How to become an independent financial adviser – that is one of the questions I got asked every now and then. Can you become one just by passing some sort of exams, like unit trust agent or insurance agent? Can one just declare to be independent, bearing in mind that the Insurance Act dictates an agent can only represent one life insurance company?

The very basic, one has to be holding the worldwide recognized Certified Financial Planner CFP qualification. Then, the individual or the financial advisory firm needs to obtain the appropriate licenses from Bank Negara & Securities Commission (SC). On top of that, he has to “untie” himself from any product providers – be in insurance or unit trust agency.

I personally think the CFP program is not that hard, but it could be just a bit tedious if you are not passionate about personal finance in general. If someone has the aim of making quick buck from selling financial products, he likely won’t want to waste time and money going through the minimum 18 months duration of getting CFP certified.

Interlude

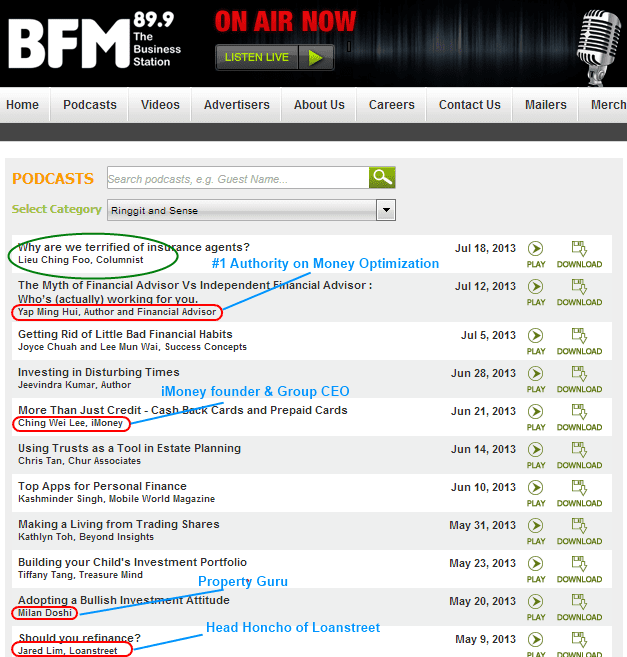

Speaking of this topic – on July 2013, I got interviewed by BFM on – “Why are we so terrified of insurance agents?” At the end of this 21 minutes interview, I provide a possible solutions to this issue to protect your best interest as a consumer and prevent from being sold the things you don’t need or don’t understand.

Listen to the interview below

The original podcast of my interview at BFM website here – http://www.bfm.my/2013-07-18-terrified-of-insurance-agents.html

Indeed I am humbled that my podcast interview happened to be listed along with Yap Ming Hui, a prominent independent financial adviser, author and columnist known as the #1 authority on money optimization.

To be fair, not everyone who has or undergoing CFP certifications wants to be an independent financial adviser. This is something I don’t understand, if you are qualified and competent enough, why don’t one become independent or at least join an independent firm? One thing is that he or she doesn’t want to give up everything he/she has built over the years. Or maybe dealing with various aspects of personal finance just frustrates the hell out of some people, that’s why they would rather specialize in only one thing?

But one lesson we can learn from mostly tied agents is conviction. Conviction towards the products they are representing – that they are the best. Independent advisers don’t believe in this – we look at things from a client’s perspective instead. What is best suited for one? There is not best product, only best suitable products for someone because everyone is different & unique. In fact, often when product providers come to meet us, we actually feedback to them how competitive their products are compared to others, and why we recommend or NOT recommend their products to our clients. This kind of feedback loop is good for the industry as consumers are getting “improved” versions of any products or solutions as time goes by.