If you walk into a developer sales gallery, and the sales staff told you the price is RM 450 psf for a soon-to-be-launched condo project, with RM 50k upfront rebate and another RM 20k interest rebate to be given at at 50% and 100% disbursement stages, how would you interpret this offer?

The below is based on a real case scenario as I attended a sales launch last Saturday (11 May 2015)

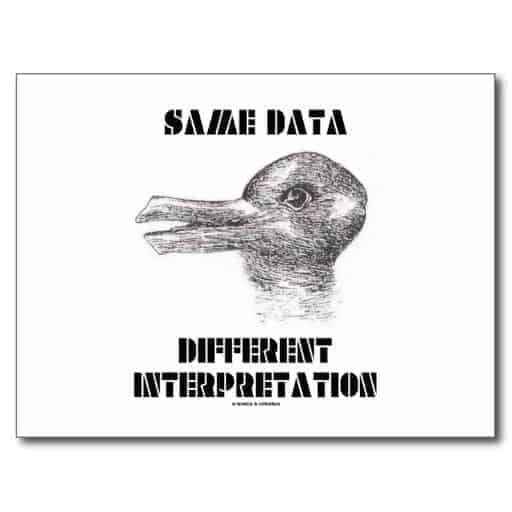

Example – Duck or rabbit in the image below?

Scenario 1

Indicated unit price = RM (450 x 1,161) = RM 522,450 After Rm 50k rebate, SPA actual unit price = RM 472,450

Scenario 2

Indicated unit price = RM [(450 x 1,161) + 50,000 + 20,000] = RM 592,450  Home loan calculator tool above from Loanstreet.com.my

Home loan calculator tool above from Loanstreet.com.my

The Effect of Difference in Intepretation..

#1 Downpayment

RM 52,245 vs RM 59,245 –> Difference of RM 7,000

#2 Monthly installment

RM 2,196 vs RM 2,490 –> Difference of RM 294

#3 SPA Agreement Costs

RM 13,780 vs RM 16,370 –> Difference of RM 2,590

#4 Loan Documentation Costs

RM 6,092 vs RM 6,848 –> Difference of RM 756

**********

Which do you think is the real scenarios I encountered last weekend?