e-Connect is Great Eastern web-based service for policyholders. With e-Connect, you can:

• View and download your Life Insurance Premium Certificate(LAPC)

• Check your policy details and values

• Download form for transactions

• View Investment Link Annual Report

Steps to sign up as user

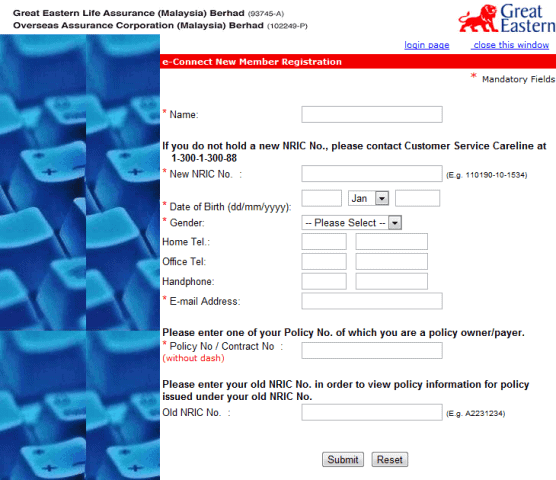

Step 1: Go to Great Eastern e-Connect Portal and click Sign Up Now.

Step 2: Read the terms and conditions, and click Submit

Step 3: Fill up the registration form. Your registration is successful only if you see a message telling you that your password will be sent to you within 7 working days.

Step 4: Retrieve your 8 digits password once you receive the slip. You will be prompted to change your password.

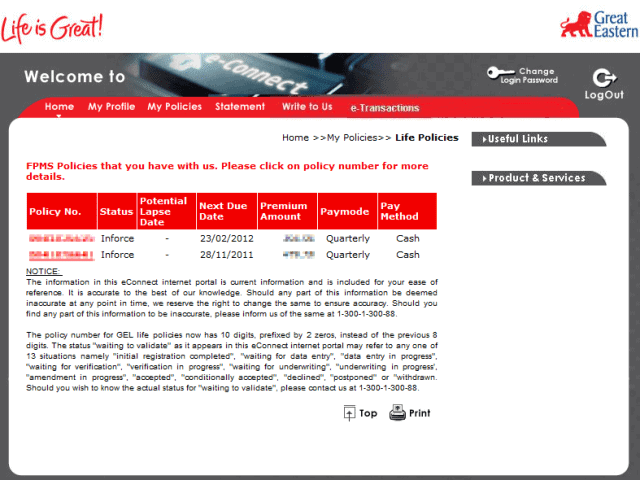

Step 5: Under the tab “My Policies”, you should see all the policies under your name.

Click on the policy number and a new pop up window will show you all the static info (policy status and benefits, premium, sum assured, beneficiary, agent name, etc) and dynamic info (policy values).

Dynamic info is of more interest to us.

For Traditional Whole Life Policy, you can check your policy surrender value. Here, SA, RB and TB means Sum Assured, Reversionary Bonus and Terminal Bonus respectively.

Reversionary bonus refers to bonus added to the sum assured of a life assurance policy out of a life company surplus profits usually on an annual basis. These bonuses are payable at the end of the term of the policy (that is, at maturity), or on prior death of the life assured. Once allocated, their values are guaranteed provided premiums are paid up to maturity or death.

Terminal bonus is bonus received upon maturity of the policy.

For Net Policy Loan value details, you can go to GE FAQ section . Basically, this is the lump sum amount you can cash out now and repay at a later date with interest charge.

Now, for ILP, the item of interest is the fund details you are currently enrolled in and current investment value. This is similar to unit trust investment – it details the number of units you own and the NAV price.

Mine’s invested in Lion Strategic Fund, managed by GE own fund manager. According to Lipper Leaders rating, it is a 5 star fund in terms of returns and consistency so far.

Readers, have you reviewed your policy lately?*I own 2 GE policies, therefore this is the example I can share.You may have a similar system for your insurance provider; please check with them.

Good morning,

I have two (2) Great Eastern Policy. They are:

(i) MULTICARE – WHOLE LIFE WITH SPECIAL CASH BONUS

INFORCE 75,000 MYR

1,839.00 MYR 31 Jul 1995

30 Jul 2060

ACCELERATED EXTENDED TOTAL AND PERMANENT DISABILITY BENEFIT RIDER

INFORCE 75,000 MYR

90.00 MYR 31 Jul 1995

30 Jul 2021

Policy Values

Net Surrender Value*

56,550.00 MYR

Loan Balance

0.00 MYR

Loan Repayment Amount

0.00 MYRSurvival Benefits Balance

-Survival Benefits Balance Option

–

Accum RB as at 07 Dec 2020

0.00 MYRTerminal Bonus upon Surrender*

-Cash Bonus Balance

37,756.56 MYRCash Bonus Balance Option

To leave cash bonus on deposit with Company

* The values marked above with * are projected and not guaranteed.

GE LIFE LIVING ASSURANCE-WHOLE LIFE WITH SPECIAL SIMPLE REVERSIONARY INFORCE 25,000 MYR

688.00 MYR 31 Jul 1995

30 Jul 2060

Policy Values

Net Surrender Value*

19,209.77 MYR

Loan Balance

0.00 MYR

Loan Repayment Amount

0.00 MYRSurvival Benefits Balance

-Survival Benefits Balance Option

–

Accum RB as at 31 Jul 2020

16,965.00 MYRTerminal Bonus upon Surrender*

-Cash Bonus Balance

-Cash Bonus Balance Option

–

* The values marked above with * are projected and not guaranteed.

My questions are as follows:

(i) In 1st policy: how much do I have if I surrender the policy?

(ii)In 2nd policy: how much do I have if I surrender the policy?

(iii) In 1st policy: Can I withdraw Accum RB as at 30 Dec 2020?

(iv) In 2nd policy: Can I withdraw Cash Bonus Balance?

Thanking you in advance.

Best regards,

Ng shouldn’t you contact your GE insurance agent instead for these questions? 🙂

sorry wrongly click and posted

Good morning,

I have two (2) Great Eastern Policy. They are:

(i) MULTICARE – WHOLE LIFE WITH SPECIAL CASH BONUS

INFORCE 75,000 MYR

1,839.00 MYR 31 Jul 1995

30 Jul 2060

ACCELERATED EXTENDED TOTAL AND PERMANENT DISABILITY BENEFIT RIDER

INFORCE 75,000 MYR

90.00 MYR 31 Jul 1995

30 Jul 2021

Policy Values

Net Surrender Value*

56,550.00 MYR

Loan Balance

0.00 MYR

Loan Repayment Amount

0.00 MYRSurvival Benefits Balance

-Survival Benefits Balance Option

–

Accum RB as at 07 Dec 2020

0.00 MYRTerminal Bonus upon Surrender*

-Cash Bonus Balance

37,756.56 MYRCash Bonus Balance Option

To leave cash bonus on deposit with Company

* The values marked above with * are projected and not guaranteed.

GE LIFE LIVING ASSURANCE-WHOLE LIFE WITH SPECIAL SIMPLE REVERSIONARY INFORCE 25,000 MYR

688.00 MYR 31 Jul 1995

30 Jul 2060

Policy Values

Net Surrender Value*

19,209.77 MYR

Loan Balance

0.00 MYR

Loan Repayment Amount

0.00 MYRSurvival Benefits Balance

-Survival Benefits Balance Option

–

Accum RB as at 31 Jul 2020

16,965.00 MYRTerminal Bonus upon Surrender*

-Cash Bonus Balance

-Cash Bonus Balance Option

–

* The values marked above with * are projected and not guaranteed.

My questions are as follows:

(i) In 1st policy: how much do I have if I surrender the policy?

(ii)In 2nd policy: how much do I have if I surrender the policy?

(iii) In 1st policy: Can I withdraw Accum RB as at 30 Dec 2020?

(iv) In 2nd policy: Can I withdraw Cash Bonus Balance?

Thanking you in advance.

Best regards,

Good morning,

I have two (2) Great Eastern Policy. They are:

(i) MULTICARE – WHOLE LIFE WITH SPECIAL CASH BONUS

NG LIAP CHIN INFORCE 75,000 MYR

1,839.00 MYR 31 Jul 1995

30 Jul 2060

ACCELERATED EXTENDED TOTAL AND PERMANENT DISABILITY BENEFIT RIDER

NG LIAP CHIN INFORCE 75,000 MYR

90.00 MYR 31 Jul 1995

30 Jul 2021

Policy Values

Net Surrender Value*

56,550.00 MYR

Loan Balance

0.00 MYR

Loan Repayment Amount

0.00 MYRSurvival Benefits Balance

-Survival Benefits Balance Option

–

Accum RB as at 07 Dec 2020

0.00 MYRTerminal Bonus upon Surrender*

-Cash Bonus Balance

37,756.56 MYRCash Bonus Balance Option

To leave cash bonus on deposit with Company

* The values marked above with * are projected and not guaranteed.

GE LIFE LIVING ASSURANCE-WHOLE LIFE WITH SPECIAL SIMPLE REVERSIONARY BONUS

NG LIAP CHIN INFORCE 25,000 MYR

688.00 MYR 31 Jul 1995

30 Jul 2060

Policy Values

Net Surrender Value*

19,209.77 MYR

Loan Balance

0.00 MYR

Loan Repayment Amount

0.00 MYRSurvival Benefits Balance

-Survival Benefits Balance Option

–

Accum RB as at 31 Jul 2020

16,965.00 MYRTerminal Bonus upon Surrender*

-Cash Bonus Balance

-Cash Bonus Balance Option

–

* The values marked above with * are projected and not guaranteed.

My questions are as follows:

(i) In 1st policy: how much do I have if I surrender the policy?

(ii)In 2nd policy: how much do I have if I surrender the policy?

(iii) In 1st policy: Can I withdraw Accum RB as at 30 Dec 2020?

(iv) In 2nd policy: Can I withdraw Cash Bonus Balance?

Thanking you in advance.

Best regards,

the message suppose to be for my insurance agent