To retire in Malaysia, or any place for that matter, everyone would agree that we need to ensure sufficient financial resources, yes?

And just so you know, this is the most practical and highly actionable guide on the planet on retiring in Malaysia.

The best part?

I am going to show you tips and to-do’s that work in your favour so your ‘retirement resource’ can outlast you while enjoying the retirement lifestyle you desire.

It could be in a lump sum or periodical cash flow, but the bottom line is that total liquid assets must be able to sustain a comfortable lifestyle. That is why retirement planning in Malaysia is crucial.

Why?

Financial requirement wise, you are required to lock in at least RM (Ringgit Malaysia) 150,000 at any Malaysian bank under MM2H or Malaysia My Second Home program for retiring in Malaysia.

But is Malaysia good for retirement?

Well, you should know that Malaysia consistently ranked high in the list of retirement havens according to InternationalLiving.com in this article.

The annual International Livings dot com Retirement Index compiles the top retirement havens worldwide, based on key criteria for a happy and successful retirement.

No less than 12 factors are taken into account when assessing potential destinations, such as cost of living, political life, retirement benefits, Malaysia climate and healthcare, all based on a couple of retirees living with at least $1,500 per month.

In short, if you want the best retirement lifestyle and sustainability, you will love this guide.

Let’s get started.

(Article intended for non-Malaysian looking to migrate to Malaysia for retirement and Malaysian working overseas who wants to return to Malaysia for retirement)

To retire in Malaysia…

Learn these 17 actionable tips to stretch thy retirement fund.

Enjoy a sustainable retirement with the lifestyle you’ve always desired, even without an active income

After all, that’s the purpose of retiring to Malaysia, yes? To stretch your money further than if you were to retire in your home country, be in UK, Canada, United States, South Korea, South Africa, Costa Rica, Hong Kong, South China or other parts of the world.

Look, here’s the deal:

I am not going to tell you how good it is to retire in Malaysia. Or where is the best place to retire in Malaysia? Or even how to apply for Malaysia My 2nd Home program.

There are countless websites and articles covering these topics.

If you want a quick walk-through, here’s a video of that.

Instead, I am going to boost your odds of outliving your retirement nest egg if you are considering retiring in Malaysia.

Whether you are a high net worth or mass affluent individual, my ultimate retirement guide here will show you how to protect, preserve and possibly grow your assets in Malaysia.

And if you need to calculate and visualize your retirement surplus or shortfall in under 1 minute, I recommend using this retirement calculator. This will answer your question of “How much do you need to retire in Malaysia?”

Other alternatives like this and this are too simplistic while doing it manually like this is too much of a hassle.

Now before continuing further, these are the top 3 questions people have always asked me which you can relate to (and which I’m going to answer in brief)

What Is The Average Monthly Cost To Retire In Malaysia?

A 10,000 (ten thousand ringgit) per month or circa USD 2,500 equivalent, can get you quite far without clipping coupons or skimping on groceries. This is very doable provided you don’t have expensive hobbies.

How Much Is Enough For Retirement In Malaysia?

The general inflation rate in Malaysia is generally manageable at 2-3 percent annually, so if you don’t have significant personal inflation issues, then you can just take MYR 10,000 per month, and multiply it by 12 months, then multiply it by your (life expectancy minus your current age). That’s your non-complicated ballpark figure.

How Much To Retire Comfortably In Malaysia?

MYR (Malaysian Ringgit) 10,000 (ten thousand) per month can get you good mileage. You may even be able to throw in local sightseeing trips around Malaysia a few times a year. In short, it is really affordable to retire comfortably in Malaysia

The Ultimate Retirement Check List

24 Matters you should do Before & After Retirement - Yours 100% FREE

(Note: check your spam/junk folder if you don't see it in your inbox)

About Me, the Author

My credibility in advising Malaysians and expatriates on their retirement & personal finances comes from the fact that in addition to managing multi-millions equity investment portfolio for clients as an independent financial adviser, I’m also sought after by corporate financial organizations (like fund houses, financial associations and reputable banks) for my investment advisory expertise, specifically tailored to professionals in their 40s and above, who consists of:

- C Level Executives

- Business Owners

- Entrepreneurs

Table of Contents

1. Retire in Malaysia: Manage the inflation risk and outlive your retirement nest egg

Inflation in Malaysia averages between 2% to 3% per year. This is measured by the CPI (Consumer Price Index) indicator from the Department of Statistics of Malaysia.

We take 3% as a conservative estimate for computation for living costs in retirement planning. However, bear in mind this could very likely be higher due to your personal retirement lifestyle & living costs in Malaysia.

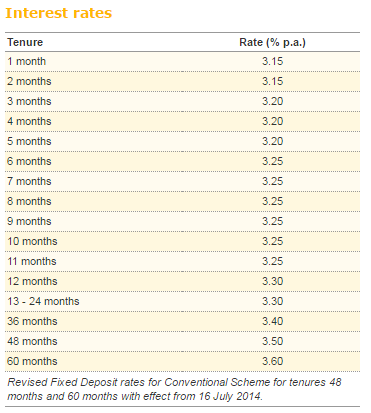

Coincidentally, Malaysia risk-free rate of return (aka cash or fixed deposit account) stands at circa 3%, which tracks the nation’s interest rate.

That means, if you put your money in any Malaysian bank cash deposit (or more famously known as a fixed deposit account among locals) for monthly renewal, you earn 3% per annum return on your money. You could get higher rates if you lock in for a longer period, for example, you may refer to the interest rate table here. It is the most liquid asset which comes with capital preservation.

That’s RM 3,000 for a RM 100,000 deposit, or RM 30,000 for a RM 1 million deposit. Not too shabby compared to near-zero fixed deposit rates in the United States or even our neighbouring country Singapore.

There has not been a drastic change in the risk-free return rate for the past 10 years since the 2008 economic crisis.

Now, you might be wondering:

Is this the best time to make to move to migrate to Malaysia for retirement, perhaps taking the famous MM2H visa?

In case you have not realized it, Malaysian Ringgit has been in depreciation mode against USD since 2015 compared to where it was at 1 Dollar = 3.2 Ringgit.

Want to know the best part?

Ringgit is now at ALL TIME LOW since 50 years ago.

Suffice to say that if you are an American, Canadian or British planning to retire to Malaysia, this is one of the best times to maximize the value of your retirement nest egg at 1 Dollar = 4+ Ringgit. More mileage for your money when you really do retire in Malaysia.

Here’s the kicker:

For just USD 250,000, you are literally a Ringgit millionaire!

But just how much does it cost to retire in Malaysia?

How much money do you need to live comfortably in Malaysia?

And how far you can go with having 1 million Ringgit to retire in Malaysia?

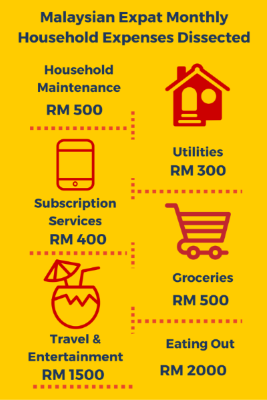

This is to give you an idea of the monthly living costs if you were to retire in Malaysia. Discretionary living costs such as eating out, travel and entertainment, while you retire in Malaysia, may vary depending on what type of person you are.

However, it is no brainer that you can save a lot by cooking at home and live in say, Penang instead of KL, especially if you are not a party goer person. Transportation wise, cycling lanes are aplenty in Penang, and Grab is also available. Therefore, you could utilize this instead of spending a huge lump sum to get a new car although all MM2H participants enjoy special price incentives.

Bottom line: don’t splurge without clear evidence you can do so. Regardless if you retire in Malaysia or other places, it may bring you temporary excitement but remember this rule – happiness is the result of income exceeding expenditure, and misery, the reverse.

Back to the topic of inflation:

Now, you, a Ringgit millionaire overnight, may feel that 2% to 3% reduction in purchasing power (or increase of 2 to 3% cost of living) isn’t alarming at all. My advice is: don’t underestimate the power of compounding.

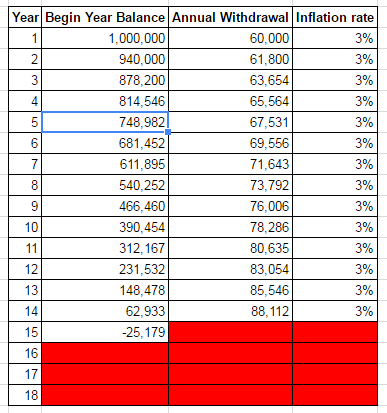

In fact, 1 million retirement nest egg will only last you just short of 14 years if you withdraw RM 5,000 per month adjusted for 3% annual inflation, without reinvesting the balance.

Besides that, there are drawbacks of becoming a Ringgit millionaire too.

With the weakened Ringgit valuation – with no end in sight, you want to expect the cost of imported goods to go up as well. This is especially true when you are used to certain brands of household items back in your home country and are reluctant to buy local brands.

Hint: 2 popular grocery stores which cater to expats – Sam’s Groceria and Cold Storage.

Furthermore, this does not factor in any other financial contingencies. Like going for that cruise vacation. Or visiting popular neighbouring cities like Bangkok, Bali and Singapore. To retire in Malaysia does not mean you only stay put in Malaysia, yes? Malaysia is in fact, a hub to many exotic destinations in Asia.

I digress, Anyway, it is easy to get tempted if you stay and retire in Malaysia. If you are not careful and prudent, you will run out of money before running out of life!

Suddenly, retirement planning does not look so straightforward as you thought. Then, there are 5 critical questions to ponder over below as well:

- What is the expected life expectancy? Ignore the mortality statistics – you want to look at how long your parents and grandparents live instead.

- How much additional active or passive income you are generating from your liquid or illiquid assets in your home country which could be used to supplement your retirement cost of living in Malaysia? Most retirement calculators fail to factor in this aspect.

- Your expenses may drop as you get older because, well, let’s be honest, you should have done what you want to do in the early years of your retirement in Malaysia. Another reason is that your mobility may get reduced as you get older. How to factor in variables like this?

- Your retirement nest egg should not stay ‘stagnant’ because the remainder balance of your retirement nest egg after withdrawal will be reinvested. We need to compute for this, and hence your retirement nest egg in Malaysia could last slightly longer than 14 years as indicated above.

- In retirement planning, there is 2 methods called capital liquidation method and capital preservation method. Whether to use one or another depends on whether you want to leave certain amount of legacy to anyone you care about. How to compute for that?

2. Retirement Planning: Get the best ‘bang for your buck’ health insurance and Prevent ever-rising medical cost from touching your retirement fund

Are we in agreement that medical costs will carry one or more of the characteristics below:

- Most unexpected

- Most unavoidable

- Possibly long term & recurring

- Most detrimental to retirement nest egg

How detrimental, you asked?

The costs of medical treatment – MUST KNOW if you live or retiring in Malaysia

For minor conditions like cataracts or appendicitis, the cost of such treatments may hardly dent your retirement nest egg. But what if major conditions like below hit you?

Medical costs have escalated around the world and this is no different in Malaysia. Medical inflation averages about 10% each year and is projected to rise due to advancements in medical technology.

In Malaysia, public hospitals are subsidized by the Malaysian government and provide affordable healthcare to the masses. Non-Malaysians need to pay a nominal sum though.

They do offer good medical treatment but patients may be subject to longer waiting times and perhaps, less personalized attention from the doctors due to the volume of patients they need to oversee.

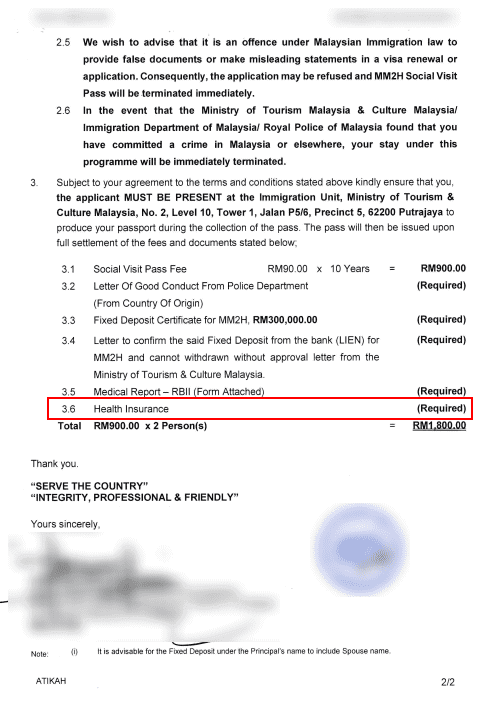

The fact is, non-Malaysians are discouraged from seeking medical treatments in public hospitals. That is why one of the requirements of MM2H (Malaysia My Second Home) program is to buy a health insurance policy in Malaysia.

Facts on MM2H program:

Sample of MM2H Visa approval letter

Health insurance policy, formally known as hospitalization and surgical insurance or casually known as medical card, provides for medical expenses incurred due to illnesses covered under the policy. The medical card itself is actually providing the convenience of cashless admission to private hospitals.

Medical tourism – world-class healthcare facility in Malaysia

SOURCE: INTERNATIONAL LIVING MAGAZINE

Another must know if you live in Malaysia for the long term or in case you wonder: “Is Malaysia cheap or expensive?”

More affordable air travel (think AirAsia), mounting health care costs in developed countries, and an ageing world population have all contributed to a global explosion of medical tourism in the past decade.

According to Global Retirement Index, Malaysia is leagues ahead compared to other Asian countries.

Among the cities in Malaysia, Georgetown, Penang and Kuala Lumpur are serviced by airlines from around the world; have a plethora of reasonably-priced hotel rooms, and when you arrive in Malaysia most nationalities are given a 3 months social visit visa by the Malaysian Immigration Department even you are not on the MM2H (Malaysia My Second Home) program.

DR. NEIL SOLOMONS

“I love it here. I’ve bought a house, established a life, and my wife and I absolutely love it. The hospitals are fantastic, the staff simply amazing. I just wish that I had made the move earlier.”u003cbru003eu003cemu003e[Dr Neil is a COSMETIC AND EAR, NOSE AND THROAT SURGEON, MOVED TO MALAYSIA, LIVING IN PENANG AND PRACTISING SURGEON AT LAM WAH EE HOSPITAL PENANG. PREVIOUSLY WORKED IN UK]u003c/emu003e

When you compare surgery prices between the U.S. and Malaysia, the benefits are obvious. A knee replacement in Malaysia costs just $4,000 compared to $45,000 or more in the States, while a hip replacement can cost as little as $5,200, versus $39,000 in the U.S.

Another example – a full-face lift in the U.S., including a chin lift (sometimes done separately or not at all), can be as much as $35,000. In Malaysia, it’s half the price.

When you think that you can add on a week of rest and recuperation somewhere, like on the exotic island of Langkawi, in a 5-star hotel, and still save $10,000 on what it would have cost you in the U.S., it’s no wonder that Malaysia’s medical tourism industry is on the rise.

Western accreditation is also a primary factor for confidence in undergoing foreign medical treatments, and hospitals in Penang and Kuala Lumpur were among Southeast Asia’s first recipients of the United States’ prestigious Joint Commission International (JCI) certification, which is seen as the gold standard for health care service providers around the world. Now Malaysia has 10 JCI-accredited hospitals for medical tourists to book with.

To check the latest list of JCI accredited hospitals in Malaysia, go to this link directly.

In short, the hospitals are first-rate and the doctors in Malaysia are either trained in the U.K. or the U.S. or they have done their postgraduate studies there. And all of them speak English fluently.

Health insurance aka medical card in Malaysia – get the best one with the features you need

The intricacies of the best medical card for you is not to be underestimated if you plan to retire in Malaysia for the long term. Since health insurance, just like any other insurance, is essentially a unilateral contract, knowing the terms and conditions of your medical coverage is absolutely critical.

Why?

To prevent the hassle of a dispute with the insurer on what is not covered or reimbursable when you thought they are covered.

Otherwise, a nasty situation like this may happen.

The other health insurance features you definitely want to take note of are:

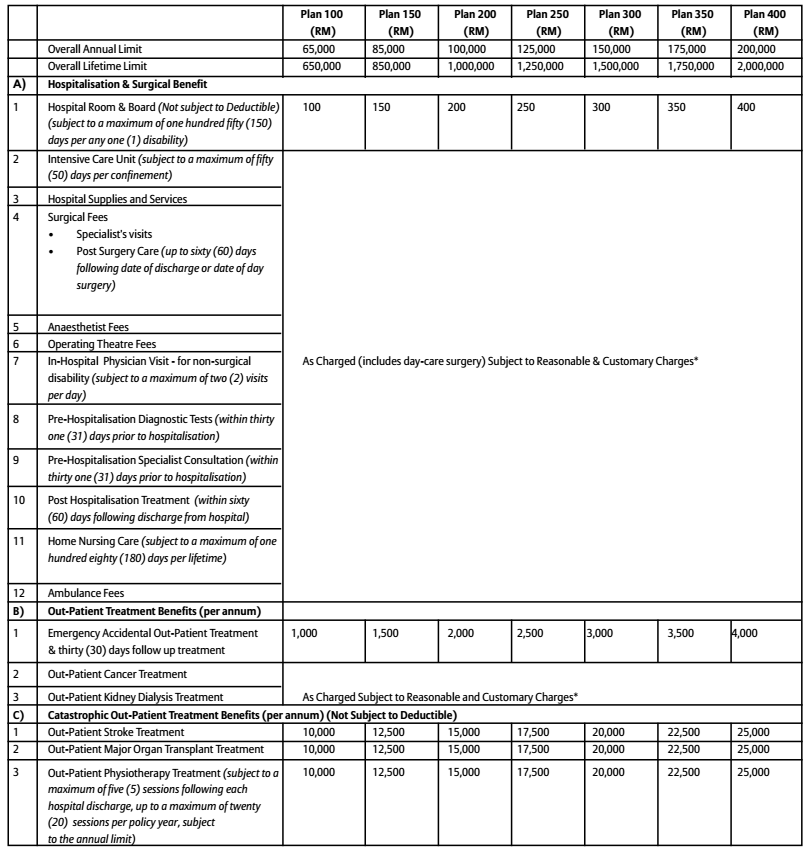

- Daily Room & Board rate – determines the type of hospital room you can choose to stay in without topping up the difference. It is very normal to go for a minimum RM 200 R&B nowadays, which could be a twin-sharing room. If you want basic single room or above, a R&B of RM 300 and above is recommended. Upgrading R&B rate higher than what you are entitled for in your health insurance policy may trigger a certain co-payment clause in the insurance contract. This render you needing to share a certain percentage of the total medical bill with the insurer, aside from paying the difference in room & board rate.

- Lifetime Limit (if any) – specifies the limited sum of medical expenses which can be exhausted throughout the duration of coverage.

- Annual Limit (if any) – specifies the limited sum of medical expenses which can be exhausted within any 1 policy year.

- As charged – covers hospitalization expenses which are deemed medically necessary, and as per reasonable and customary charges according to the schedule set by MMA (Malaysian Medical Association). If a medical procedure was being overcharged by hospital, then you need to top up the difference of amount for which the insurer doesn’t cover.

- Last entry age – the last age where you can buy a health policy. Normally it could be at 60, 65 or 70.

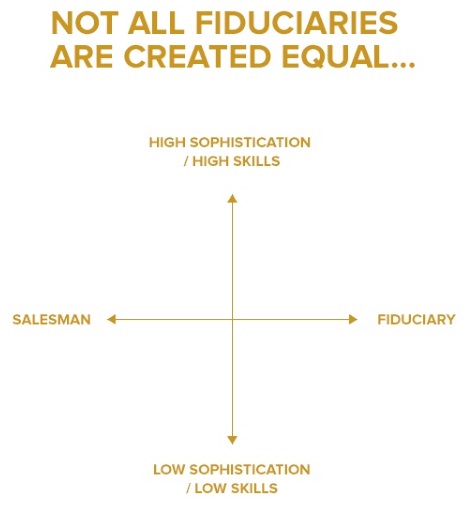

As a fiduciary financial adviser, we provide a non-biased comparison of all major health insurance providers in Malaysia.

As opposed to approaching tied agents from multiple insurance companies, they would not be able to highlight to you what are the weak points in their products.

That’s Why MM2H Applicants want to work with us to get Non-Biased Advice when it comes to Getting a Proper Medical Insurance

We believe every product has its weakness, the question is whether that very feature is important to you.

And to wrap up this section, here are the medical card features you should be aware of. And do check out Best Medical Card in Malaysia – the most complete comparison guide.

3. Retirement Planning: Invest for dividend & cash flow and abandon the need to ever withdraw the principal portion of your retirement fund again

Getting Guaranteed Return at no Risk

If you hail from countries like the US where the interest rate is near zero percentage, a 3% guaranteed return every year in a Malaysian fixed deposit does appear like an offer you can’t refuse.

Agree?

We have clients who are contented with putting money into Malaysian fixed deposits, generating a return of 3% every year – guaranteed and risk-free.

Why not, right?

After all, capital preservation & protection is more important in retirement than anything. Why risk your money?

Say you have RM 2.5 million in liquid cash. When you decided you want to retire in Malaysia, you transfer it over into a fixed deposit account in any Malaysian bank. At 3% per annum return, you are getting RM 75,000 per year or RM 6,250 per month.

RM 6,250 per month – this amount of tax-free income can yield you a pretty comfortable lifestyle if you are not a big spender, even for an expatriate family. See Section 1 – Malaysian expat household expenses dissected.

Getting Consistent Dividend at Low Risk

However, if you want something higher than 3% per year, still comes with low risk, low management and low cost, you might be thinking – how about ETF – Exchange Traded Funds?

Unfortunately, ETFs in Malaysia are still underdeveloped. The trading volume is small, rendering it illiquid.

The next best option, which we personally invest in, is REIT – Real Estate Investment Trusts.

Malaysian REITs are trusts which invest in properties only. They are traded on stock exchanges and the dividends are tax free in the hands of investors. The price of REIT counters don’t budge much – mostly horizontal price movement, hence making it low management. The only cost involved is brokerage fees, which comes about as low as 0.1% for transacted amount.

Here are 4 reasons why you should consider investing in REITs in Malaysia:

a. Get exposure to the top shopping malls and commercial buildings

With MREITs, you will be able to buy into the top shopping malls in Malaysia. Malls such as Pavilion (Pavilion REIT), MidValley Megamall (IGB REIT), Sunway Pyramid (Sunway REIT) are all available on Kuala Lumpur Stocks Exchange.

In other words, the underlying assets are correlated with some of the premium commercial properties in major cities. Income-generating properties like shopping malls are pretty resilient in their ability to generate income even in anaemic economic times. Hence, this fulfils the low-risk criteria.

And I am obliged to tell you that in this part of the world, rentals almost always go up. It is not a matter of ‘what if’, but it is a matter of ‘when’.

b. Earn consistent & sustainable dividends

This is perhaps the most important because we must prioritize cash flow over capital gain when you retire in Malaysia.

Now, like property rentals, MREITs also generate income in the form of dividends to investors like clockwork. Since MREITs are usually diversified, vacancy rates are generally low so they are a more stable form of income as compared to physical properties which could have vacancy periods.

The frequency of dividends payout for REITs is quarterly or bi-annually, making them an ideal investment for retirement income. To make it even more attractive, the dividend payout for REITs tend to be pretty high as they need to pay out at least 90% of their net income so that the REIT will be tax-exempt.

c. No hassle in buying and disposing MREITs

As MREITs are exchange-traded, buying and disposing of your holdings is generally easier compared to physical properties. MREITs are bought and sold like normal stocks so the prices are transparent and the transactions take place instantly.

d. Minimal effort required

One of the key advantages of MREITs is that there is a minimal effort required to maintain these investments. MREITs hire professional management teams to manage the tenants and upkeep of the properties, leaving you to enjoy the fruits of your labour. Anyone familiar with property investments will know that there is in fact a lot of work involved in managing your own properties.

At current market conditions, net dividend yields of most MREITs are pretty attractive compared to other investments, ranging from 5% to 7%.

Avoid insurance plans disguised as investment plans

If stay and retire in Malaysia, inevitably you will encounter agents from even very reputable insurance companies OR relationship managers at banks, pitching you some form of single/regular premium insurance products structured (and disguised as!) as investment plans. Like this.

This is a subtle mistake that can cost you a lot of money over a long time, although it may not appear as glaring as the 7 biggest retirement mistakes in retirement.

The unfortunate thing about these products is that they are perfectly legitimate. They are often packaged & marketed as being able to generate more than 3% per annum while providing basic life insurance coverage.

Sounds like a great combo?

Nope.

Here’s the bottom line.

Banks and insurance companies are both conglomerates. If an insurance ‘savings’ plan aka endowment plan can generate more than 3% guaranteed for its policyholders, shouldn’t the bank be able to offer the same return to its customers?

After all, it is a competitive market out there. If an insurance company can do “X”, the bank will match it.

Why, then, fixed deposit rate stays at 3%? The truth is, only the financially illiterate and those who do not conduct due diligence would be fooled into thinking an endowment plan can provide a “real’ 3% per annum compounded return (aka IRR Internal Rate of Return) over the duration of the policy.

The truth is, their real return will be lower than a fixed deposit’s 3% per annum.

Read this to understand in detail why I lambasted one of the largest financial products comparison websites in Malaysia for being biased in its sponsored article – Everything wrong with iMoney article on Retirement Planning.

4. Retire in Malaysia: Identify Investment scams & prevent them from preying on your retirement fund

What’s worse than an endowment plan aka insurance savings plan which gives you a lower than risk-free-rate of return?

Scams. The Ponzi scheme type.

Not unlike what Bernard Madoff was running before he get caught.

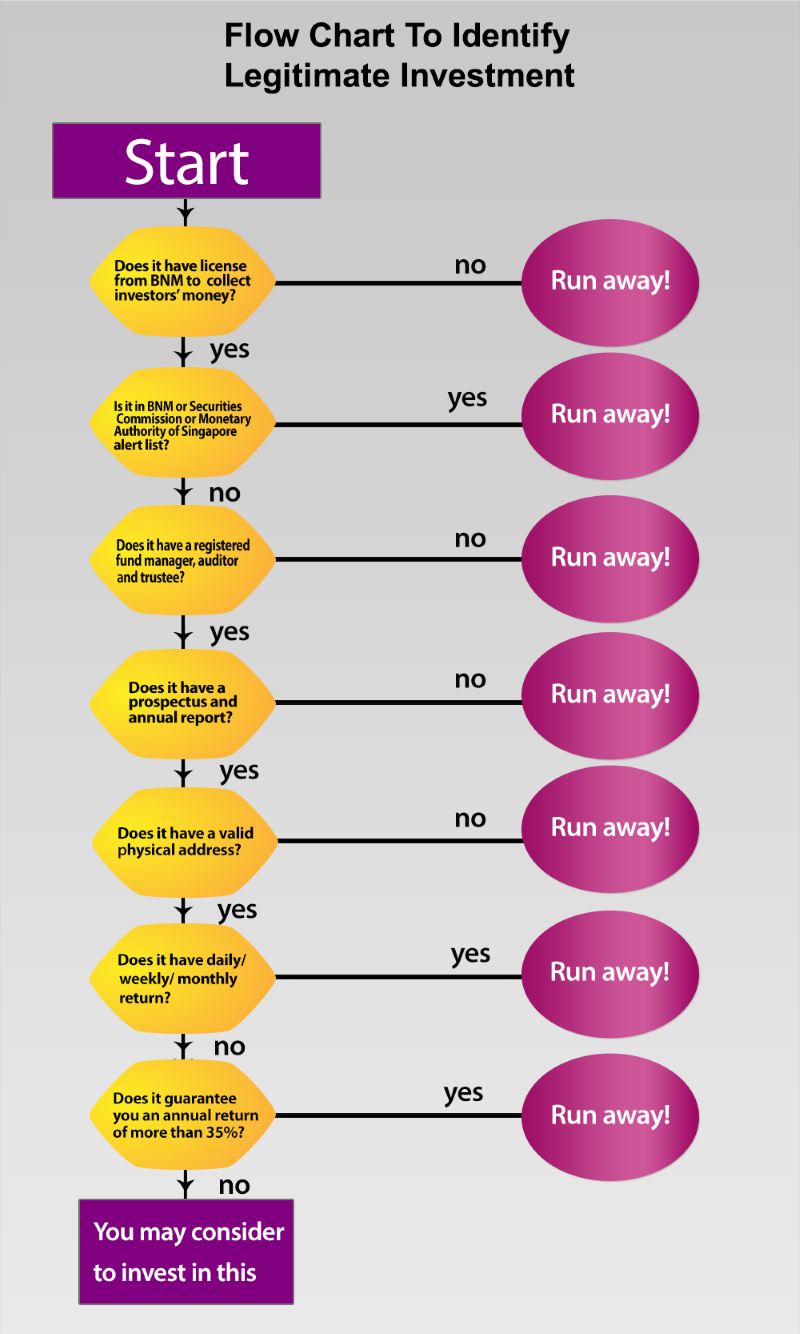

Here are 2 main ways to identify investment scams.

Firstly, use this mental flowchart to detect if anything is off.

Here’s the kicker:

The world’s famous and most successful investor, Warren Buffett, on average, achieved an annual compounding return rate of 21% over the past 51 years in this 2015 Berkshire Hathaway annual report.

It may be possible to achieve more than this on non-market correlated investment (such as private equity deals or hedge funds) for a single year or another but not for 51 years consistently for sure.

Secondly, use these websites to check if any of the schemes are in the Securities Commission and Bank Negara Malaysia Alert list.

Securities Commission Alert List

Bank Negara Malaysia Alert List

Sometimes, the scams will span neighbouring countries before targeting Malaysian residents. In that case, the scams will not appear in the 2 lists above, however, they may have appeared in Monetary of Singapore Alert List here. So check that also just in case.

The general mantra is – if it sounds too good to be true, then it is probably not true. Outrageous promise of guaranteed investment returns should always be backed with solid fundamentals. Thread with caution.

Remember, you don’t need fantastic returns or growth over your capital asset during retirement. What is more important is cash flow and capital asset preservation.

Of course, the other easier way to engage the advice of an independent fee-based financial adviser to act as your filter when it comes to investment options.

5. Retirement Planning: Chart your retirement landscape using Retirement Scenario Modelling and debunk the myth of the 4% Withdrawal Rule

To retire in Malaysia, or other foreign countries for that matter, retirement planning might not be so straightforward as you initially thought. It is likely the scenarios for retirement planning in another country is vastly different from your own country, although the general concepts are similar.

Don’t let that overwhelm you though.

Why?

Because we are about to provide you information on how you can plan to simultaneously deplete and reinvest your retirement nest egg.

…before you make the decision to migrate to Malaysia, or apply for MM2H (Malaysia My Second Home) program.

The secret is this:

Retirement Scenario Modelling.

This will answer nagging questions like:

How much do I need to save to retire at 55?

How much should I have saved for retirement by age 60?

How much is needed to retire at 60?

How much do you need to retire on?

How long will retirement money last?

This also beats any complex retirement calculators assumptions and statistical methods, hands down.

We are using this tool to advise our local or overseas clients in Malaysia on retirement planning.

It is very powerful because the tool enables you to dynamically manage your retirement fund by adjusting to life events post-retirement.

Life events like helping a family member financially, such as buying a house.

Sometimes it is hard to say NO to a request like that, but you need to guesstimate – can I afford to extend that kind of financial assistance?

Because you don’t want it to jeopardize your retirement lifestyle in Malaysia, although to retire in Malaysia isn’t as expensive in your home country. Most people fail to see that and go by gut feeling.

DON’T.

(And don’t get me started yet on the 3 main killers in retirement planning – taxes, high investment fees and emotions)

You need to make informed decisions.

Although it is a projected number using the RetireMethod Scenario Modelling system, an accuracy of 70% is good enough so that you know what and how much to adjust on your retirement lifestyle when a lump sum is taken out from your retirement nest egg.

Here’s the lesson you want to go through.

On top of that, our Scenario Modelling is also useful in determining how you want to adapt in case your investment portfolio suffers losses which impacts your retirement nest egg.

In fact, you could even use this for your investment portfolio back in your home country.

You always want to think of the worst-case scenario.

If monetary losses happen, you will need to make adjustments in our lifestyle so that you still have money to last throughout the remaining years.

But how much to cut back? How much is enough?

Conventional retirement calculators usually don’t take this into account because it is difficult to model or forecast.

That means no single retirement calculator is 100% accurate.

Without periodic review, that is.

BUT…!

By knowing the “Retirement Scenario Modelling system”, you could see for yourself how this impact your entire retirement landscape objectively.

Here’s the tutorial lesson to SHOW you to prove my point.

The common, but lesser-known and articulated problem we are addressing here is the Sequence of Return & Loss.

And finally, you may ask:

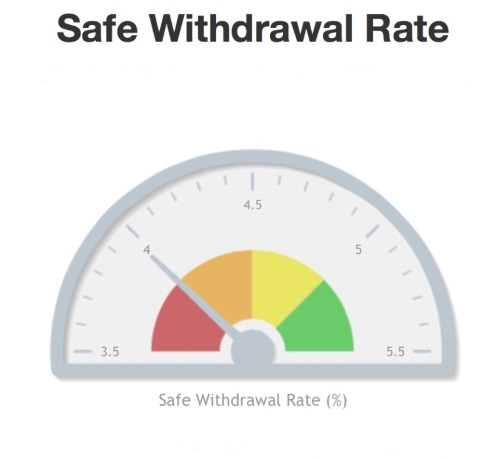

“What is 4% withdrawal rule and how does the above relate to this?”

The 4% rule is often presented as a virtually fail-safe guideline cum regimen for making sure you don’t out of money before running out of life.

The gist of it:

Just withdraw 4% of your nest egg the first year of retirement, increase that dollar amount each year by inflation to preserve your purchasing power, and you have an 80% to 90% assurance that your savings will last at least 30 years

But it’s not quite that straightforward.

To see why let’s look at an example. Say you retire with RM 1 million nest egg. Going by the 4% rule, you would withdraw, RM 40,000, or 4%, your first year of retirement and then, assuming inflation runs at 2% a year, you’d pull out RM 40,800 the second year, RM 41,600 the third, RM 42,450 the fourth and so on the rest of your life.

Simple and exact, no?

Trouble is, life isn’t so easy and exact. Just as we highlighted above.

Any single or interaction of unforeseen circumstances beyond your control can wreak havoc with any retirement plan you started off with.

Unlike things like whether to extend financial help to your relatives, how much return Mr Market decides to give you in any given year is entirely up to him.

The real threat to your retirement security comes when Mr Market goes into manic depressive mode early in retirement.

You don’t have to look back very long to find periods when the stock lost 50% or more of its value. That happened between 2000 and 2002 and again between 2007 and 2009.

If you’re unfortunate enough to get hit with such a big loss during your retirement in Malaysia, or even an extended period of weak gains, especially early in retirement, the chances of your retirement savings lasting 30 or more years with 4%-plus-inflation withdrawals can drop like a brick.

The reason is that the combination of your withdrawals and investment losses can so deplete the value of your retirement nest egg that you just don’t have enough capital left to repair the damage when the market eventually turns around.

But there’s another way you can run afoul following the 4% rule. If your retirement portfolio thrive, limiting your withdrawals to an inflation-adjusted 4% could leave you sitting on a big pile of savings late in retirement, possibly more than you had when you retired.

Granted, this may not seem like much of a problem.

But ending up with a large nest egg late in life could mean that you economized unnecessarily early in retirement, the very time when you probably could have most productively enjoyed spending some extra dough travelling, trying out new hobbies or other activities or just indulging yourself occasionally.

There are other potential issues with blindly sticking to the 4% rule. For example, a spike in inflation could rocket the size of your withdrawals so much that you deplete your retirement nest egg much sooner.

You probably want to consider moving back to your home country if this happens then.

Or you may simply find yourself unable to live within the constraints of the rule. Unanticipated expenses, especially the recurring ones, may crop up, requiring you to pull more than your planned amount each year.

Therefore, the primary question is this:

How, then, can you manage withdrawals from your savings so you don’t run out of money before you run out of life but also don’t end up discovering late in life that you unnecessarily stinted during your prime retirement years?

You need a system to cater for such retirement variables. Such a system will benefit you in such ways:

-

Ongoing monitoring of how long, given your portfolio’s value and your current rate of spending, your money is likely to last

-

Dynamically adjust your retirement nest egg withdrawals and spending as conditions change while evaluating its long term impact

-

If the market is bearish, you forego boosting your withdrawal for inflation or even reduce it a bit to give your nest egg a better chance to recover when the market rebounds

-

If the market is bullish, you may use that as a chance to spend a little more and indulge yourself a bit.

Our closing comment is this:

Start with an initial withdrawal of 4%.

However, if you’re really concerned about running exhausting your retirement nest egg faster than you expect, you can start with a smaller amount, 3.5% or even 3%.

If, on the other hand, you’ve got other resources to fall back on—a pension, lots of home equity, generous relatives—you might start with a bit more, 4.5% or even 5%.

Whatever percentage you start with, be flexible about future withdrawals.

6. Retire in Malaysia: Understand taxation system in Malaysia for non-Malaysian to minimize tax impact on your retirement nest egg

As cliched as it may sound, don’t we agree that there are only 2 things certain in life:

Death & Taxes.

Some people fear taxes more than death because taxes are recurring, and you can’t run away even you are lying 6 feet below.

Well, then today I’ve got good news for you even if you are a non-resident individual in Malaysia (stay in Malaysia for less than 182 days in the first year, and stay less than 90 days in subsequent years even though you stay more than 182 days in the preceding year).

Here are 6 kickers:

- You are NOT taxable for any income derived outside of Malaysia

- You are NOT taxable for the capital gains from your non-real-estate-property investment in Malaysia

- You are NOT taxable for capital gains from real estate property if the holding period is more than 5 years

- You are NOT taxable for interest income received from Malaysian banks (such as fixed deposit in Section 3)

- You are NOT taxable for tax exempt dividends received from Malaysia public listed companies (such as REITs in Section 3)

- You are NOT taxable for any inheritance in your home country

So by now, you can conclude Malaysia has a very welcoming tax regime for foreigners, making it the absolute perfect place to retire in Malaysia.

World-renowned Tony Robbin’s financial adviser remarked that the 3 major destroyers of wealth are alarmingly simple. They are – fees, taxes and emotional decisions.

So you see in Malaysia, many non-Malaysians sometimes cannot fathom while capital gain and passive dividend income are not taxable. The reason is that Malaysia is not following the global taxation rule.

But I am telling you it is what it is. Malaysia, unlike the United States, does not practice worldwide income taxation.

7. Retire in Malaysia: Find a fiduciary financial adviser in Malaysia to stretch your retirement nest egg even further

As a practising independent financial adviser with CFP credentials, I am firmly rooted in the belief that financial advice should be given without bias or a desire to earn investment commissions and transaction fees. Advice should be advice—not sales. Advice must be transparent and in your best interests at all times.

*The term ‘financial planner’ is used interchangeably with ‘financial adviser’, similarly, ‘independent financial adviser’ refers to ‘financial fiduciary’.

We call that a financial fiduciary.

How do you find someone like that? Aren’t financial planners tied to some banks, brokerage, investment or insurance firms?

It seems like a silly question, but here’s a quick example to demonstrate. When you walk into a butcher shop, you are always encouraged to buy meat. Ask a butcher what’s for dinner, and the answer is always “Meat!”

But a dietitian, on the other hand, will advise you to eat what’s best for your health. She has no interest in selling you meat if fish is better for you. Tied financial planners are butchers, while fiduciaries are dietitians.

A financial fiduciary is in a position whereby he represents you and put YOUR needs above his own – so they give you “conflict-free” advice. Financial fiduciaries look out for you and they will give you transparent advice and investment solutions to protect you from marketing “pitches.”

Plus, a talented fiduciary can find you investment opportunities that safely help you allocate your assets while also giving you a reasonable return – sometimes even a significant return if you find the right environment.

While many honest people work within the financial services industry, they work within a system that is set up in order for the house to win, not the clients. It’s not an evil system – just one created to grow the assets of corporations, not individual investors. However, now there is an alternative – one that has been created to serve the investor without conflict. It is called an independent financial adviser (IFA).

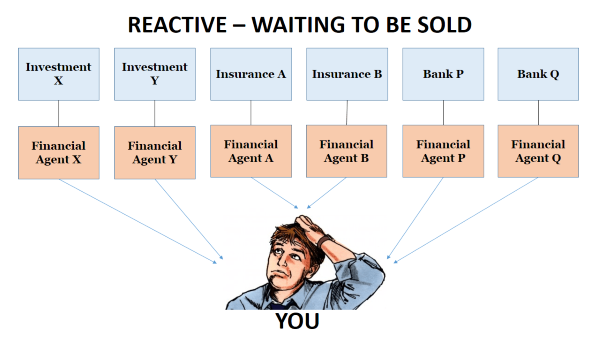

Beware – not all fiduciaries are created equal. The below scale will help you differentiate.

DIAGRAM SOURCE: TONY ROBBINS

On the left side is a salesman who might be nice and might be sincere. But, can you be sincere but sincerely wrong, yes or no?

And you move from the left side to the far right, the furthest right is a pure fiduciary, someone who is going to look out for you more than anything else.

But in addition, there are some fiduciaries that would be in the bottom right quadrant. That means they really are fiduciary, but they have low sophistication and low skills. They are very sincere and they’re looking out for your best interest, but they’re not that talented.

You want someone in the upper right quadrant, a trusted independent adviser who will put your interest above anything else, and has the sophistication and skills to help you turn your financial dreams into a reality.

If there is one single step you can take today to solidify your position as an insider, it’s to align yourself with a fiduciary or an IFA in Malaysia.

Click Here to access a Public Register of License Holders, then search under Representatives – “Lieu Ching Foo”

Alternatively, you can connect with him via his LinkedIn profile HERE

CF Lieu is an independent financial adviser (IFA) with CFP qualification and licensed by the Securities Commission of Malaysia to conduct regulated financial planning activities and charge a professional fee for it.

Related resources

Retire To Malaysia? 15 Reasons Why And Some Reasons Why Not

11 Insider Tricks Nobody Told You about Retirement Withdrawal Calculator

Retiring in Malaysia 2020: International Living

Tropical Malaysia: What It’s Like for Retirement

Thank you for sharing this very informative write up on Retirement.It increases my knowledge and awareness on retirement.

Thank you for your kind words Patricia!

Nice Blog!! The content you have shared is very elaborative and informative. Thanks a lot for sharing such a great piece of knowledge with us.

Thank you for sharing this valuable information. Your explanation clearly answers in an understandable way and very helpful! This can give better insights and inspiration for business owners. We would love to see more updates from you on SST Malaysia.