Thorough, Step by Step Guide on How to Generate Passive Income in Malaysia, BOTH with or without money.

If you do not have money to make passive income, then you need to spend time building up your passive income skills.

On the contrary, if you already have money, then this actionable guide will also show you the best way to build a legit investment portfolio that gives you guaranteed passive income like clockwork.

Proven Examples Revealed to you below – No Holds Barred.

Let’s get started

As someone who had real-life experience (prove below, I don’t talk only OK?) earning monthly passive income in Ringgit and USD for many years, I am absolutely qualified to give you insights on how to earn side or passive income in Malaysia like a Pro.

(see below: how to earn USD in Malaysia)

But first, I want to make this online passive income guide beginner-friendly in the form of bite-size information – so you can ‘chew’ and won’t choke.

Don’t skip a single sentence below, else it will be your loss, not mine.

How can I make passive income with no money?

Then you must use whatever extra time you have to start doing affiliate marketing or leverage on your skills/expertise/passion to create info product which you can sell online via the many social media channels online.

How can I get passive income in Malaysia?

There are only 2 ways: the first one, you monetize your skills or knowledge by packaging it into an info product to sell online. The second one, you market other people’s products or services to a target audience.

Can passive income make you rich?

The brutal truth is NO. You first earn your active income selling your time u0026amp; skills, hopefully a unique one so that you get paid bucket-loads of money, then you put that into investments that generate passive income. Then you are rich.

Table of Contents

Are Passive Income Opportunities suitable for me?

If you are still skeptical – ‘what’s the catch?‘

Or doubt yourself – ‘Can I even do this?’

Or wonder – ‘Do I need to be a social media influencer or a famous person?’ Or think – ‘This must require some complex tech skills I need to learn right?’

I can reassuringly tell you~

- There is NO catch, nothing illegal and zero hanky-panky

- Yes you can do this, it’s not a Myth

- No, you don’t need to be a famous influencer

- and Nope, it is based off skills you already have anyway

Let me repeat that – compared to other types of passive income in Malaysia, you need nothing of those to start making passive income of RM 50 or even a few hundreds extra side income every month. You just need to be NOT lazy and be willing to be open-minded.

Here’s the deal – the fastest way to earn passive income without starting capital is by using an approach called Affiliate Marketing, in which you get paid a commission for referring a product or service to people who need or want it.

At this point you may retort –

“oh, so I need to sell? I am not good in sales because I am not trained to sell, and selling just make me uncomfortable (want to puke or bury head into the sand)”

The fact is, everyday you are already naturally ‘selling’ when you…

- convince your boss/superior/subordinate to follow your way of doing things at work (or even ask for that increment or promotion)

- teach your children why they should do this but NOT that.

- convince someone you’re interested in to be your girlfriend/boyfriend

How to Get Safe Passive Income in Malaysia with Money?

Your money inside Fixed Deposit (FD) accounts, EPF or ASB earns you passive income easy-peasy, although each of them comes with its own set of pros and cons.

Another little-known, unique investment instrument to consider is MGS.

MGS comes with better advantages than FD, EPF and ASB, yet without their major disadvantages.

| Comparison | MGS | FD | EPF | ASB | Stocks |

|---|---|---|---|---|---|

| Your Yearly Return* (Guaranteed) | 4-5+% | 2-3+% | 4-6+% | 4-8+% | ? |

| Is your Capital Guaranteed? | Yes | Yes | Yes | Yes | No |

| Who Guarantees your Capital? | Government | Bank/PIDM (up to 250k only) | EPF | ASB | Nobody |

| Capital Can Withdraw Anytime? | Yes | Yes | No (< age 55) Yes (> age 55) | Yes | Yes |

| Max Amount you can Invest | No Limit | No Limit | 100k/year | 300k | No Limit |

How to Get Safe Passive Income in Malaysia with No Money?

If you don’t have (or don’t want) to plunk down a single cent to create passive income in Malaysia, then Affiliate Marketing method may just be one of the best passive income in Malaysia because you have more control over it.

What you do need though is a localized online platform which ropes in a growing list of credible businesses and brands offering services or products that the mass market uses.

Does these businesses or brands sounds familiar to you?

- Shopee

- Lazada

- Lenovo

- Kinokuniya

- Alibaba

- Watsons

- Adidas

- Zalora

- Ringgit Plus

- Car & motor insurance from Loanstreet

- Life & medical insurance

One such prominent platform is Accesstrade, originally from Japan, now expanding rapidly in Malaysia & other countries in the Southeast Asia region like Singapore, Vietnam, Thailand and Indonesia.

Accesstrade will be your middle-man or intermediary platform that pays you a percentage of purchase made by your friends, relatives and colleague when the purchases are attributed to you.

The platform will provide every publisher (aka promoter or affiliate, which is you) a unique URL (even though it directs to the same product or services) so that the purchase, when it happens, is traceable back to you. You can track, transparently, how many people that use your unique URL and how many sales have occurred, in (almost) real time.

It is perhaps the easiest way for beginner to learn how to make money online in Malaysia without investment

How much can you earn making a living off Passive Income in Malaysia being an Affiliate?

Well, depends on how much time you put in and how large is your network or circle of influence.

Obviously, the modern, 21st century way to do referral marketing effectively is when you have a large social media following and your followers trust, respect and like you.

If what you genuinely recommend is what you believe in, your audience can actually feel that your recommendation is in their best interest.

And they would not mind if you take a cut (commission) out of what they buy because they are not paying money extra anyway.

Or even if you are not into this Facebook, Instagram, Youtube or TikTok, you can still do the same among your circle of acquaintance, friends, colleague or relatives.

The success factor here, we reckon, isn’t about whether the products or services are good or needed (which is non-disputable when it comes to platform like Shopee, Lazada or Alibaba).

These platforms are becoming the part and parcel of everyone’s life so it is proven to work.

So generating monthly passive income online in Malaysia is truly not a myth in 2020 and beyond, especially in the post covid era. This is evidence, proof that what you have read so far works.

There is no limit or glass ceiling of what you can potentially earn unlike working in a traditional job.

Our experience: We got started in 8 July 2020. Even though we are not focused on this, we were able to generate RM 800+ in 3 weeks without forking out any money from our own pocket.

You need to watch the video below on how we do that even as we don’t consider ourselves ‘influencer’ of any sort.

So, that my friend, is the epitome of how to make money online in Malaysia without investment capital upfront, passively.

The hardest part is to actually start because just like anything new, there is always an inner voice within ourselves that is self-sabotaging.

When something is new, less people are doing it. We don’t see people around us doing it so we default to our ‘tidak-apa’ attitude.

But when people around you start to talk about or do it in mass, baru you jump into the bandwagon coz FOMO ~ fear of missing out. Unfortunately, by that time, the ‘thing’ is already saturated with competition.

Is it important to learn how to earn passive income in Malaysia, now?

You may retort –

“well, I am earning comfortable salary from my corporate 9 to 5 job (aka ‘active income’), why should I take the trouble to plan for passive income in Malaysia?“

The thing is, you could be absolutely right, now but let me share with you this true story ‘kisah benar’.

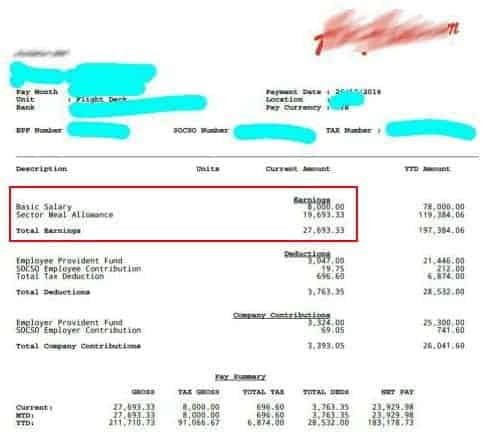

Do you know how much a first-officer pilot earns working for a domestic airline in Malaysia?

Here, see the payslip below.

By the way, this is someone we personally know and at the time this was taken, he was just 26 years old. Didn’t go to any college or university; just after SPM straight enrolled into pilot training school for 3 years.

About 30 to 35 hours work week only OK? Compare that with being a doctor (medical officer in government hospital when you are in your mid 20’s la?)

FYI, a pilot with Captain rank (if you’re really good, you get this before age 30) earns circa RM 40k to RM 50k a month conservatively, where a large portion of that comes from flight allowance, which is non-taxable.

How about now?

Fast forward past the pandemic era, I don’t need to tell you that more pilots are getting jobless after #AviationApocalyse.

I hope you get my point because no jobs in today’s fast moving world is 100% safe or guaranteed anymore. Your active earning skills, no matter how high-paying it is, will regress into obsoletion if you aren’t ready improvise, adapt or relearn.

In other words, without learning how to create passive income stream in Malaysia or anywhere you’re living, most people will work until they die (just look at the elderly people being janitors and McDonald cashiers in Singapore)

I want you to end up NOT like that; you should do better now that you’re reading this – don’t be like most other people you have little understanding on passive income in Malaysia.

Is it important to plan out the time to learn how to earn Passive Income in Malaysia?

You may retort –

“well, I don’t have time to create my first, or even additional passive income stream because I am so busy with my job/business and family.“

Frankly, I have this words of wisdom for you:

In life, the best situation is when you have enough money* and time.

*By the way, enough money or not is pretty subjective.

From our extensive financial advisory experience, no one single person’s definition is the same when it comes to having enough money to retire from active income or to proclaim themselves ‘financially free’ (which often refers to you have at least a decent cashflow of passive income to sustain you comfortably for the lifestyle you desire for a foreseeable future). If you don’t have that clarity yet, then reach out to us over here

Something like, have your cake and eat it too. If you either have enough money or too much time, then you want to flip it around.

Something like, have your cake and eat it too. If you either have enough money or too much time, then you want to flip it around.

With enough money, you buy other’s time to do things you don’t like to do or repetitive things that don’t generate much income for you…

…so you are able to focus on higher income-generating activities.

…instead of mundane but crucial tasks like washing your car or cleaning your house.

But when you have too much time, you should use your time more productively by focusing on income-generating activities…

…which you already took the initiative by consuming valuable, income-generating knowledge online, like this one,

…instead of consuming BS content that don’t better your life or add extra zeroes to your bank account balance.

What if you now feel you Neither have the Money Nor the Time (or worst, don’t enjoy what you’re doing)?

Then, my friend, you are in critical condition because you are heading in the wrong direction.

My advice to you – hit PAUSE button – really sit down and review what you’re doing by ruthlessly cutting the ‘fats’ – things that take too much time but give you too little income or tangible return.

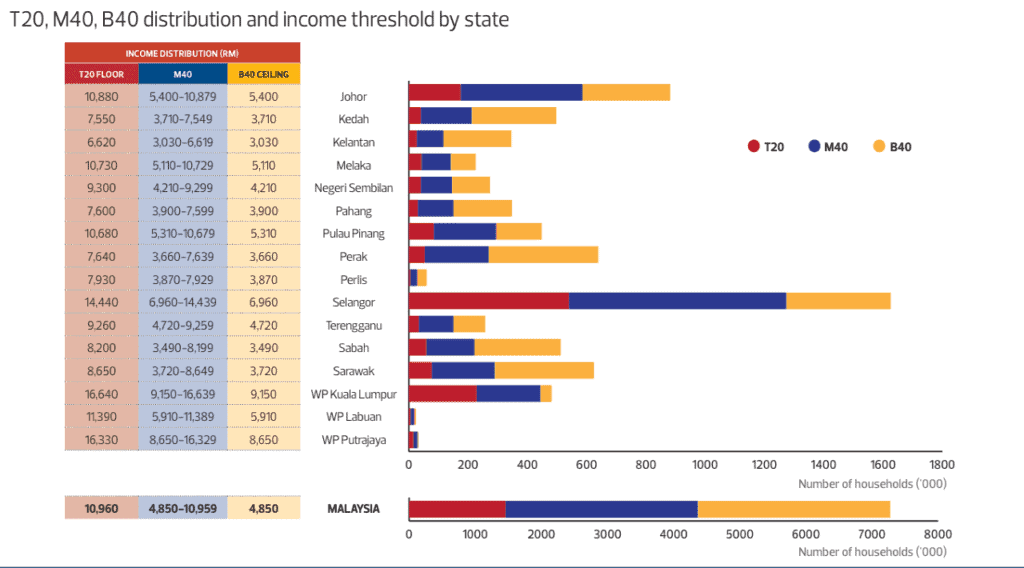

That is how you move forward in life – like moving from B40 to M40 or from M40 to T20. Capisce?

Wrap-up: How to Earn Passive Income in Malaysia being an Affiliate

We reckon your effort to generate passive income in Malaysia will yield the Best result if the product or services recommended are something you are already or actively using anyway.

But it does not always have to be this way.

In some instances, it could also be instead the recommendation or product/services review revolves around your area or expertise.

Furthermore, it is scalable. Affiliate marketers typically don’t hire extra help. You can introduce products to an audience and create campaigns while your past work makes money in the background.

There’ no shortage of things to promote in Accesstrade but you cannot be jack of all trades, as the saying goes, – A Person who chases two rabbits catches neither.

For example, professionally, we are certified, licensed financial adviser with a well-established website (this one, you are seeing right now) and Youtube channel.

While it make sense for us to talk about credit cards (example below) which is a financial instrument, it would be out-of-our-element to promote consumer goods like Adidas or Watson.

But hey if you’re a fashion or beauty influencer, promoting Adidas or Watson will be like a fit made in heaven for you.

You don’t have to set up a shop to be a reseller of Adidas or Watson and get these companies to pay you for brand deals like sponsored IG posts.

You don’t need any of that, no hard costs and these social media channels are what you are using daily anyway. The only difference now is you are monetizing your time spent on these social medial channels in a more financially productive way.

What if you do not like this method, despite it being the EASIEST to start?

Then you want to watch the video below for 8 more options I have for you – best of all, you don’t need any qualifications and can be done even if you are a student or a teenager.

Nonsense Passive Income Ideas on the Internet (that don’t work)

In this article at FMT, titled ‘Revealed: the 6 types of passive income in Malaysia’ ~ the author is disillusioned to claim these passive income instruments work:

- Property investment (hello? huge upfront capital ok?)

- Intellectual property (not everyone is a designer or scientist ok?)

- High risk investments (WTF? you can lose your pants ok before any income gets generated)

- Valuable items like antiques (holy sh!t, absolute bollocks because you may need to wait 100 years before it becomes valuable enough ok?)

Author did get 1 thing right when she mentioned ‘referral type’ passive income, which is what this passive income guide for Malaysians is about

Then you have another post on iMoney: How Malaysians can make side income online. While most of the points discussed revolve around active income, like freelance work, selling digital content etc – it also mentions ‘Sell someone else’s product or service’ ~ which is what Accesstrade platform is about -to enable you to do that precisely. The pros are – Your earning potential is not limited by your hours & You don’t have to be accountable to clients or customers.

Passive Income Ideas that are NOT Passive and NOT Practical At All!

In reference to this – 29 Passive Income Ideas by Shopify, it blows my mind to see some of the points mentioned about passive income. Here are some sticking out like a sore thumb.

Start a drop shipping store

Problem: Sure, dropshipping can be potentially profitable and will not require you to maintain inventory as you would when running a traditional store. The business model will demand a significant amount of time, effort, and investment to start and operate.

Become a blogger or social media influencer

Problem: Realistically, people who claim to be blogger/influencer/youtuber still has a full time job, either that or they are privileged financially where the side income from brand deals/ads are just like spare change to them.

Sell handmade goods

Problem: Not passive if you have to hand-make it for every order. Duh!

Rent out your spare room or unused space or parking space

Problem: High barrier of entry to start because that is assuming you are a landlord or own some prime real estate property in the first place.

Rent out your car

Problem: Unless you have an exotic car that can be rented for wedding events, why would anyone rent your MyVi if people can call a Grab to get from point A to point B?

Buy and sell (flip) websites

Problem: Does hunting for websites to buy, and then finding buyers to sell your websites to at profit, over and over again, screams ‘passive income’ to you? If yes, you have my respect.

Start a YouTube channel

Problem: Coming up with video ideas, scripting, recording and editing – does that sound like too much work for you for too little passive income? Ask the world’s top Youtuber MrBeast whether his Youtube ad revenue is ‘passive’. Next…

Invest in businesses

Problem: This assumes you are business savvy with bucket loads of money sitting around, or a venture capitalist.

Record audiobooks

Problem: Are you already an author? The work that goes into writing and publishing a book is hardly passive

Earn royalties through inventions

Problem: This tip assume everyone is a scientist or an inventor.

Invest in vending machines

Problem: Just google ‘vending machine scam’ and you will see countless horror stories. You could be throwing money into the abyss.

Myths on Passive Income Debunked

“Passive income” is a buzzword as people seek to get the greatest amount of cash inflow for the least amount of effort. However, there are some serious misconceptions with passive income, both in theory and in practice, that you need to address and reconcile before moving forward with any plan.

Passive income do not start out passive (myth 1)

- Actively work to accumulate the investment capital in the first place.

- Then, you need to spend time to conduct research, do your due diligence and

- Lastly, purchase a basket of stocks that would give you highest dividend yields.

Similarly, if you want to generate passive income from a rental property, this is what you need to do initially:

- Hunt for the right property with growth prospects in a good location

- Obtain mortgage from banks

- Have enough savings to pay at least 10% down payment & other incidental costs

- Fix or renovate it

- Advertise it to get the right tenants.

Passive income still needs maintenance (myth 2)

Very few passive income streams fall into the type where you “set it and forget it” for 10 years.

The truth is, majority of passive income streams still require ongoing upkeep otherwise it falls apart.

For example, if you’re making money via Google Adsense advertising on a blog, you need to churn out content on regular basis for your intended audience.

Not to mention, the maintenance of the website. Marketing your content on the top social media platforms like Facebook, YouTube, Twitter, Instagram and TikTok is a full time job on its own.

The same thing happens if you own an investment rental property. You must also handle dirty works like:

- Handle tenant who refuses to pay rent,

- Evict tenant who ruins your property (can be both expensive and time consuming)

- Cater to tenant requests or complaints

All these are hardly passive in nature, agree?

Initial Capital is a Massive Hurdle (myth 3).

It is very short-sighted for most people to assume investing is the only way to generate passive income stream. In fact, I do not suggest you count on investing at the start to generate passive income.

Because with small capital, strategies like managing rental property and collecting dividends from stocks, would not work.

Why?

Well, until you are able to plunk in tens, if not hundreds, even of thousands of ringgit into any investments, you will not actually get a reasonable passive income amount.

The only time you want to diversify your income stream into investments is when you already got your finances together and you’re making a strong stream of revenue from an active source.

Related

Five Passive Income Idea for the Digitally Savvy

CF, can u send me the link to the interview with the girl please? Thanks much. Looking to start this journey of AM soon.

somewhere here: https://www.youtube.com/c/ACCESSTRADEMalaysia/videos

Great info, just wanted to point out a vocabulary mistake in your title.

You should use the word “Exposed”, not “Exposéd”.

“Exposed” is used to describe an action, while “Exposé” is used to describe a thing.

Cheers.

This is really nice article. Earning passive income, it seem getting tough Over time. Therefore I guess not for everyone, I have personally try it myself. Like blogs, have little bit success with it.

I am interested!

Thank you sir for the information. At least I get some idea and opportunity how to create passive income.

Yes Im interested.

yea, go to here: https://link.howtofinancemoney.com/invite-act