I was recently admitted to a private hospital for severe respiratory viral infection. It was a result of a prolonged sore throat infection, which consequently lead to appearance of rashes on my body and conjunctivitis. Before my hospitalization, I went to 2 different company panel clinics (one with follow up visit), and the antibiotics given just doesn’t cut it for my sore throat. I am suspecting that it could be due to substandard medicine prescribed- a scenario I described in my previous post, One thing you should know about your company outpatient medical insurance.

It would have cost me an arm and a leg. Here’s the total bill of RM 4,831 for 3 days “stay cation”.

I am attached to a company where staff are entitled for corporate rate. Total discount = RM 951, which reduces the bill to RM 3,903. Other companies in this private hospital corporate list:

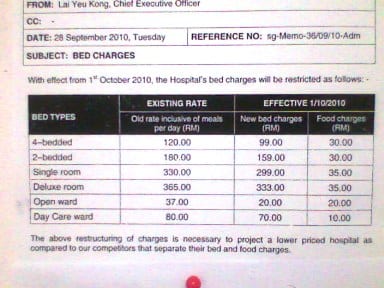

The room and board rate for public. Note that meals are not inclusive.

Morale of the story: Buy your own medical/hospitalization insurance once you start working, regardless whether your company has insurance coverage for you or not. It should be the first insurance policy anyone should have if you ask me, before any life insurance or investment. A basic coverage is better than nothing – you can claim up to RM 3,000 of tax relief per annum for medical insurance premiums. Even a RM 2,000 annual premium coverage is already pretty decent at the time of this writing.

Another thing to note is that you can actually continue your company group insurance policy by continuing to pay the premium from your own pocket after you resigned.