1) The fund annual management fee must be deducted from the indicated ROI to reflect net return

In a fund fact sheet, many investors tend to substract the annual management fee from the indicated returns to get the actual returns. For instance:

Annual Management Fee : 1.5%

Annual return : 10%

Actual Returns : 8.5%

The example above is a mistake.

Firstly the annual management fee will be deducted from the fund’s Net Asset Value daily. Therefore when a fund publishes their fund price at the end of each business day, this is the true value of the fund after deducting all cost incurred for the day including the annual management fee.

Secondly, when calculating a fund’s Annual Return for a particular year, the fund price on 31st December is deducted from the fund price the year before.

2) You must buy in a fund just before its income distribution to gain a quick profit

This is one of the biggest misconception many have towards unit trust. I have seen a bank officer tell this to an aunty!

Fact is, the fund price will dip slightly just before income distribution, but this is not a “real” price drop due to averse factors. When it distribute “dividends” to unit holders, the fund price will make an adjustment to its fair value. If you are already invested before ex-distribution date, your units will normally be reinvested.

Unit trusts pay out (either cash or re-invested) and their NAV will be adjusted lower EXACTLY to the value paid out +/- the fund’s holdings (stocks/bonds/cash/etc) movement for the day.

Stocks pay out and their MARKET PRICE:

a. Usually drops but to the exact value paid out is highly unlikely

b. May stay

c. May surge

All the above for stocks is due to bid/offer of free market VS…

Unit trusts aint strictly a bid/offer thing – fund house HAS TO BUY BACK at NAV of end day (usually) price.

3) There is only one Fund Management company – P* Mutual

Yes, it is undisputed that P* Mutual (PM) is the largest fund house in Malaysia. But bear in mind that it is not the only one available for investors. Due to aggressive advertising and promotion by PM, many are only exposed to PM.

The same analogy is when we want to buy toothpaste, we say we need to buy Colgate – a brand that is synonymous with toothpaste itself, as opposed to other brand like Darlie, Fresh & White.

There are many other credible fund houses apart from PM such as Eastspring Investment Berhad, CIMB Principal Asset Management, and Kenanga Investors Berhad

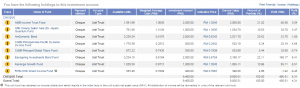

You’ll soon realize that other funds apart from PM are really gems which are leaders in their own category – example, Kenanga Growth is one in the Equity Malaysia category. That is a fact. Just read The Edge column on UT returns published which organizes its Lipper Fund Awards every year.

4) If a fund management company goes bust,we will lose our money

A structure of unit trust investment consist of the investor, a fund management company (fund house) and a trustee. The investors, that’s us, place our money into a the unit trust scheme which is safeguarded by the trustee. A fund house manages the funds available from the scheme and in return charges investors an annual management fee.

In the event that a fund house or company goes into bankruptcy, the money that investors have placed into the scheme cannot not be legally used to pay off creditors of the fund house that declares bankruptcy

5) Once invested, I don’t need to bother anymore

Not true. While it is relatively passive form of investing, you do need to do switching when situation warrants it – major economic upheaval in certain regions or fund no longer perform. Intra-switch (switch from 1 fund to another within same fund house) is normally free or with negligible cost, while inter-switch (switch from 1 company to another) needs be charge a new sales charge. Which is why for independent advisers, when we manage unit trust portfolio for clients, we use a platform called iFast Capital Malaysia (click here) to do switching for clients free of charge, no limit of switch transactions.

What u dont agree. Please share