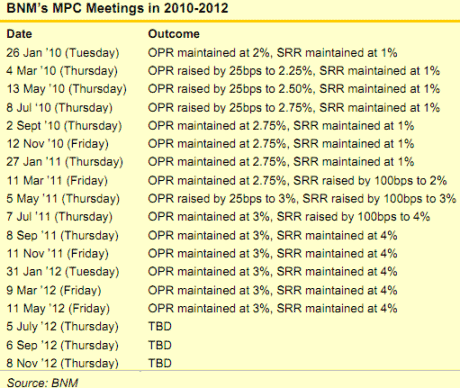

During the third Monenetary Policy Committee meeting on 11 May 2012, Bank Negara Malaysia kept the Overnight Policy Rate (OPR) at 3 percent. With three more meetings to go in 2012, most investment analysts opinionated that the OPR will remain at 3 percent for the rest of the year.

This is certainly a good news for house owners. When OPR rises, BLR is almost certain to follow suit. Read my previous article – OPR, BLR & Inflation – The Correlation to understand more about how OPR and BLR affect your home mortgage repayment. It is one of the prime financial concept in personal finance.

I dug out an old newspaper article by a 15-year veteran in mortgage financing and investment, on BLR adjustment. Here’s the summarized excerpt on this matter.

A client claimed that his monthly mortgage repayment maintains the same amount even though the base lending rate (BLR) rises.

What actually happens is, when interest rate rises, the bank’s computer system will automatically increase the number of payments and maintain the monthly installment.

When BLR rises, you have two choices. Either you maintain your monthly installment (which increases repayment tenure – and more interest paid to bank!) or you increase the monthly installment (which results in the same repayment tenure).

My advice is to go to the bank and request to increase the monthly installment if it does not put you in financial constraint.

Normally, banks will not send a letter to borrower or offer the 2 choices stated above.

Likewise, , if the BLR comes down, opt to maintain the installment and reduce the repayment tenure.

Related post: Economic Recession? Unlikely in 2012