REIT: How To Invest Profitably?

In KC’s post on Malaysia REIT, there are a few pointers on the critical criterion to check on before investing in REIT.

Let’s take Capital Malls Malaysia Trust (CMMT) REIT as case study here, for 2 full quarters – Q4 2011 to Q1 2012. I bet you must have been to at least one of these shopping malls for retail therapy – Sungei Wang Plaza, The Mines, Gurney Plaza and East Coast Mall. Have you ever wondered the management and inherent investment element behind these shopping malls?

In this post, I am going to show you how you could scrutinize the criterion yourself by training your eyes to look for key data in its quarterly financial statements. If Warren Buffet, the greatest investor of all time does it, so should you.

Unless you are a business owner, I am aware that most people don’t like reading even your own monthly bank statement. But ask yourself, is spending 30 minutes every 3 months worth 6 percent or more return per annum? It is a definite yes for me.

I’ll present the fact and figures in a very much simplified how-to REIT investment article.

**********

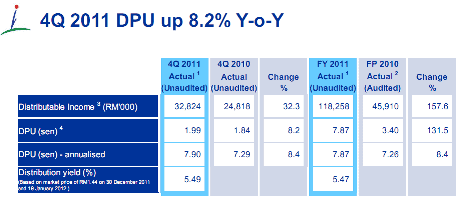

REIT performance in Quarter 4 2011

Dividend payout growth: 8.2 percent increase Y.o.Y. (year over year), with dividend yield of 5.5 percent for FY2011.

Growing portfolio asset value: Acquisition of one more shopping mall worth RM 330 millions, apart from existing asset value appreciation of RM 21 millions. Overall asset value growth of 14.4 percent.

Gearing ratio no more than 35 percent (lower, better): In fact, it has reduced to 28.7 percent, while unencumbered assets* (higher better)increased from 35.2 percent to 42.5 percent.

Value-added asset enhancement initiative (Gurney plaza, the primary asset): Completed renovation to accommodate extra 20k square feet of NLA (net lettable area) with 28 new tenants. Basement 1 floor space reconfiguration makes way for additional 2.8k square feet of NLA. All these translates to more rental income.

Occupancy rate (higher, better) and type: Occupancy rate hovers above 98 percent throughout 4 quarters of 2011. Good mix of tenant variety.

Portfolio lease expiry (higher, better): More than 75 percent of total leases expire in 2 years or longer. Good sign.

Management team with good track record: Capital Land Ltd, based in Singapore is one of SEA largest developer in shopping malls.

**********

Fast forward to 2012…

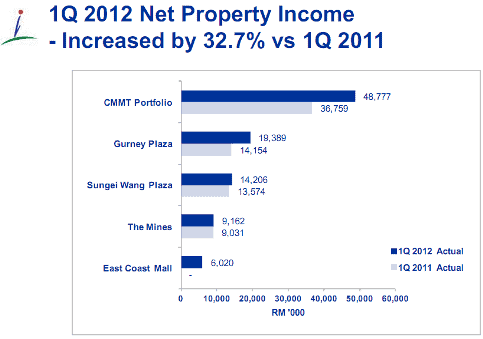

How is this REIT performance in Quarter 1 2012 given the full quarter contributions from the acquisition of East Coast Mall and the successful completion of the 2011 asset enhancement works at Gurney Plaza?

The results speak for themselves.

Note: CMMT REIT distribution policy for FY2012 is still at 100 percent of its distributable income.

Such analysis is the exact due diligence I do before investing in any REIT, and it is part of the step by step analysis members will get to learn in the membership area of REITMethod.com, the first online REIT investment course for Malaysians.

It’s really no rocket science when it comes to value investing in REIT.

For a quick video guide on how to pick a REIT and invest confidently based on data, you can also see this – 10 Minutes Guide to Read REIT Annual Financial Report.

Disclaimer: Long in CMMT REIT. This is not an invitation to buy or sell. Do your own due diligence before investing and invest at your own risk.