There are 2 things very wrong with iMoney article dated 5 April 2016 titled “How Do You Juggle Retirement With Multiple Financial Goals?”. You may have seen it in your Facebook timeline too as Sponsored Post.

As a licensed independent financial adviser and an industry practitioner, the first problem has to do with blatant misrepresentation, breaking one of the cardinal rules in promoting financial products – a mistake made mostly by tied financial agents who need to meet sales quota. The second problem has to do with breaking the another cardinal rule in selling financial products – abbreviated KYC or Know Your Client.

Let me explain.

Issue#1: Misrepresentation of Retirement Planning

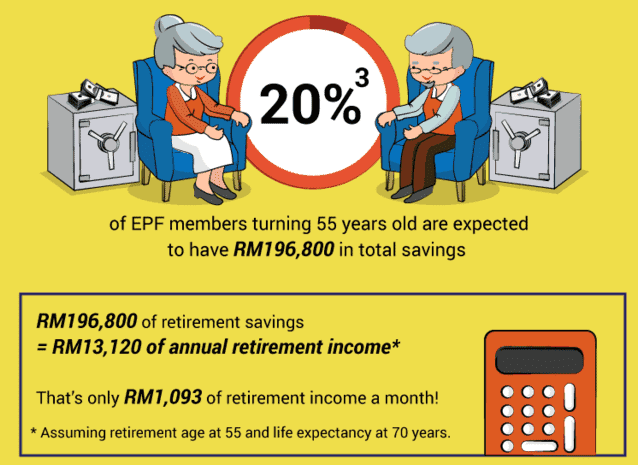

No big deal with the section below, except the fact that it didn’t take into account the inflation factor. Even if you take into account a nominal inflation 3%, per year, compounded, you only have a lot less than RM 1,093/month if you were to ‘tahan’ for 15 years without re-investing the balance after retirement income withdrawal. This is a very layman calculation, clearly far from being financially savvy.

This section implies that it is crucial that you use the next 8 years, starting now, to accumulate for your retirement nest egg using a savings plan aka insurance endowment plan. While you are doing this (by paying insurance premiums), you will also get back some of the premiums you paid from insurance company. Thereafter, for the following 12 years, you don’t need to pay for the endowment policy anymore but instead benefit by having the endowment plan paying you back cash income which could be sufficient for your retirement lifestyle. Basically you don’t need to worry on this part and hence, can focus on other financial goals.

Sounds too simplistic. If so, financial planning does not need to exist. We live in utopia.

This is the assumption made for the case study. Self explanatory.

This is the deal. Don’t be fooled by “120% of BSA (Basic Sum Assured)”. These means nothing.

So in summary, you get a Guaranteed lump sum of RM 124k, and a non-guaranteed lump sum of RM 126k.

That is IF and only if you hold the policy for full term – 20 years. Warning: Any early redemption will give you much lower values than that.

The 9% you see here also means nothing because it relates to insurance company, not in any way your investment return. Some agent will misled you with this figure, especially if you are auntie/uncle with little financial literacy. Beware, tell your parents/in laws not to fall for this when they encounter some sweet little twenty somethings. My in laws would have bought this if I didn’t intervene.

Finally, this implies that if you buy this endowment plan, you’d have a retirement savings of RM 447k, or RM 2,484 monthly retirement income. Not too shabby, but bear in mind RM 126k of it is just a projected return on a best case scenario, which is normally unlikely.

Disregarding 126k, it is actually only circa RM 1,782 based on the editor’s over simplified calculation.

**********

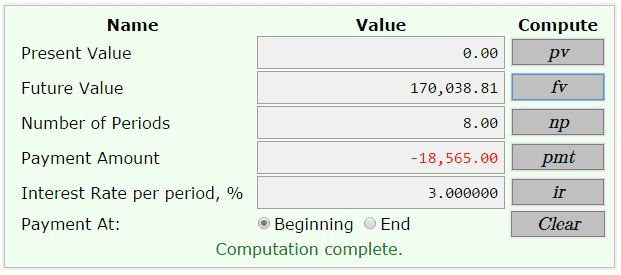

How this compare to putting RM 18k at the beginning of every year into Fixed Deposits for 8 years at Compound Annual Growth Rate (CAGR) of 3%. Outcome = RM 170k.

Then let it compound organically for 12 years, still at 3% per year, and this is what you get at the end of the 20th year.

RM 242k.

Bear in mind, all of this is guaranteed, and risk free.

So, do you want to put RM 18k every year into the endowment plan or in FD instead?

Issue#2: KYC – Know your Client on Retirement Planning

It is assumed that the right 30 years old person to take up this:

- Can contribute RM 18,565 per year, or RM 1,547 per month into the savings plan

- Has the needs to take up this plan because they risk of being having only RM 196,800 of retirement nest egg at the age of 60.

Now, if a person has 35 productive, income earning years, with EPF annual return of 6% and at worst case scenario, without any increment at all throughout his entire 35 years, I want to know what kind of monthly salary he is actually earning which makes him end up with only RM 196,800 of EPF amount at the end of the 35th year.

EPF total contribution per year = 196,800 / 35 = RM 5,623

For total employee+employer contribution of 23% (11% + 12%), about half of it forms employee deduction. For simplification, assume this is RM 2,800 annually.

Therefore, 2,800 / 0.11 = RM 25,456

Hence, monthly gross salary = 25,456 / 12 = RM 2,121

Monthly net salary = RM 1,887

Does it make sense for a person earning RM 1,887 a month to allocate almost RM 1,547 into his retirement savings?

Clearly, when iMoney editor wrote this, she failed to think logically and sensibly a practical scenario.

That, in my books, also equals to really bad marketing strategy because you attract the wrong type of prospects with mismatched income level. He or she clearly does not suit the solutions you are offering. If I am the provider, I’ll question the validity of the figures used in this case study.

You may think I am being a sour grape because iMoney clearly gets a cut of the revenue generated from this article but bear in mind that I can also sell this solution, but I chose not to because it is really not something I’d even buy. Proof – I can access Zurich quotation system to show you the below.

You may think I am being a sour grape because iMoney clearly gets a cut of the revenue generated from this article but bear in mind that I can also sell this solution, but I chose not to because it is really not something I’d even buy. Proof – I can access Zurich quotation system to show you the below.

Some also may argue that the premium is higher because there is protection element in it. In this case study, it amounts to Basic Sum Assured (BSA) of RM 50,000. Let me tell you that for that amount, you can buy a 20 years term policy from the same insurer at only RM 248.

Conclusion

I applaud iMoney for its other articles in raising financial literacy among Malaysians. iMoney offers some insightful information which sometimes I also learn something new. But definitely not this one.

Still, I’d give credit for its awesome info-graphic design, which unfortunately lacks substance. Actually, I am not surprised at the way it is marketed, because this is how insurance agent selling savings plan in shopping malls are going to tell you. However, it is unexpected for a reputable money authority site like iMoney to be on the same level like tied financial agents when it comes to marketing financial products.

I don’t blame the product provider because such endowment plans are also offered by other insurers, which, upon dissection, regardless of how they are being packaged, comes to a Compound Annual Growth Rate (CAGR) of lower/equal/slightly higher than risk-free FD rate, but generally, nothing to shout about.

I do hope that iMoney, deemed as one of the authority website when it comes to personal finance, should do more work in vetting through how financial products are being represented in its website. How can you claim to be the best money website in Malaysia when you don’t have readers’ best interest? I doubt the editors are certified financial planners (CFP), let alone licensed independent financial planners. As you can see, the above computation is actually pretty straightforward, you don’t need a CFP to tell you that you that even fixed deposit would be far more superior than the savings plan. With the monetary resources it has, I would have thought they can hire smarter, more qualified people for the job before publishing shallow information.

Retirement planning and management is NOT about buying insurance or investment products; it is about knowing the limitation of what you can and cannot do when you cannot turn back time. No point lamenting “I should have started early” because that is NOT going to change anything. The right way is to make the best use of what you have for your golden years.