…when local (Malaysian) property investments appear inferior.

Let me explain.

Property investment, in general, as we all know, provides investment leverage. However, to quote a wall post by Faizul R, the best time to buy a property is when ALL of the conditions below simultaneously exist…

a. There is no economic, currency or commodity price crisis

b. Property price suddenly depreciates without any reason, but rises the moment after you bought one

c. Banks did not tighten their lending guidelines, and generally lenient in loan approval

d. Our politicians don’t make brainless comments, and are all ‘clean’

e. Your job/business are certainly secure & resilient to any economic conditions until age 60

To wait for for all the above condition is akin to waiting for all planets in our solar system to align, which may never happen in our lifetime.

Sure, shit may happen, but know this – Property investment is probably the type of investment that forgives you the most (read – “12 Great Reasons to Invest in Real Estate”). Because there will be some bad investment no matter how careful you are. But when it comes to real estate properties, the bad investment can turn good provided that you have the capacity to wade through the tough time. You may buy a property at a wrong place and at a wrong time. But a time will come around when you can actually make a very good profit out of it. It might take 3 or 5 years, but the profits will eventually show up. Sometimes, even your worst decision will bear fruit someday. That someday, we want to shorten it as much as possible of course.

In this article, I am sharing with you a case study where property investment is used to specifically fund children education. This based on multiple cases (fees based financial planning) I’ve advised clients before.

1) The cost of overseas children education

2) Using a Malaysian property investment to fund this

3) Using a foreign (Perth) property investment to fund this

4) Profitability analysis – local vs foreign property

*****

Common traits of people who engaged a fee based independent financial planner:

- Working or self employed couples in their early to mid 40’s

- Have substantial unit trust/stocks investments and one or more property investments

- Have even more substantial EPF assets, but illiquid until 50 and 55, except for specific purposes allowed for EPF Account #2 withdrawals

- Likely have outdated insurance policies which are no longer relevant or wrongly bought in the first place

- Can have positive, zero or negative monthly cash flows, regardless of income

- Aspire to strike a balance between giving the best education to their children, without jeopardizing own retirement fund

- Wishes to optimize the finances and maximize wealth accumulation in their limited but peak earning years

1) The cost of overseas children education

For Malaysians, we cannot run away from these 3 choices of countries – US, UK and Australia.

Let’s take Australia for 2 reasons – proximity to Malaysia and most affordable (at the time of this writing, 1 AUD = RM 3.xx), compared to 1 USD = RM 4.xx and 1 GBP = RM 6.xx

Also, for sake of simplicity, let’s take Western Australia, the closest city to Malaysia, Perth, as an example. This is how much the 4 universities costs per annum according to Knight Frank Research Dec 2015.

Let’s just take a median value of AUD 30k/year in 2016.

Therefore a 3 years degree structure costs AUD 90k.

How about living costs?

We take AUD 25k/year as in 2016. Source – University of Western Australia

A 3 years study, therefore, could set you back at least AUD 75k.

Total = 90k + 75k = AUD 165k, which is equivalent to say, RM 500k.

Imagine you got 2 children. That amounts to RM 1 mil.

2) Using a Malaysian property investment to fund this.

By now, you would have realized the best way to fund such huge financial goals is to utilize abit of leverage – property investment. Wise indeed. Better still if you have more than 10 years to prepare for this, unfortunately only a minority of clients I met have such ‘vision’.

Usually, when they do realize there is a need ‘do something’ to fund a substantial children education fund, it is only less than 10 years before their eldest child needs to go for university.

The irony is when most parents do have > 10 years to work on to fund their children education, one of the below is usually true:

- They don’t appreciate or financial planning yet, because kids still young – still ‘a long way to go’, don’t feel the need to do it.

- Too busy with work, climbing career ladder, children education planning not top priority.

- High financial commitment, no surplus cash to plough into property investment.

The consequence is this:

When they do feel the need to plan for children education, at a time when they got more surplus due to stronger earning power (although not less busier than before), time is not on their side. 3 reason why:

- You have limited productive years before retirement

- You have even less time to manage property investments yourself

- Your mortgage duration will be capped at 20 years or LESS

You see, no time or busy is always an excuse. I always am too busy or no time for things I don’t feel is important. In other words, if something is IMPORTANT for you, you will make for it.

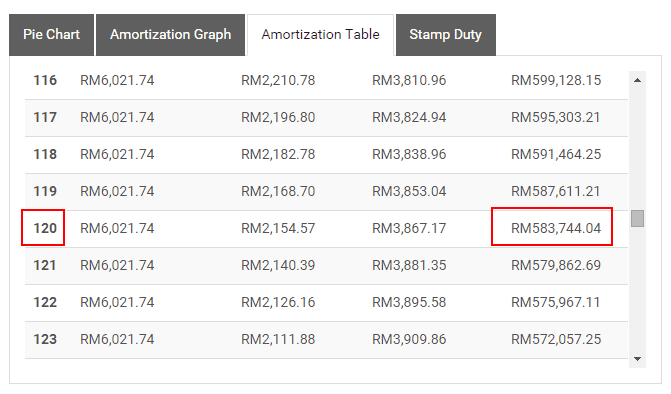

This is how the upfront costs will look like – using a tool from Loanstreet.com.my, for a RM 1.2 mil property.

Please note that a RM 1.2 mil property in Malaysia is definitely not a mass market property.

In summary:

Monthly mortgage repayment = RM 6k

20% downpayment = Rm 24ok

Incidental costs = RM 51k

Initial capital = RM 291k

If it is in Penang, the market for a RM 6k rental is extremely small, unless for expatriate market. Even in areas like Batu Feringhi, you could probably get max RM 4k rental per month. Therefore, for most people, you’ll be bleeding cash flow every month. That is not accounting for vacancy period, on-going repair costs, maintenance/service charges, which will further bleed cash flow.

3) Using a Perth property investment to fund this

Compare this with an investment grade property located in Perth CBD priced also circa AUD 400k or RM 1.2 mil (with AUD 1 = RM 3), with financing from Australian bank.

Initial capital, 20% downpayment + incidental costs = A$ 69,135 ( RM 207k)

Monthly mortgage repayment = A$ 1,425 (RM 4,305)

The main determinant which changes the landscape of investment over here is

- 30 years mortgage duration even if you are 50 years old

- Interest only loan – your repayment only on the interest over loan amount, not by amortization schedule. Monthly repayment amount for interest only loan is lower than if it were a conventional mortgage based on amortization schedule, with everything else being the same. Interest only loan is the Utopian arrangement for property investors.

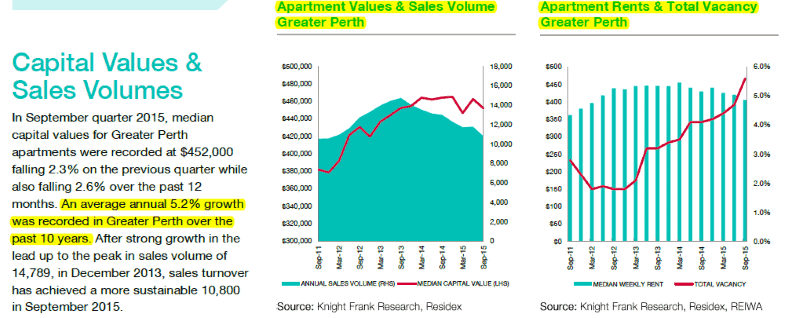

- Steadily consistent capital appreciation (circa 4-5%/year), a LOT less speculative

- High Possibility to strike positive cash flow, or at least an equilibrium between rental and mortgage repayments, if structured properly

A property costing AUD 435k today is projected to appreciate to AUD 700k+ in a decade, assuming a 5%/year appreciation – which is the case from Knight Frank Research for the past 10 years.

Compare this to data from National Property Information Center (NaPIC) on Malaysia House Price Index, say from 2004 to 2014 for high rise properties [see report PDF here]. You got index of 113 in 2004 and index of 222 i 2014, which is an appreciation circa 7%/year.

Let’s just bump this to 10%/year assuming you live in property investment hotspots such as Klang Valley, Iskandar or Penang.

If this trend of 10%/year property value appreciation continues, then a property costing RM 1.2 mil today will cost a freaking RM 3 mil in a decade.

So if you got a Malaysian property which is worth RM 3 mil on paper even in 10 years from now, the critical questions are:

- Is this a property that you can easily sell to mass market?

- If there is a qualified buyer – either pay cash or qualify for a, say, RM 2.7 mil loan, why should he/she buy your property in your location and not others? Since, put yourself in the shoes of a loaded investor, if you can afford to buy a RM 3 mil property comfortably, the world is your oyster.

4) Profitability analysis – local vs Perth property investment

It is easy to overlook a RM 2.4 mil vs RM 1.1 mil capital gain, but as advanced investor you got to consider cash-on-cash return. Normally, cash on cash return is not used to compute capital gain but to compute annual rental income instead, but for this purpose, I use it to illustrate an important point below:

Scenario 1: A local property costing RM 1.2 mil

Projected Capital Gain in 10 years = RM 3 mil – RM 584k = RM 2.4 mil, 584k is outstanding principal portion of the loan.

Initial down-payment + incidental costs = RM 291k

Monthly Cash flow, assuming RM 3k constant for the next 10 years = (RM 3k) – negative cash flow, since mortgage repayment is RM 6k+/month

Annual negative cash flow = (RM 36k)

Cumulative negative cash flow in 10 years = (RM 360k)

Simplified Cash on cash return = 2.4 mil / (291k + 360k) = 368%

Scenario 2: A property in Perth costing AUD 435k

Projected capital gain in 10 years = AUD 700k – AUD 324k = AUD 376k or RM 1.1 mil

Initial downpayment + incidental costs = RM 207k

Monthly Cash flow = Breakeven, means no negative or positive cash flow in the worst case scenario, and assuming no rental hike (unlikely), since we assume the rental also remain constant in Scenario 1 above.

Simplified Cash on cash return = 1.1 mil / 207k = 531%

Furthermore, if you have upfront capital, what is stopping you from buying another property costing AUD 435k if you got the initial downpayment to start? That easily doubles your potential capital gain to RM 2.2 mil in 10 years via 2 properties, matching the RM 2.4 mil capital gain for 1 local property.

The question is:

Do you want a property that appreciates more on paper but you bleed cash flow every month due to rental inches up slowly….or a property that appreciates more steadily and consistently on paper but you don’t bleed cash flow every month?

Conclusion and a Qualitative Perspective

Last but not least, back to the topic of this article – which is to fund children education, ability to liquidate a property in time is of utmost importance because we know property isn’t liquid as stocks/mutual funds, and children education timing is NOT as flexible as retirement timing.

Paper gain due to capital appreciation is one thing when you can keep it for retirement funding, but it is another thing when you need it for children education fund. The higher is the market price of a property, especially a non-mass market property, the lesser is your group of prospective buyers in Malaysia because even as we speak now (2016), mass market income is not keeping up with property price appreciation, although price appreciation does keep up with inflation.

You might be stuck with a property which only 1% of the population can afford – is this a good picture?

And this sore point is compounded if your bank account bleed every month covering the mortgage repayments. Investments should not bleed cash in long term.

Apart from that, there are a few not so apparent benefits which clients agreed:

- If Ringgit weakens further by the time it is time children enters university, you would need to pay more in Ringgit to fund their education overseas, so it makes sense to buy a property early in a place where you foresee you are going to send your children to when you can afford it. It may seems to early or even ridiculous to do it now, but 10 years from now, it might just be the wisest move you ever made. Otherwise, it is a dual killer – a Malaysian property which bleeds cash flow, and a weak Ringgit which renders you paying more in Ringgit for overseas education

- If you need to sell, say, the property in Perth to fund their education in Australia itself, then this move is not subject to currency risks should Ringgit weaken further.

- Another option is to channel the positive cash flows from the rental property in Perth to fund children living expenses, which again, is not subject to currency risks should Ringgit weaken further. This is possible when you have enough cash funding for their tuition fees and don’t need to liquidate the property in question to fund the tuition fees.

“If you want to be Rich, you have to borrow money when you don’t need it, and not when you need it.”

We provide advisory services including direct property investment which fits the scenario above in the vicinity of Perth CBD area. Projects are by M Group – Western Australia established integrated boutique property group focused on investment, development, construction and real estate services. Match Properties Asia, a subsidiary of Cheng & Co Chartered Accountants Group, is M Group marketing partner in Malaysia.

Submit your details below for enquiry.

The next best day to do something is yesterday. Next best day is today.

Also read – Akrasia – Why we fail in achieving our financial goals