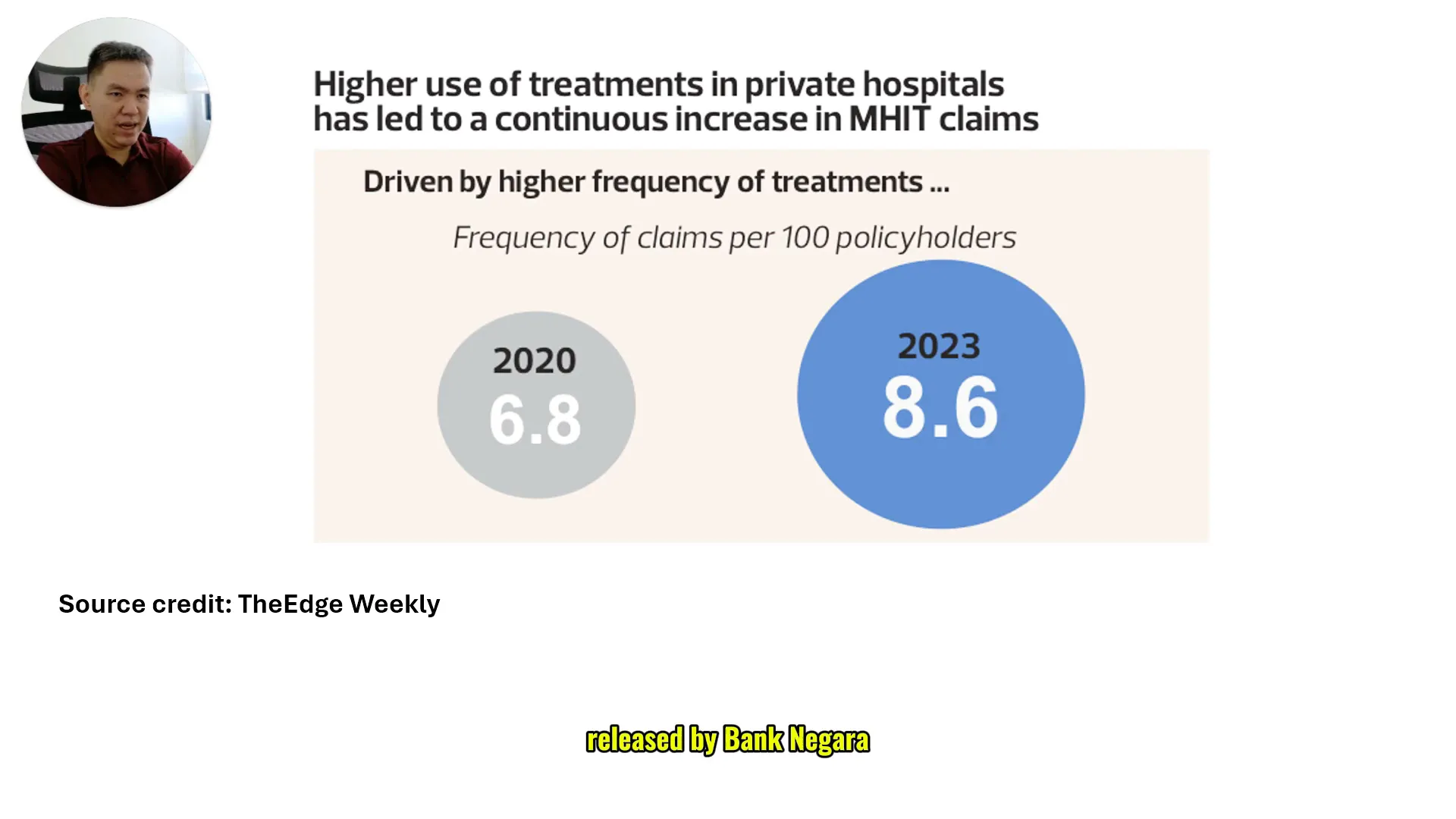

The COVID-19 pandemic has been incredibly impactful in changing the situation of the healthcare sector and the aftershocks of this are still resolutely existing. The post-pandemic has seen an outburst of claims which has had staggering consequences with the majority of the insurers indicating their payouts significantly increased. This hike in claims is among the crucial factors for the medical insurance premium escalation in Malaysia.

The pandemic has caused an unfortunate situation due to the increasing frequency of claims per hundred policyholders. For example, recent reports show that this figure has risen from 6.8 to 8.6, on the contrary, it is a sign of an increasing number of medical services that have to be used by the people, in the future, for the treatment of the problems which have been caused by the pandemic.

Healthcare Cost Discrepancies

Another of the more amazing discoveries from the post-pandemic environment is the discrepancy in costs between private and public patients. For instance, a stay at a private hospital with no insurance may have to be around RM1,300, on the other hand, a medical card may allow you to use medical services worth over RM5,000. The complex nature of this situation created an impact on the determination of the price of private healthcare providers and the overall justness of the system.

The Long-term Effects of Increased Claims

When we talk about the future, the repercussions of the rising claims and orderly healthcare costs will be more and more evident as time goes on. The vision of the insurance companies is that they may have to charge higher premiums to cover their expenses, which will be a direct result of this. It is advantageous for the policyholders to stay alert and discover the ways to maximize their original plan without having to pay additional costs.

🧓 Long-term Considerations for Retirement and Insurance

Retirement planning involves more than just accumulating savings; it necessitates the foresight of expenses that might arise in the future, especially those related to medical care. Nearing the retirement stage, a person must also consider the likely possible rise in insurance premium for medical coverage in the place where he intended to reside; Malaysia. This is not a thought to have later on; it is an indispensable chord of your retirement plan.

A lot of people have the wrong impression that their medical expenses will stay the same, but this is simply not true. Due to the commonly existing annual hikes in medical premiums, you should definitely get ready for a state in which your medical premium expenses could go up drastically over a period of time. This directly implies that your retirement savings have to be strong enough to endure such hikes.

To sail successfully through these financial troubles, think about the strategies given below:

- Budget for Medical Inflation: Include an estimated increase of 10% every year for your medical insurance premiums in your retirement budget.

- Invest in Your Skills: Continuously improve your skill set to ensure you can command a higher salary, which can help offset rising costs.

- Reassess Your Coverage: Regularly review your insurance policies to ensure they align with your current needs and financial capacity.

Adopting these measures in advance, you will be able to adequately equip yourselves for the financial impact of health care as you enter retirement.

Understanding the Cost-Benefit of Insurance

Based on what I have learned until now, the first step in addressing the increase of medical insurance premiums is to do a cost-benefit analysis of the current policy possible way. They are mainly the ones who are trying to grapple with the reality of higher costs without actually seeing the huge advantages these policies provide in terms of covering bills from unexpected hardships.

As an example, the high premiums that you may have to pay, in some cases, could be the best option to have coverage that will save you thousands of out-of-pocket costs, which is the case, perhaps, for millions of people. That says it all, keeping the full-fledged health insurance card might be a good plan, particularly, it is so to say with the increasing age.

The decision to drop the coverage should not only be based on the fact of getting possible short-term benefits, like cheaper premiums, but also must be accompanied by the careful analysis of the probable long-run effects. For instance, that what starts as a temporary gain from a lower monthly premium could very well lead you to insolvency later due to the liability of facing a hard medical condition and not being able to pay for it.

❓ FAQ

What should I do if my medical insurance premium increases?

First and foremost, you should evaluate your current financial status. You should find out if you have the capacity to embrace the new budget. In case you can’t, you may need to think about getting some advice on changing your insurance portfolio or enhancing it with the critical coverage first.

How can I prepare for future medical expenses in retirement?

First of all, the retirement plan should always take into account an increase in medical insurance premiums, which is for sure. And then, concentrate on the development of your skills as this is the best way to earn more money, which will give you more financial flexibility.

Is public healthcare a viable alternative to private insurance?

Though the public healthcare system in Malaysia can be a viable alternative however, it frequently entails extended waiting periods and is not able to furnish the same immediacy of treatment like the private establishments do. Evaluate the pluses and the minuses depending on your health requirements and the financial situation you have.

How can I manage my medical insurance costs effectively?

How about reallocating the funds from obsolete or redundant policies to your medical card premium? By doing this, you assure yourself protection against catastrophic incursions while you will not be subjected to heavy financial implications.

Where can I find more information about managing insurance costs?

Obtain personalized and tailored advice by making inquiries with certified financial advisors or insurance professionals. Various tips on how to manage insurance well are found on many websites that are available on the internet.

As a final note, knowledge about the medical insurance premium augmentation in Malaysia and the associated long-term effects is a must for a healthy financial condition. If you take the approach of being proactive and well informed, you can deal with these challenges and also, on top of that, you can save your health and finances for the future.