Willpower is not something you are born with – either more of it or less of it.

You could say people with more self-discipline could achieve more in life because they are able to deflect temptations or distractions being thrown their way. But that’s probably not an innate ability–instead, they’ve found ways to store up their willpower and use it when it really matters.

They have remarkable willpower not because they ample supply of it, but because they’ve figured out how to best use it at the right time.

It is especially important when it comes to personal finance – I call it financial willpower.

Here’s how you can, too:

Financial willpower – Less is More

By eliminating available choices to pick from, we could accomplish more. After all, don’t you agree we all have a finite store of mental energy to deflect the constant bombardment of various distractions or temptations before losing self-control?

The more choices we make during the day, the harder each one is on our brain–and the more we start to look for shortcuts. (Call it the “Oh, screw it,” syndrome.)

Then we get impulsive.

Then we get reckless.

Then we make dumb decisions we know we shouldn’t make, but it’s as if we can’t help ourselves.

Say you want to make smarter financial choices. Easy. Keep your credit card from easy reach. Like what KC Lau in his trip to New Zealand in 2014.

Choices and convenience are the enemy of financial willpower. Think of decisions that require financial willpower, and then take financial willpower totally out of the equation. Simplify.

Make up your mind today, execute tomorrow

The fact is, smart choices come naturally when a decision doesn’t need to be made in a jiffy.

Therefore, consider the decisions that will drain your reservoir of financial willpower tomorrow, and make them tonight.

Even better is to make a system yourself that makes decision for you. Like setting up auto bill payment for your utility bills.

Decide what you’ll have for lunch–and go ahead and prepare it. Chances are, if you don’t, you likely to follow what will be decided by others which may not work in your best interest.

Take as many decisions off the board tonight as you can; that will allow you to conserve your mental energy for the decisions that really matter tomorrow. And while you’re at it, decide what you will do first when you get to work. Then commit to…

Do the most strenuous/time consuming things first.

You have the greatest amount of mental energy early in the morning. Science says so:

In a landmark study performed by the National Academy of Sciences, parole board judges were most likely to give a favorable ruling early in the morning; just before lunch, the odds of a favorable ruling dropped to almost zero.

Should judges’ decisions have been affected by factors other than legal? Of course not–but they were. They got mentally tired. They experienced decision fatigue. The best time to make tough decisions is early in the day. The best time to do the most important things you need to do is early in the day. Decide what those things are, and plan to tackle them first thing.

What about the rest of the day?

Stop and recharge

Although the judges involved in such experiment started strong, a graph of their decision making looks like a roller coaster: up and down and up and down.

Why?

They took breaks–and they ate. Just after lunch, their likelihood of making favorable rulings spiked upward. The same was true after midmorning and midafternoon breaks.

It turns out glucose is a vital part of willpower. Though your brain does not stop working when glucose is low, it does stop doing some things and start doing others: It responds more strongly to instant gratification and pays less attention to long-term outcomes – and in many cases, long term consequences.

And speaking of long-term…

Remind yourself WHY what you decide today matters down the road

You want to be financially free and retire early, but when you’re mentally tired, it’s easy to rationalize why getting a new spanking ride is a good way to reward yourself after that pay rise. You see how many of our small, daily decisions contradict with our long term desires or goals?

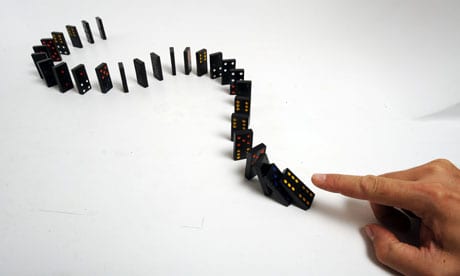

Over time, such scenario is like a delayed domino effect.

Read this:

Mental fatigue makes you take the easy way out–even though the easy way takes you the wrong way.

So create tangible reminders that pull you back from the impulse brink. That’s why sticky notes work – you have them taped to your computer monitor as a constant reminder of an obligation you must meet.

Some fill their desk with family photos because it reminds them of the people he is ultimately working for.

Think of moments when you are most likely to give in to impulses that take you farther away from your long-term goals. Then use tangible reminders of those long-term goals to interrupt the impulse and keep you on track.

Or better yet, create an automated system or rework your environment so you eliminate your ability to be impulsive–then you don’t have to exercise any financial willpower at all.

Adapted from INC’s 5 Habits of People with Remarkable Willpower