Before I tell how you can get back ALL of your life insurance premiums paid at the end of the insurance policy coverage period…

Let me give you a brutally-honest lesson how to make you own ‘insurance saving plan calculator’ to compare insurance saving plan vs fixed deposit.

Watch this video, and while you do so, you will also answer these questions in your mind:

- Is insurance saving plan worth it in Malaysia?

- What is insurance saving plan interest rate?

- How do insurance saving plan work?

Consider this scenario:

Let’s say you are in your 40’s and need a 300,000 Life insurance to cover for natural or accidental deaths for 15 years. You have 3 options

1. Insurance Saving Plan in Malaysia with Guaranteed Life Cover & Cheapest Premium

You buy a Term insurance policy for duration of 15 years which coincide with the time you are likely to retire. This is how your cash flow will look like.

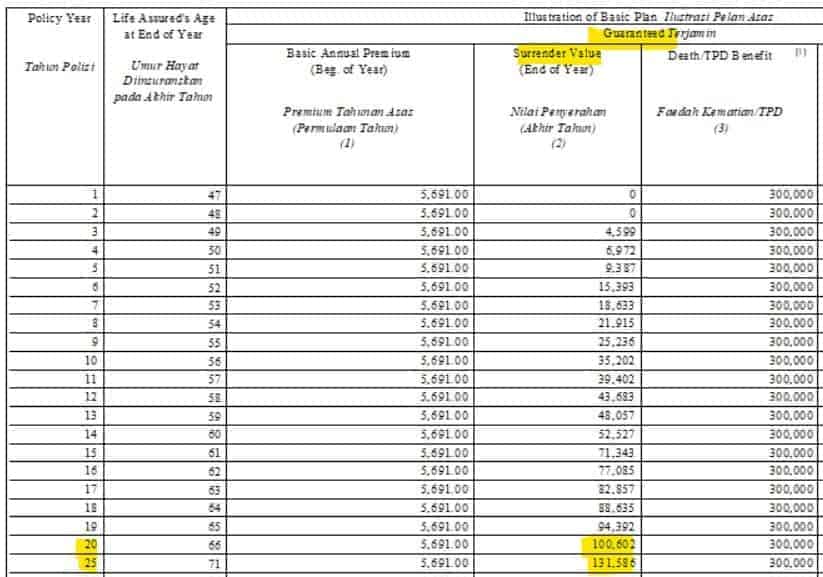

2. Saving Plan in Malaysia with Guaranteed Life Insurance & 100% Refund in Total Premiums Paid

The type of saving plan in Malaysia for you could be a Traditional, Time-Restricted Non-Participating (TTRNPP) policy for 15 years. This is how your cash flow will look like.

Now because this is on a compressed premium paying duration with guaranteed surrender value equivalent to total premiums paid, the annual premium becomes much higher than other plans with similar coverage.

Why some of our financially-able clients choose Option 2

This is the ONE QUESTION to get the policy Accepted or Approved.

Let’s see some examples highlighting the purpose of having any of the saving plan in Malaysia:

Example 1: John, 36, a family-first man blessed with a 6 years old daughter.

- Year 10: Passes away due to an unfortunate accident. His family receives a lump sum payout of RM 600,000

- With this, his daughter can use it to fund her college education fees.

- Year 15: John is alive and kicking. Thus, insurer writes him a cheque back totaling RM 110k.

- His daughter graduates, and as a graduation gift, he uses part of that money to pay for the downpayment for his daughter’s new car or even for 10% deposit for her apartment purchase.

Example 2: Ingrid, 45 a single mother of a 13 and 11 years old. Her main concern is the outstanding mortgage balance.

- Year 8: Passes away due to unexpected heart attack. His family receives a lump sum payout of RM 300,000

- With this, the outstanding mortgage balance is settled and her children can use it to fund their college education fees.

- Year 15: Ingrid is alive and kicking. Thus, insurer writes him a cheque back totaling RM 110k, just in time for her 60th birthday celebration cum retirement.

- Ingrid uses this money to enjoy the little pleasures in life as she looks forward to her golden years.

This type of life insurance policy is most suitable for you if:

- you are in your mid 30’s to mid 40’s

- you need the coverage for 15 years

- you predict that you’ll be most financially stable with maximum earning power in the next 6 years but anything after that is pretty much up in the air

- you need no more than 300k of pure Life (Death) protection

- you have been blindsided by insurance agents previously buying into some notorious insurance savings plan but then you discovered there’s this guaranteed & non-guaranteed cash surrender value – you realized the cash surrender value fell short of your expectation (not as what you’ve shown or promised at the time you bought the policy plan)

3. Best Saving Plan in Malaysia with Guaranteed Life Insurance & Fixed Cash Value

The Best Saving Plan in Malaysia for you could be a Traditional, Whole Life Non-Participating policy. This is how your cash flow will look like.

This type of life insurance policy is relevant for you if:

- you are in your mid 30’s to mid 40’s

- you need the coverage for more than 15 years

- you predict that you’ll be financially stable in the next 20 years until retirement

- you may need more than 300k of pure Life (Death) protection

- you cannot afford the high insurance premiums due to compressed premium paying duration (#2 above)

- you have been blindsided by insurance agents previously buying into some notorious insurance savings plan but then you discovered there’s this guaranteed & non-guaranteed cash surrender value – you realized the cash surrender value fell short of your expectation (not as what you’ve shown or promised at the time you bought the policy plan)

If insurance company goes bankrupt before saving plan maturity, how will it work out?

Question you may ask

Answer: They are available as Q1 and Q13 over here

Warning on Insurance Saving Plan in Malaysia with Non-Guaranteed Cash Value

If you do not want to be blindsided or hoodwinked by the unscrupulous or incompetent insurance agents out there, watching the video lesson below is MANDATORY.

Related: The best medical card in Malaysia: most complete comparison

Prudential saving plan in Malaysia

Can we purchase TTRNPP policy online instead of going through an agent?

Sure, why not when it is available via online portals

I’m interested to know more.

all the info is in this page, anything you feel is missing? 🙂

Hi I’m interested but is this shariah compliance? Thank you.

no it’s not 🙁

I am keen

Already responded to you Brian

Hi, im interested.

Already responded to you