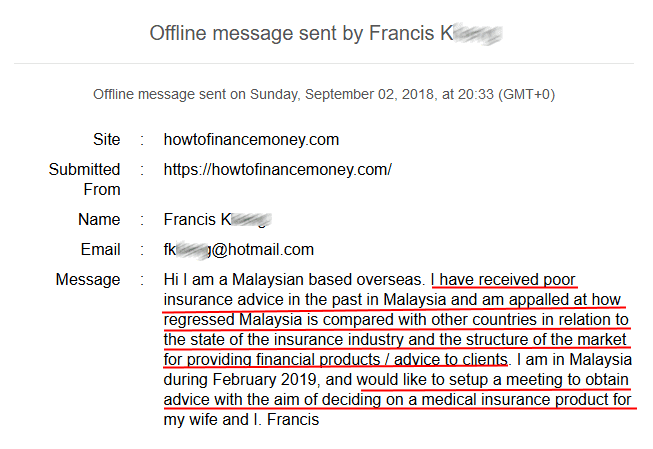

Now, when it comes to hiring a financial planner, especially in Penang, it is really no easy task.

It is sometimes difficult to avoid a bad one (pushy financial sales agents masquerading as ‘financial planner’), let alone finding a good financial planner aka financial adviser.

However, this comprehensive guide will put your worry to rest when you want to get unbiased financial advice in Malaysia.

We are going to show you everything you need to know when it comes to engaging a qualified and credible professional adviser.

Also, most people get it wrong when it comes to financial advisory & financial planning.

Real financial planning & advisory truly includes your values and life, as I explain below – why my clients seek financial advice even though they are intelligent to ‘do it themselves’

Also, due to the generally cost-conscious Penang population; when it comes to engaging a financial planner, they want the best bang for their buck. After all, the well-known Hokkien phrase – “Bang Yi Tua Teh” which translates to “Want Cheap and Big” is applicable here. Even if you are not a Penangite, you will think and act like a Penangite once you stay long enough in Penang.

Nonetheless, you know you probably understand the benefits a true financial planner can bring to your life & family. This is a comprehensive guide to separate the wheat from the chaff when it comes to hiring that good financial planner in Penang. At the same time, it will help you maximize the benefits of engaging a financial planner with the fees you paid.

My independence sets me apart

I have a firmly rooted belief that financial advice should be given without bias or a desire to earn investment commissions and transaction fees. Advice should be advice—not sales. I make my advice transparent, conflict-free and in your best interests at all times. I am dedicated to sitting on the same side of the table as you.

Any fees you pay to are fees for advice—that is it. Unlike big “name brand” advisers or firms, I am not driven to generate profits for shareholders by selling proprietary solutions that generate the most revenue. I advocate entirely for you.

While many honest people work within the financial services industry, they work within a system that is set up in order for the house to win, not the clients. It’s not an evil system – just one created to grow the assets of corporations, not individual investors. However, now there is an alternative – one that has been created to serve the investor without conflict. It is called an independent financial planner/adviser.

If there is one single step you can take today to solidify your financial position, it’s to align yourself with a credible & skilled independent financial planner in Penang.

***Pick a section to read more***

I) 10 Considerations before engaging a financial planner in Penang

II) 7 benefits can a financial planner in Penang bring you

III) 3 Reasons to engage a financial planner in Penang instead of DIY financial planning

IV) The 9 criterion to look for in a financial planner

V) 5 aspects an independent financial planner is different from normal financial planner

VI) What constitutes a cream of the crop independent financial planner

VII) 11 types of financial advice should you expect from a financial planner in Penang

VIII) 6 things NOT to expect from your financial planner

I) 10 Considerations before engaging a financial planner in Penang

1. Know what you want and expect from a financial planner

Taking time to determine what are the financial goals you want to achieve is the first step towards deciding how closely you will be working with a financial planner in Penang. It is also important to consider which area of financial planning you need assistance n.

2. Knowledge of financial matters

If your knowledge of personal finance is limited, the expertise of a licensed financial planner in Penang would be crucial in realizing your financial goals. Check the qualifications and license of the financial planner, to ensure his/her qualification is recognized and his/her practising license is valid. Check the financial planning license of a financial planner HERE.

3. Degree of involvement in achieving financial goals

Decide in the beginning whether you would rather carry out your own investment plan (hence seeking only second opinion advice from the financial planner) or rather have the financial planner assists you in executing the plans.

4. Complexity of financial situation

This will directly impact the degree of involvement of the Penang financial planner. For example, the needs of a single young adult differ from a middle-aged family man. This is also knowing as scoping the aspects of financial advisory you need advice on.

5. Relationship with the financial planner in Penang

The frequency of contact that you desire with a financial planner in Penang should also be considered, which is why it would be tricky if your financial planner is based in KL. Also, whether you want to review the financial plan half-yearly or annually or more frequently is also a factor to consider in hiring a Penang financial planner

6. Budget constraints

The amount of which you are willing to pay a Penang financial planner would also be an important deciding factor in how to engage the services of a financial planner in Penang. You are advised to discuss the compensation structure with the financial planner at the onset. Having a clear understanding of how the financial planner is being compensated for the advisory work done would prevent any misunderstanding later on.

7. Familiarize yourself with terminologies and concepts

It would be in your best interest to be prepared and to learn about financial planning concepts and the language often used by Penang financial planners. While you may not be familiar with all terminologies used by a financial planner in the beginning, it would be good to know at least the basic terms used.

8. Obtain referrals and interview more than one financial planner in Penang

Just as you shop around before purchasing an item, it would be wise to speak to family, relatives, colleagues or friends so that you may get referrals from the parties you trust. It is also better to speak to more than one financial planner in Penang until you are able to select one whom you trust with your financial information with.

9. Check the Penang financial planner’s background and obtain references

Since the financial planner would be privy to one’s financial information, it is advisable to verify the planner’s background by checking with their professional associations or any regulatory bodies. This is especially true in Penang where it is relatively a small place where you know someone in second or third degree from your existing network of friends or acquaintances. A financial planner who is in a full-time long term practice would not be folly to shoot himself in the foot by leaking a client’s financial information to any third party without the client’s consent as it would soon mean the end of business for him, especially in a place like Penang.

10. Get in writing

Remember to request any advisory contracts or engagement letters in writing to document the nature and scope of work to be provided by the Penang financial planner. This is also to avoid any misunderstanding later on.

II) 7 Benefits can a financial planner in Penang bring you

A true financial planner in Penang charges a professional fee just like your doctor, lawyer or accountant. [Also read: Why financial planner charges fees]

Financial planning, in its truest sense, is not about products. It is a 6 steps process.

Depending on the scope of advisory, the outcome of a comprehensive advisory comes in the form of a financial plan. A full-fledged financial plan enables you to make better financial decisions because of it…

- Integrates every aspects of your personal finances and shows you how one aspect correlates with each other.

- Contains a snapshot of your financial health, just like a blood test

- Analyzes your unique financial situations in increasing the odds of achieving your financial goals

- Identifies blind spots you may have missed

- Optimizes your money

- Gives custom-tailored made recommendations to achieve these financial goals

- Gives you better peace of mind

A true financial planner can make you feel more secure and confident (sometimes making you see the light at the end of the tunnel) in achieving the many often conflicting financial goals with the resources you have.

Financial planning, from technical standpoint boils down to this –

“Solving life’s mathematical equations.”

Don’t you agree life is a collection of ever-changing and often conflicting financial goals?

If life were so simple as just having one financial goal (for example, retirement), this mathematical problem is as simple as 1 plus 1 equals 2. Simple and straightforward. Everyone can do some extrapolations, and work backwards some figures using a simple retirement calculator – walla! You would have a financial roadmap laid out in front of you. No need for any financial planner.

But the complexities come when we desire more things in life. It is not wrong, in fact, it is normal.

We want the best for our children’s education – which is really, the major dent to any parents’ finances.

We also want to go for that dream vacation, purchase our dream house, etc.

And at times, life throws us a curveball that not only “dents” us emotionally but financially as well – like, chronic illnesses.

Now, the roadmap to our ultimate goal – comfortable retirement, doesn’t appear as straightforward as we have thought, aye?

To complicate matters, there are external factors beyond our control that also comes into our life equation – the likes of inflation, fiscal policy, monetary policy, bull cycle, bear cycle.

What about retrenchment? It is pretty common nowadays, yes?

With all these variables, how is our roadmap going to look like? From a simple 1+1=2, this has ballooned up to a complex calculus equation.

Can you solve this on your own?

Or would you want to solve this at all or just let things run their own course?

More often than not, unlike a true mathematical problem, there are NO right or wrong answers when solving life equations.

It depends on which area you are willing to adjust and compromise. For example, delaying retirement age or lowering post-retirement lifestyle expenses.

Don’t you agree money is a sensitive subject?

We deal with it every day in our adult life but we tend to avoid talking about the bad sides of it.

In the end, money is just money, but in actuality, our emotions are at stake. We are depressed when we have less money and are in the highs when we have more money.

To reduce this emotional volatility, the same way we want to reduce volatility in our investments is to have a financial roadmap described above. Let me give you an analogy if today, you have abdomen pain, you and your family will worry day and night, right? Your emotions will be affected. So what do you do?

You would be willing to fork out money to do a medical checkup. Now, the outcome of this might be good or bad. Good is the doctor might tell you – it’s just an indigestion problem and will go away in a week’s time. Bad is when the doctor tells you you have cancer. Either way, you know what to do from now on instead of guessing.

As a result, some of the common questions can be answered with clarity by engaging a Penang financial planner to solve life’s mathematical equations:

- Am I on track and making the right financial decisions toward my retirement?

- Can I afford my children education without jeopardizing my own retirement nest egg?

- Am I optimizing my investment returns? Can I do better? How?

- Is there a way to have more surplus without cutting down?

- What is my current financial health condition?

- Am I overpaying for my insurance premiums?

- How can I get sufficient human life value protection for my family and business?

- How can I visualize the cause and effect of my multiple financial goals?

- What are the best financial products in the market & who can do an objective comparison?

- What should I do with my business so I can retire while still reaping passive income from it?

- How do I preserve my wealth for my family after I pass on?

- How can I avoid making costly mistakes that will jeopardize my retirement?

Moving on to the next level, financial planning will also help you achieve optimum fulfilment in life.

We also call this – Financial Life Planning, achieving maximum happiness with the optimum money spent – whereby return-on-life (ROL) is more important than return-on-investment (ROI).

The 3 crucial questions to ask in our financial life planning are:

- How can I derive the most meaning from my means (money)?

- Is the fulfillment received in proportion to the money spent?

- Is this in alignment with my values, goals and purposes?

Financial life planning revolves around developing the skills and mindset to:

- Achieve enough means to align with our life meaning

- Recognize when we have achieved enough

- Stay near the peak of life fulfillment without falling back into deprivation or gluttony

This must be further explained using the Fulfillment Curve.

Using a Home Buying analogy to further explain this:

1 – You are essentially homeless; you sleep under the bridge.

2 – You own an extremely cheap, extremely small old flat. That means there’s barely enough room for sleeping space for all family members or room to do anything at all. You are embarrassed to have guests at all.

3 – You own and stay in a nice condominium with facilities. There’s enough room for everyone but you are sometimes pinched for space and there’s more clutter than you’d like. You sometimes have your friends over, but still, you feel pretty self-conscious about the place and don’t have the dinner parties you’d like

4 – You own a semi-detached house that is just the right size for your family. You feel comfortable having any and all guests over, the housework doesn’t overwhelm you, and the bills are completely affordable.

5 – Your house slightly exceeds what your family needs, but it gives you ample room to grow. The bills are slightly painful, but you can still manage them. You spend a bit more of your weekends on home cleaning and maintenance than you’d like, but you feel quite proud giving dinner parties and inviting people over.

6 – Your house is a freaking mansion. We can afford the bills, but just barely, and only if you don’t eat out often. The bills make you feel kind of guilty, and there are times where it feels like all you do is earning your income just to pay for the bills.

7 – You over-leveraged and bought a house ten times your annual income to impress your friends and relatives. Your house is mind-bendingly awesome, but just last week, you just got retrenched from your job.

Point#1 – The fulfilment curve applies to everything where money is spent on.

The basic principle applies to almost everything in our lives, from food to clothing to shelter up to hobby-oriented activities. In almost every aspect of life, the point of maximum enjoyment is not the point of maximum spending – spending too much reduces fulfillment.

Point#2 – Guilt is one of the surest signs of the downside of the curve.

If one feels guilty about spending in any area, he is likely spending more than his natural fulfillment peak. Take a few steps back on that spending some and you’ll almost always find that things return to being enjoyable again.

Point#3 – Your fulfilment curve peak might actually come with spending no money at all.

Here’s an example: family time spent with your spouse and/or kids playing at a neighbourhood park on a Sunday morning. The cost is virtually nil, but it was a peak on the fulfillment curve. Fulfillment curve peaks don’t necessarily have to cost you.

Point#4 – Fulfillment curve vanishes by Routine frivolous purchases

Like a RM 15 Starbucks coffee each morning – are beyond the peak, whether you actively notice it or not. If you do it every day, it’s no longer a treat. It’s not something special to really bring you fulfilment. Try drinking cheap coffee at the office all but one day a week. You’ll find that the one good coffee you do drink brings you far more fulfilment than it used to.

III) 3 Reasons to engage a financial planner in Penang instead of DIY financial planning

How does the role of a Penang financial planner benefit you compared to DIY financial planning? Again, let me explain using 3 analogies below:

The Architect

Imagine undertaking a 10 years mega home construction project. Think of having to manage civil engineers, electrical engineers, mechanical engineers, contractors, interior designers, etc on top of your full-time job or business. You need to ensure everything and everyone is coordinated – so that the result is what you envisioned.

TEDIOUS? We thought so too.

Now, imagine the pivotal role of an architect who fully understands what you need, and manage your home construction project.

Financial Planner Penang is the Architect of your Personal Finances – making sure it meets your desired outcome. And your Personal Finance is, in fact, a Dynamic Long Term Mega Project.

The Doctor

Imagine you wake up one day and feel prolonged uneasiness in your chest. Do you prescribe your own medication? Or…does it feel right if a medical professional dispenses medication without proper consultation and diagnosis?

NOPE? We thought so too.

Getting the wrong or unnecessary medicine not only worsens your condition but can possibly endanger your life.

Doctors charge for diagnosis (consultation) and only dispense suitable medicine (solutions) as required. They are billed separately. It should be that way for your best interest as a patient.

It works the same way for a true financial planner in Penang.

The Mechanic

Imagine a highly educated you, driving a nice continental car. Do you fix your own car when discovering a potential problem – like, a loud rattling sound under the hood?

NOPE.

You bring your car to your trusted mechanic at a reputable service centre because he is highly skilled and trained in this area – although he may not have a diploma/degree.

Can you be your own DIY mechanic? Of course, you can – everyone can learn to be one, given the time and training.

But you’ll find out that it’s not worth the trouble, and you can afford to pay the mechanic to get your car fixed in no time. You are smart to leverage the mechanic’s practical experience.

“You engage a financial planner not because you’re not smart enough to do this yourself.

But you hire one because he is not you.”

IV) The 9 criterion to look for in a financial planner

A reputable financial planner in Penang should possess the following qualities:

1) Be licensed by the Securities Commission

In fact, all financial planners in Malaysia are required to be licensed by the Securities Commission. Ensure that your Penang financial planner is licensed. Also, check with the professional body with which he is affiliated with or check the Securities Commission website at www.sc.com.my

2) Possess qualifications recognized by regulatory bodies

It is vital to ensure that your financial planner in Penang is well qualified. A good example is the Certified Financial Planner (CFP CERT TM) designation. For example, an example of a featured CFP professional.

3) Have adequate experience

A good financial planner in Penang is one who has the expertise to help you meet your financial goals – be in short term or long term. However, one should also take into account whether the Penang financial planner is close to retirement or if he is going to be available to assist you for an adequate period of time.

4) Be trustworthy and open

A good financial planner in Penang is one whom you are comfortable with and who is honest with you. He should be someone who is forthright enough to tell you the facts as they are, yet understanding enough to ensure that you are comfortable dealing with them.

5) Disclose the compensation structure

Any financial planner in Penang should disclose all fees and compensation from the start. It is in your interest yo agree on the compensation structure before the commencement of the engagement.

6) Be able to provide on-going service

You need a financial planner in Penang who can provide ongoing service and is committed to developing a long term relationship with you. It is of no help to you if the Penang financial planner constructs a financial plan for you and then never contacts you again. Constant contact is vital to ensure the success of the plan.

7) Assess your existing financial situations and identify your personal cum financial goals

A financial planner in Penang should review all of your financial records and help you to identify your goals before embarking on constructing a financial plan.

8) Explain the pros and cons of various options and products

It is the Penang financial planner’s responsibility to explain the different options available to you before recommending the best solution to meet your unique objectives.

9) Periodically evaluate your financial plan(s)

The Penang financial planner should review your plan periodically to ensure it gets closer to your goals, and it isn’t, then actions need to be taken to bring it back to on-track instead of off-track.

V) 5 aspects an independent financial planner is different from normal financial planner

Financial planning services in Malaysia and Penang is still in its infancy. More and more financial planners are recognizing that just selling financial products and receiving commissions does not meet clients’ expectations. To provide services which are of value, it is necessary to move to a place where financial planners become more consumer-centric and focus entirely on helping their clients achieve their financial goals. They are a new class of people called independent financial planners.

Info from insuranceinfo.com.my – Dealing with intermediaries

| Compare | Licensed Financial Adviser or Planner | Tied Financial Agent | Examples |

|---|---|---|---|

| Minimum Qualifying Requirements | A Bachelor’s Degree, CFP certification (240hrs of lecture and 14hrs of exam) or RFP certification, 3 years minimum of relevant experience. | SPM, CPE (2hrs exam), CEILI (2hrs exam), CUTE (2hrs exam) | The Ivy league universities vs others |

| Approach and Methodology | Financial planning & systematic process or holistic approach, i.e. optimizing your current & future resources to your financial goals. In-house research on funds selection, life insurance plan stars rating and financial life planning / cash flow modelling. | Single need / piecemeal solution and pretty much product focused. | Chief Accountant / CFO vs Accounts executive. |

| No. of financial providers or solutions | At least two providers in life insurance, unit trust and PRS. In addition provide service like financial plan and estate planning, i.e. will writing, trust, biz succession planning, etc. | Cannot represent more than one supplier, and tied to its principal | 1-stop shop, e.g. Senheng Electric, senQ, Harvey Norman. |

| Interest represented / Client & Distributor (legal) Relationship | Client & Professional (i.e. FA) relationship. (Is required to purchase a Professional Indemnity insurance). | Client & Supplier (i.e. Insurer / Unit Trust Management Company) relationship (note: Agent acts as an employee of the supplier, and he/she has no legal relationship with the client) | External auditor vs internal auditor |

| Transparency of proposed solution | Impartial views (evaluating pros and cons of each possible solutions or products) and choices. | Biased view (pros only) and without choice | Senheng vs Sony/Apple Store |

| Continued education (CE) | SC (20hrs), BNM (20hrs), FiMM (16hrs), FPAM (20hrs) | LIAM (30hrs), FiMM (16hrs) | Doctors & accountants who needs to fulfill CE points to renew license |

For many years, the term ‘financial planners’ has been abused by tied financial agents who are masquerading as financial planners, where, in fact, they are only glorified sales intermediaries who do not take into account the holistic approach in planning your personal finances. You may come across the tied agents below who claim themselves as financial planners:

- Insurance agents

- Unit trust consultants

- Investment/wealth adviser or banker

- Real estate planner

In actuality, these are 5 non-negotiable MUSTs when it comes to independent financial planners versus tied financial planners.

- He holds the right regulatory licenses

- He charges a fee fro his advice and services

- The advice he gives is holistic in nature

- He has NO sales quota to meet

- He has access to a wide range of products

1. He holds the right regulatory licenses

It is a simple approach because a quality financial planner in Penang will disclose what licenses they hold as it is certainly something that works to their advantage. In fact, in Malaysia, any financial planner who claims to offer financial planning services must hold Capital Market Service Representative License for dealing in financial planning activities under the Securities Commission. This license allows the financial planner to charge a fee for his advisory work.

Besides that, he also holds Financial Adviser Representative License under Bank Negara for providing financial advisory work, relating to insurance products and recommend the appropriate solutions. He can source insurance products from various insurance companies.

A financial planner in Penang who wants to recommend and source unit trust from the various unit trust companies must hold the Corporate Unit Trust Advisor (CUTA) license under the Securities Commission.

2. He charges fee for his advice and services

The financial planning and advisory process should be free from commercial influence and the vested interest of the provider of the products that may result in an outcome that is suboptimal for you. This is why fees first for advisory work before any products come into the picture, just like a doctor gives your consultation before dispensing medicine if required.

Having said that, there are 2 differing approaches in fees:

- Fee-based: This means the Penang financial planner charges a fee which reflects his time and billing rates to deliver holistic advisory services. He will derive extra income in the form of commission or in the form of asset-based management fee when he helps you to secure and implement the needed financial and investment products respectively.

- Fee-only: This means the Penang financial planner does not receive any income from other sources such as provider of financial products. He will help you purchase the financial products and return to you all commissions and income arising. The problem is that because the Penang financial planner has no other sources of income, he will charge you full cost of his professional services which is sometimes can be cost prohibitive for most Malaysians.

3. The advice he gives is holistic in nature

A genuine Penang financial planner helps you to address various issues which include income, expenses and debt planning, insurance planning, tax planning, retirement & EPF planning, children education funding, home purchase and property investment planning, estate planning and investment planning.

Any financial planner in Penang whom you engage with must be competent enough to identify your financial goals, analyze your current financial standing, determine the gap and subsequently develop the strategies to achieve your financial goals. He should have the necessary intellectual framework, advisory model and tools to do the job.

The analogy is similar to a doctor conducting diagnostic tests. He may not prescribe any medicine if not necessary. Instead, he may just ask you to do more exercise and control your diet. Therefore, you should be on alert if you meet a Penang financial planner who insists on recommending financial products before going through a proper diagnostic process.

What happens when all you are seeking is advice on a specific issue like investment planning? If a one-dimensional Penang financial planner only specializes in this 1 area, he may not be able to foresee how his solutions affect your other financial goals.

When a competent, licensed and independent Penang financial planner can provide multiple advisory services, the result is often very different. He will be able to align his advice and solutions with your other goals and assets even though he is only engaged to address a specific issue for you.

4. He has no sales quota to meet

Independent Penang financial planners have no agency contracts with any financial institutions that manufacture proprietary products like insurance, mutual fund companies or banks. As such, he will never be under any pressure to sell you these products to meet his sales quotas. The biggest advantage of this is that you will know that when an independent Penang financial planner recommends you invest in a product, he is doing it because it fits your financial objectives, not because he has quotas to fulfil.

5. He has access to a wide range of products

Last but not least, this will give you the opportunity to explore various financial solutions and evaluate the advantages and disadvantages of such options. Thereafter, he is able to package a combination of financial products to provide innovative solutions to achieve your financial goals.

Ideally, an independent Penang financial planner has and maintains a strong network of contacts with financial service providers like legal firms, trustee companies, accounting firms, tax advisory firms, stock broking companies, equity fund managers, real estate companies and banks. This allows him to refer you to the right specialists when required.

With access to financial solutions from multiple providers, an independent financial planner in Penang will also be able to recommend the most competitive solutions. Ultimately, this benefits you because you have the power to choose and make decisions as an informed consumer.

VI) What constitutes a cream of the crop independent financial planner

What makes you go to one doctor and not another is probably because of things like one doctor having more experience, better communicator with more empathy or having a better or more detailed diagnostic process. The same goes for any financial planners in Penang. The 5 MUSTs highlighted just above this section are the pre-conditions that a Penang financial planner must fulfil before you even consult him. Now, we look at some of the criteria which might make you choose one financial planner in Penang, but not another.

They say a picture is worth a thousand words. In the case of any independent financial planner in Penang, testimonials from delighted clients are worth more than gold. Of course, realistically, due to privacy and confidentiality issues, not every client of a financial planner will be willing to lend his name and face to vouch for the satisfaction & positive income from the advisory work provided. However, one should expect some sort of testimonials from an experienced Penang financial planner.

As you can see below, an experienced Penang financial planner is able to work indiscriminately with professional clientele from all walks of life – this is truly 1Malaysia.

Testimonials from Dr Thinakaran Malapan, 40 (Ipoh), married with 2 children, Gynecologist with Tropicana Medical Center

CF Lieu helped me to conduct a thorough tax planning for my private practice and investment portfolio. He came to me at the right timing of my career and, in turn, I engaged him for fees-based advisory. I never would have thought a financial planner can do advanced company & property tax planning, so I really credit CF for a fee-based advisory nicely done – giving me and my wife much clarity on the overall big picture.

The approach

CF gave me ample time to clear my doubts, me being not coming from a financial background, albeit being an analytical person. The process is like this – After coming out with the first drafts of the tax planning advisory reports, which CF will send to me to digest, then we will have discussions to clarify/fine-tune/amend the sections where required. The response time is good; CF is contactable and the follow-ups meet my expectation.

The ROI

The advisory fees are not cheap – that’s what I feel when we started. However, I’d say it is certainly affordable.

Only after I experienced the approach CF delivered the end result, I can vouch it is certainly worth the professional fees.

Evidently, there are aspects in my investment properties portfolio that need to be fined-tuned. Without going into details, these “fine-tunes” saves me money in the long run which is way more than the fees charged. Also, cost savings tips and tricks I would not have known if I didn’t go thru the advisory process.

I can vouch for CF in delivering quality advisory work to clients.

Testimonial from John Paul Wang SS (Penang), married with 2 children, Operation Manager, Intel

Working with CF Lieu has really been a breath of fresh air. He has been most professional and efficient in all their services rendered. The advisory approach by CF was structured and no fluff– he simplified it without missing the important points, yet not too much information to digest for a non-financial background person.

CF is really easy to work with and is prepared to give me + my wife time to discuss ideas, address concerns and solve problems. I can safely say we have never experienced such a comprehensive, integrated advisory approach, and we’ve since set our standards high.

I vouch for CF and have no qualms in recommending to friends or relatives who need an independent adviser to make a positive quantifiable impact on their personal finances.

To date, we still keep in touch regularly and CF has further assisted us in other aspects such as investment and estate planning.

Testimonial from Saiful Amry Mahat, 40 (Cyberjaya), married, HR Account Manager, Shell

The most useful part of the advisory process was that on how you educate me on optimizing my spending on maximizing coverage at the lowest cost. Saved more than RM 6,000 a year for the next 17 years, and that’s not taking into account investing this amount and compounded annually.

I like the common sense you advise on things and the details of it – even though I tend to forget but I still like the details you explained because I am a detailed person.

Testimonial from Kuldip Singh, 60 (Melaka) Retired, Ex Senior Manager at multiple MNCs

I have followed CF’s valuable sharing in this blog since its early days. But it was not until I engaged him 1-to-1 as my “retirement adviser” that I could really see the value of independent advice he could deliver.

I consider myself financially savvy and comfortably retired than most – yet I think I need a lil’ help from an independent adviser who could advise me from different angles to manage my retirement nest egg – so like they say – I don’t run out of money before running out of life!

CF injected much clarity in helping me with this area with his patience and dedication. I have no qualms in recommending CF to my relatives and friends who need independent financial advisory.

Testimonial from Samuel Wong, 32 & Dr Stephanie Tan, 28 (Johor Bahru), Business Owner & Dental Surgeon

The immediate positive outcome from it – we thought we had a conventional non-transferable MLTA for our first KL property purchase but then we discovered it is actually a personal investment-linked policy. The banker from which we took the mortgage was supposed to send us the insurance policy but didn’t – until we asked.

We probably saved RM 4,000 to RM 5,000 insurance premiums a year from needlessly buying another insurance policy when we bought a second property in JB – if we were to not know this until CF highlighted it to us.

Throughout our engagement, CF patiently answered even the most unintelligent questions from us without contempt. And a very refreshing non-product pushing consultative approach, to say the least!

A licensed financial planner we would highly recommend to people not from the finance sector but trying to set their finances straight

*****

Apart from testimonials from real people, a cream of the crop financial planner in Penang will also be a recognized figure in the industry. This is evident when he is invited to deliver public talks and private seminars to professional bodies or financial events.

And even engaged by financial institutions like Maybank and investment companies like Permodalan Nasional Bhd to train their staff.

VII) 11 types of financial advice should you expect from a financial planner in Penang

- Be in writing

- Be without obligation

- Focus on your financial goals

- Be Impartial

- Consider your cash flow requirements and need for spare cash

- Disclose any entry fees, exit fees and any other costs to you in the future

- Justify the reasons for selecting the proposed investments or recommendations

- Divulge all inherent risks associated with the recommendations

- Spread your investments across different assets

- Highlight any tax implications

- Give options on how to pay for your investments

VIII) 6 things NOT to expect from your financial planner

Any productive and meaningful relationship between you and your Penang financial planner rests on both parties playing their roles in managing your personal finances.

With that in mind, there are 2 things required of you to ensure that there is little deviation from your path towards attaining financial freedom.

Commitment and Time

You must commit and don’t be half-hearted halfway through the process. Even the most competent & dedicated financial planner in Penang cannot achieve much for you if you are not accountable for your own financial goals.

Although you can now delegate many of the tasks in managing your personal finances to a trusted Penang financial planner, it does not mean you can forget about it altogether. You still have to make time to meet him on regular basis to enable him to give you a progress report as to where you stand financially. The financial planner needs to get your consent to execute the necessary actions. Ideally, set aside about 2 hours each month to meet with your financial planner in Penang during the first year, and probably about 5 times a year in the following years.

Now, come to what you can realistically expect from an independent financial planner in Penang. If your expectations are unrealistic, you might find reasons to terminate your professional relationship and that could lead you to change financial planners regularly. Unfortunately, this will adversely affect your financial standings, disrupt your personal financial management, affect your investment performance and increase your expenses. As a result, you will be running out of time to achieve financial freedom. Here are the few things you should not expect from an independent financial planner in Penang:

1. Don’t say to your independent Penang financial planner: “You must guarantee my investments will make money even if the economy is bad”

Financial planners cannot make your investments grow when the market is in a downtrend, unless he is also running a hedge fund or private equity fund (unlikely). However, if he has done a good job of proper asset allocation and informed diversification, ‘best of breed’ fund selection and rebalancing, your investment won’t suffer as much in a bear market

2. Don’t say to your independent Penang financial planner: “You must guarantee that my investments will outperform the market when the market is up”

Again, if your independent Penang financial planner does proper asset allocation and diversification into multiple asset classes, this is unlikely to occur. For example, when the market is up by 30% in a particular year, but the bond market is only up by 5%, you may expect your investment return goes up to 40%. A proper asset allocation might put your portfolio weightage as 40% bonds, so your portfolio can actually be up, say, 20% only. On the other hand, your portfolio would have beaten the stock market when the equity market is going down as bonds outperform stocks. Remember, your independent Penang financial planner main job is not beating the market, but optimizing your long term investment returns by reducing their volatility.

Most importantly, a real financial planner in Penang should be the thing between YOU and the BIG MISTAKE – in other words, someone who helps you to manage things which you can control (risks) instead of promising you high returns (which no one can control).

3. Don’t expect your independent Penang financial planner to know where the economy or stock market is heading

Your independent Penang financial planner is not a fortune-teller because even economists are frequently dead wrong about economic predictions. On the contrary, be alarmed when he spits out recommendations based on predictions on where the market is heading. It is not possible to deliver this promise consistently.

4. Don’t expect your independent Penang financial planner to agree with everything you say; keep an open mind to his recommendations

An independent Penang financial planner has the duty to help you manage your finances effectively. It is normal if his advice or recommendations contradicts yours at times. For example, you may be an avid property investor and may have made substantial money from your historical purchase. Confident, you put 90% of your investable assets in properties. From a prudent financial planning perspective, such a concentrated portfolio has its inherent risks. Do not be upset when your independent Penang financial planner suggests you divest some of your holdings into more liquid portfolios.

Don’t close your mind and start judging him and questioning his agenda. Instead, listen to what he has to say, give feedback and voice your concerns in a two-way discussion. Never shut down any communication between you and your independent Penang financial planner without giving him any chance to justify his recommendations.

5. Do not expect your independent Penang financial planner to produce immediate results

Your independent Penang financial planner will need time to deliver investment performance. A reasonable period to allow your financial planner to deliver results is at least 5 years or a full market cycle. For example, do not terminate his services if you experience negative returns after 1 year of investing which coincides with a bear market or market correction. Your independent Penang financial planner deserves more time to prove the success of the holistic plan he has developed for you.

6. You must share information and any concerns you have with your independent Penang financial planner

As the saying goes, garbage in, garbage out. If you do not provide accurate and timely information to your independent Penang financial planner, he will not be able to provide effective services. Furthermore, by being open to what concerns you, your independent Penang financial planner will be in a position to suggest customized strategies to help you. Beware that you can only expect lower quality advice and service from your independent Penang financial planner if you have withheld information from him.

Conclusion

As the public gets savvier and financial markets mature, independence in fee-based financial planning will get increasingly popular. This is when the trend turns away from ubiquitous financial products and homogeneous asset management or unit trust companies. The general public who appreciate the nuances between different financial products and understand that there are more than just the good “highlights” of what tied agents tell you will start to appreciate independent financial planners, especially in places like Penang.

Independent financial planners (generally, but more so in Penang) does not enjoy the privilege of being backed by an insurance company or associated with unit trust companies. It is relatively small, compared to the existing agencies structure everywhere. But being small and independent offers some specific advantages. For example, tied agents trained by agencies can be strongly encouraged to recommend the more profitable products, which may not be in the client’s best interest.

But independence is still underappreciated, as the possible conflict of interests that can arise from being tied to another institution with its own set of priorities are rarely highlighted. That’s why no agencies can do away with the quota system, while independent advisory can. It takes time for independent financial planners in Penang to explain the value and importance of independence to our potential clients. Independence is not something highlighted in our market, and most people are not used to financial services that are not owned or backed by a brand name we are familiar with.