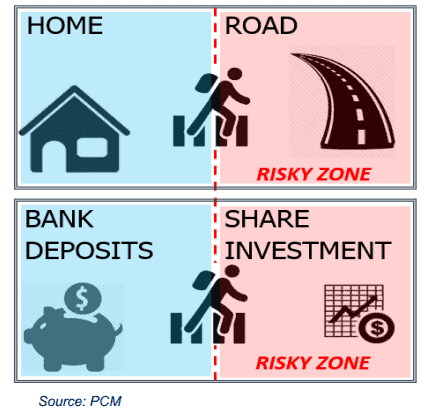

Despite the high road accident rate in Malaysia, we continue to drive everyday as normal. Of course, no one is a fool as we all are aware of the risks on the road but we manage it by cautious driving. And we will definitely disallow our young children to drive as they are not old enough to know the danger. When it comes to investment, there is always a risk of losing money but we still need to invest to hedge against inflation. The risks, then, are managed through careful asset allocation and diversification.

As for investment, we learn from own experience or better, from experience from others. They say – “the wise man learns from the mistakes of others and never make it in the first place”. Those who are wise enough will not dabble in risky and poor quality stocks as we know they are speculative.

But everyone started as a novice when it comes to investment, akin to adults crossing the street. For investors who have little knowledge on share investment, they are like young children (although they are really adults!) crossing the street where they need the hands of another adult to assist them, otherwise they may just step on the wrong side of the road. The bad experience encountered by some investors who punted on the wrong stocks and subsequently made losses, had imprinted in their minds that investment is risky, a phenomenon similar to the risk of crossing a road.

You may hear the below before….

1. “I make so little money. Can’t save much. Invest so little, what is the point?”

2. “I have a very good career. I make very good earnings. I don’t need to invest.”

3. “Aiyoh, invest in stocks? That is gambling lah. I rather buy 4D.”

But life isn’t only about crossing the road…

Because you also need to learn how to drive a car, a bike, defensive driving, car-handling in heavy rains, etc.

Using these analogies, crossing the road is just one part of it. The whole part of it is how to get around safely using Malaysian transportation system.

Enter Financial Planning.

Myth #1: Financial plans are only for people who have money to manage, right? Wrong

Myth #2: It is perceived by the masses as a service only for the rich and wealthy. Since you have more money, automatically your financial needs are more complex. Wrong again.

Financial planning in its true spirit (note – no product pushing) isn’t about the complexity of your personal finances. Rather it is about your life goals or aspirations.

The only people who don’t need financial planning is people with no life goals or aspirations for themselves or their loved ones.

Are you one?

Just scrapping by does not and should not be an excuse not to plan. How else are you going to improve? By continuing telling yourself that you have no money – now and forever?

For those who don’t feel they have enough (read – salary account is just as transit point), a plan becomes more crucial. Any mistakes, no matter how small, in their investment or risk management strategy will be far more detrimental than it is for a high income earner, who can earn it back in no time. The wrong insurance (cough – endowment aka savings plan) can bind you for years while eating up your cashflow at the expenses of other financial objectives. The wrong investment decision can wipe out any limited funds you’ve saved. You can only afford a very thin margin of error.

And yet it amazes me that there are people who spend more time planning for their vacation, honeymoon or even buying the latest tech gadget than planning their ultimate financial freedom.

Speak to financially successful people (boy, I’ve spoken to many), and you are likely to find it is a culmination of shrewd planning and smart money decisions throughout the years. It has become a second nature to them.

The sooner you start making smart informed decisions, the sooner you will feel the difference, internalize this experience and ultimately reap the rewards. Not to mention, you would have time to recoup from your losses or mistakes.

Yes, no one is invincible, we are bound to make mistakes along our journey. Ceteris paribus, mistakes at age 50 is deadly – it means extending retirement years. Mistakes made at my age of 30+ means there is still enough time to recover any losses in my long income-producing years.

So where and how do you start?

Think your wishes & aspirations for yourself and family.

First, ignore your current bank balance. Don’t let it demotivate you if it isn’t much.

Second – Think of your aspirations- it could be – Invest in second property? Overseas child education? Retire earlier than your peers?

And be realistic. some of us may not even achieve the utopian version of our aspirations, but preceding in life without knowing this is living dangerously.

Need some Help? Contact Me