This is the most practical, highly actionable guide to buying the best medical card in Malaysia.

If you want just the right amount of information to maximize your coverage while minimizing the premium cost, without the spam calls from aggressively pushy & sales-sy insurance agents..

…you’ll love this guide and the approach we use.

This guide has existed from 2018 to now, with 250+ questions below. Last updated on 👇

Table of Contents

The fact is, medical card products from major insurance companies in Malaysia are constantly evolving rapidly, ever-trying to outdo each other to become the best medical insurance or the top medical card in Malaysia, at least according to consumers.

Anyway, at this point of time…

Summary: Best Medical Cards in Malaysia

Note: you should flip your device horizontally if you’re using a phone/tablet

| Insurer | Product Name | Highlights |

|---|---|---|

| AIA | A-Plus Health 2 | ▪️ high annual limit (T&C applies) ▪️ high deductible cost-saving option with retirement option ▪️ unique ‘Health Wallet’ feature |

| Allianz | Health Assured | ▪️ very high annual limit & R&B rate (limited time) ▪️ unlimited room & board & ICU days ▪️ covers alternative outpatient cancer treatment ▪️ upfront discount on insurance charges ▪️ optional solution available to cover for hospitalization & surgical procedures globally without geographical restrictions, up to U$ 2 million yearly |

| Great Eastern | Smart Health Protector | ▪️ auto-increase room rate ▪️ very high annual limit (optional) ▪️ covers new cancer drug & post cancer screening ▪️ high deductible cost-saving option with retirement option |

| Hong Leong Assurance | Medi Shield III / Medi Shield Pro | ▪️ high deductible cost-saving option with retirement option ▪️ covers alternative outpatient cancer treatment ▪️ covers mental health and medical implants ▪️ auto-room rate increase ▪️ no claim refund as % of insurance charges |

| Prudential | Pru Million Med 2.0 / Active | ▪️ multiple co-insurance & deductible cost saving combo options ▪️ unlimited room & board & ICU days ▪️ very high annual limit (optional) |

The best in this sense refers to competitiveness in features and costs; so it is great for consumers.

The best part of being an industry practitioner, as a licensed, independent financial adviser, is that we are NOT tied to any insurance company.

Meaning, we are not obligated or limited to only recommend 1 single product, like an insurance agent.

Licensed, independent financial adviser possess ‘super-license’ from Bank Negara Malaysia and hence is authorized to source medical insurance from major insurers on client’s behalf.

Watch a series of lessons on buying the best medical cards for yourself

Watch our videos on TikTok where we answer your questions on health insurance claims

TikTok

🌟 Medical Insurance Comparison table 1️⃣: Allianz Life – AIA – Great Eastern Life – Manulife – Hong Leong Assurance – Prudential – AmMetLife – Zurich

This is the Highest Medical Card Plan from each insurance company

Allianz medical card is the Best medical insurance in Malaysia?

Allianz medical card commentary

- Covers a reasonably high 5 million annual limit (up to 20 million for limited time) in its basic plan and no limit for its premier plan

- Allianz HealthAssured has unlimited hospital room & board (R&B) and Intensive Care Unit (ICU) days coverage

- Mandatory co-insurance that is upper-capped.

- Comes with upfront discount on insurance charges, good for longer sustainability

- It covers alternative outpatient cancer treatment as charged

- Optional solution available to cover for hospitalization & surgical procedures globally without geographical restrictions, U$ 2 million minimum, yearly

- Allianz Diabetic Essentials enable you to obtain a medical plan protection up to 70 years old even though you have diabetes.

What About Allianz HealthInsured Medical Card?

It has been replaced by Health Assured medical card in Mar 2025. Comparatively, it has much lower annual limits, and does not cover mental health and medical implants. It has also been repriced so you want to consider upgrading to Health Assured if you are eligible.

What About Allianz Medisafe Infinite Medical Card?

It has been obsoleted by Healthinsured medical card. It has also been repriced significantly so you want to consider upgrading to Health Assured if you are eligible.

What About Allianz MediAdvantage Medical Card?

Only if you need to get the best overseas medical treatment for severe illnesses (refer to Overseas Medical Treatment section below). It does provide a generous annual limit of up to USD 4 million but limited to these diseases:

- -Cancer

- -Heart valve surgery

- -Intracranial and specific spinal cord surgery

- -Coronary artery bypass surgery

- -Live-donor organ transplant

- -Bone marrow transplant

What About Allianz Medicure Medical Card?

You should not get this because:

- -Annual limit too low

- -Pre & post hospitalization coverage days too low (60/60)

What About Allianz Booster Care Medical Card (legacy product)?

You should upgrade because:

- -Annual limit too low (max RM 200k only)

- -Lifetime limit is capped at RM 1 million (not future-proof)

- -only covers you up to 80 years old

- -Pre & post hospitalization coverage days too low (60/60)

What About Allianz Diabetic Essential Medical Card?

Only apply for this medical card that provides RM 500k – RM 1.5 million annual limit and RM 1.4 million – RM 4.2 million lifetime limit, if you have Type 2 Diabetes in which application to the normal medical card will usually get rejected.

It offers similar coverage like your normal medical card, on top of diabetes management benefits, where once a year, you will have access to a health screening benefit, claimable up to RM250, Specifically, they are:

- -Medical examination by a Doctor

- -Glycated Haemoglobin (HbA1c)

- -Urine FEME

- -Renal Function test

- -Lipid Profile

Apart from that, Allianz Diabetic Essential Medical Card comes with a premium discount benefit that is applicable subject to the results of your Health Screening Benefit tests.

For example, when you are first approved for the plan and have a good medical report, you enjoy 20% discount on your premium.

Subsequently, by submitting your annual medical reports, you stand to receive 10% discount even if your medical report results aren’t perfect.

But if it shows improvement, you may receive a premium discount of up to 40%, although the premium discount rates are not guaranteed and the rate given may vary from policy year to policy year.

Last entry age at 60, but it can only be renewed up to age 70.

AIA medical card is the Best medical insurance in Malaysia?

AIA medical card commentary

- A Plus Health 2 medical insurance replaced A Plus Med as its flagship medical card in Q4 ’18.

- It has upgraded to 150 days of normal Room & Board (R&B) and Intensive Care unit (ICU), totaling 300 days/year

- Latest iteration comes with 20k deductible with option to convert to 500 deductible at age 60 without underwriting. Also comes with ‘SMART option’ – Specially Selected Panels, Minimise Unnecessary Cost with the Right Treatment to ensure Affordable Premium / Contribution,

- It also provides Emergency Medical Evacuation and Repatriation up to USD 1 mil (do not mistakenly think this is international health insurance coverage)

- Lifetime limit for outpatient kidney dialysis and cancer treatment has been upgraded to no lifetime limit.

- Unique Health Wallet, Prevention Benefit and Protect Boost feature

What About AIA A-Life Mediflex Medical Card?

We opined that this standalone (term) medical card pales in comparison to its medical rider counterpart due to inferior annual limit (RM 180k to 350k only) and room & board rate (RM 350 is the top option available). Suitable option though if you only need short term medical coverage.

What About AIA Med Basic Medical Card?

Suitable if you are very budget conscious and does not need medical coverage beyond 70 years old. Can be bought online direct from AIA website, with 20k annual limit, 80k lifetime limit.

What About AIA A-Life Med Regular Medical Card (obsolete)?

We opined that this standalone (term) medical card pales in comparison to its medical rider counterpart due to inferior annual limit (RM 100k to 150k only) and room & board rate (RM 250 is the top option available). A shared outpatient cancer & kidney dialysis treatment up to RM 375k per lifetime is too low for comfort.

What About AIA Public Takaful A-Plus Med-I Or Booster-I Medical Card (obsolete)?

It is just a Takaful version of AIA A-Plus Med with Booster medical card, so it is subject to the weaknesses stated above.

What About AIA A-Plus Med Medical Card (obsolete)?

It has been succeeded by the newer AIA A-Plus Health 2 medical card (flagship product).

Its weaknesses of standalone lifetime limit for outpatient cancer & kidney dialysis and 2 mil lifetime limit for Plan 200 makes it unfavorable among the other options available.

What About AIA Public Takaful A-Life Medik Famili Medical Card (obsolete)?

It is just a Takaful version of AIA A-Life Med Regular Medical card, so it is subject to the weaknesses stated above.

Great Eastern medical card is the Best medical insurance in Malaysia?

Great Eastern medical card commentary

- The base medical insurance plan Smart Health Protector comes with decent annual limit; with the addition of Smart Health Protectors Plus rider, its annual limit increases significantly

- It has no limit days of hospital confinement but 200 days ICU (intensive care unit)

- It covers new cancer drug & post cancer screening

- High deductible cost saving configurations available, together with retirement option

- Now comes with ‘RM 50 increase in R&B limit every 5 years; up to a cumulative total of 100% R&B limit’ and Psychological Counselling

What About Great Eastern Great Medic Shield 2?

This standalone (term) medical card is comparable, although its room & board rate is capped at RM 200 (RM 200 is the top option available). Great Medic Shield Extender boosts its low RM 150k annual limit by RM 1.5 million

What About Great Eastern SmartMedic Xtra 99?

It has been replaced by SmartMedic Million and SmartMedic Million Extender

What About Great Eastern SmartMedic Million?

It has been superseded by Smart Medic Shield & Smart Medic Shield Extender

What About Great Eastern Smart Medic Shield?

It has been superseded by Smart Health Protector in 2025

Manulife medical card is the Best medical insurance in Malaysia?

Manulife medical card commentary

- Manulife Health Saver medical insurance replaced its predecessor, ManuHealth Elite

- Technically, Manulife Room & Board rate is in a class of its own because after R&B 250, the next Room & Board rate is titled “As Charged”.

- What it means by this is that if you are in “As Charged” R&B rate, you are entitled to the amount for reimbursement is limited up to 2 basic categories of Single-bedded Room available in the hospital.

- This means it is inflation-proof to a certain extent because you are guaranteed a single room no matter what in the future.

- No limit on the number of annual confinement days and a high annual limit plus having outpatient stroke coverage which none other medical card in comparison has this benefit.

- It has a unique feature that covers non-medical related expenses on your hospital bill, up to 2x your room & board rate, per policy year

- Comes with 30% Cost of Insurance (COI) Discount upfront, then to 40% for as long as no claim is made. Once claim is made, COI discount resets and then increase again 10%/year thereafter up to 40% as long as no claim is made. Will not reset even if claim is made after 60 years old and medical card in force for at least 5 years.

What About Manulife ManuEZ-Med Medical Card?

The standalone (term) medical card only has room & board rate from RM 150 to RM 250, with available annual and lifetime limit of RM 150k-RM250k & RM 1.5 million – RM 2.5 million respectively.

Prudential medical card is Best medical insurance in Malaysia?

Prudential medical card commentary

- Prudential most affordable medical card does not use the the term annual limit or lifetime limit. Instead, it replaces them with this – Med Value Point.

- Med Value Point is defined as – if the total claims that exceed the stipulated Med Value Point amount, the Prudential will still be liable to pay 80% of the total cost of the eligible benefit while policyholder bear the remaining 20%.

- Med Value Point increases at 2% of the initial Med Value Point at the end of every 2 policy years, provided no claim has incurred during the 2 policy years.

- With PruValue Med Booster, Med Value Point increases by RM100,000 every year, uncapped room & ICU days, 500-1,000 yearly preventive care benefits on no claim preceding year.

- Pru Value Med can be configured Pru Diabetes Care for diabetics with HBA1c < 8.0%, BMI < 30, total cholesterol < 6 mmol/L, no insulin jab, and without diabetes-related complications, but must be configured as such – RM 200 Room & Board rate + 20,000/50,000 deductible with max 1 mil Med Value point.

- Prudential also has another 2 older medical card range – PruHealth and PruFlexi Medi, on top of PruMedicOverseas providing coverage in Singapore, Hong Kong and China.

- Has the capability to customize the hospital room & board rate and Med Value Point (1, 1.5 or 2 million). It also has has an optional co-insurance like feature, called Med Saver, which policyholder needs to pay RM 500/1k/5k/10k co-insurance for hospitalization, even though it is a cashless admission.

- Higher end (newer) medical card range called PruMillion Med 2.0 / Active instead is used for comparison above, that comes with optional Booster with higher premium costs. The base medical insurance plan comes with decent annual limit; with the addition of Booster rider, its annual limit increases significantly (+ 10 mil – unlimited), yet highly configurable with multiple co-insurance and/or deductible levels.

- Unlimited Room & Board and ICU days

What About Prudential PruValueMed Medical Card?

It has been succeeded by the newer PruMillion Med medical card (flagship product, used in comparison table above).

What About Prudential Prusenior Med Medical Card?

You need to be over 45 years old to buy this, nonetheless, avoid this standalone medical card unless you are really strapped for budget because lifetime limit is notoriously low at RM 225k. Coverage also expire at age 80.

What About Prudential PruHealth Medical Card (legacy product)?

There’s no reason to consider this when you can afford PruMillion Med. Furthermore, because it is an older product, annual limit is maxed out at RM 250k while lifetime limit is capped at RM 2.6 million although you can opt for room & board rate as high as RM 600. Be warned that medical card coverage terminates at age 80!

Hong Leong medical card is the Best medical insurance in Malaysia?

Hong Leong Assurance commentary

- Hong Leong Assurance has a separate number of days for ICU coverage (75 vs 150 days), the lowest among those compared.

- If this is not a deal breaker, then you’ll be glad to know it does not have co-insurance or co-payment due to room & board upgrade

- It also does not have a separate limit for outpatient cancer treatment and kidney dialysis.

- With the addition of the Million Extra III rider, its annual limit skyrockets

- Newer iteration (2025) Medi Shield Pro comes with way better coverage (refer to the comparison table above for full details) especially with Double Pro rider. However, deductible levels options limited to 500 and 10,000 only.

- Insurance charged discounts and auto increase in room rate

How About HLA MedGlobal IV Plus Medical Card?

You should avoid this because:

- Low annual limit (RM 75k to RM 240k)

- Max lifetime limit capped at RM 1.2 million

🌟 Medical Insurance Comparison table 2️⃣: Allianz Life – AIA – Great Eastern Life – Manulife – Hong Leong Assurance – Prudential – AmMetLife – Zurich

This is the Lowest Medical Card Plan (most affordable) from each insurance company

Deductible medical card in Malaysia

Best deductible medical card in Malaysia – which one is it?

Not having a full medical card after retirement could potentially be deadlier than the silent killer – inflation, when it actually hits. I’ve talked to individuals in their fifties who admitted to me they overlooked of getting their own medical card when they were in employment. Then, just before the mandatory retirement, it struck them – nobody is going to cover his post retirement medical bills.

If you are reading this, then I don’t want this to happen to you. Yet, I know what you are thinking – you probably don’t want to get a redundant medical card while you are covered by your company.

If this is your concern, then Second Medical Card aka Deductible aka Top Up medical card is the best for you. See below

When you are employed before age 60:

It could well be a good complement to your company-provided group medical card.

For example, if your company medical card coverage is RM 30k/year, you could get a RM 30k deductible medical card, with minimum premium (RM 1,200). Which means, only RM 30k and above medical expenses will be covered by this second card. (by the way, the deductible amount is configurable from RM 2k up to RM 30k)

When you retire after age 60:

What it means, when you reach age 60, this health care insurance will convert to become a zero deductible card – which means any medical expenses can be charged under this card – at the time when your company medical insurance coverage ceases. This happens without needing you to prove your health condition at age 60. Besides, it also has:

Cheaper? Yes. Peace of mind when you retire? Absolutely.

Understand Common Medical Card Terminologies

If you are totally new to the concept of a medical card or medical insurance, you may wonder:

“What does a medical card cover?” or “What does a medical card do?” or “What is medical card insurance?”

The intricacies of the best medical insurance is not to be underestimated, especially if you plan to retire in Malaysia for long term. Since health insurance, just like any other insurance, is essentially an unilateral contract, knowing the terms and conditions of your medical coverage is absolutely critical.

Why?

To prevent the hassle of dispute with the insurer on what it is not covered or reimbursable when you thought they are covered.

Otherwise, nasty situation like this may happen.

The other health insurance features you definitely want to take note on are:

- Daily Room & Board rate – determines the type of hospital room you can choose to stay in without topping up the difference. It is very normal to go for a minimum RM 200 R&B nowadays, which could be a twin-sharing room. If you want basic single room or above, a R&B of RM 300 and above is recommended. Some hospitals like Pantai Hospital Bangsar or Sunway medical center ever offers suite room which can cost you up to 4 figures per night. Upgrading R&B rate higher than what you are entitled for in your health insurance policy may trigger a certain co-payment clause in the insurance contract. This render you needing to share a certain percentage of the total medical bill with the insurer, aside from paying the difference in room & board rate.

- Lifetime Limit (if any) – specifies the limited sum of medical expenses which can be exhausted throughout the duration of health insurance coverage (usually up to age 100). It does not refresh every year but the best medical cards usually have no limit lifetime coverage.

- Annual Limit (if any) – specifies the limited sum of medical expenses which can be exhausted within any 1 policy year as long as the health insurance is in-force. No worry, it will be refreshed upon your policy anniversary date. If you actual cost of medical treatment exceed your medical card annual limit though, you have no choice but to cover the exceeded amount.

- As charged – covers hospitalization expenses which are deemed medically necessary, and as per reasonable and customary charges according to the schedule set by MMA (Malaysian Medical Association). If a medical procedure was being overcharged by hospital, then you need to top up the difference of amount for which the insurer doesn’t cover.

- Deductible – an amount that you will have to pay for your medical treatment before your medical insurance plan will begin to pay for you.For example:

Deductible level of RM 5,000 means when Ali got admitted to hospital and the medical bill costs RM 9,000, Ali has to pay RM 5,000 first before his insurer pays the balance, up to the medical card annual or lifetime limit.

- Co insurance – an amount, usually in percentage (10%, 20%) of the total medical bill which you have to fork out on your own, regardless of the medical bill amount. The insurance company does not cover for this amount. Usually, the best medical card in Malaysia comes with zero co insurance.

- Pre or post hospitalization coverage – could include two or all of these: diagnostic tests (x-ray scans or lab tests), specialist consultation, treatment, prescribed medication and second medical opinion

- Home Nursing Care coverage – a public or private residential facility providing a high level of long-term personal or nursing care for persons (such as the aged or the chronically ill) who are unable to care for themselves properly.

For example:

Co insurance of 10% means when Ali got admitted to hospital and the medical bill costs RM 9,000, Ali has to pay RM 900 while his insurer pays the remaining amount, up to the medical card annual or lifetime limit.

- Last entry age – the last age where you can buy a medical insurance policy. Normally it could be at 60, 65 or 70.

- Exclusions – illnesses or medical conditions that are not covered by a medical card or medical insurance. Common exclusions include pre-existing conditions, specified illness occurring during the first one hundred twenty (120) days of upon policy being in-force (hypertension, cardiovascular disease, diabetes mellitus, all tumors, cancers, cysts, nodules, polyps, stones of the urinary and biliary system, all ear, nose (including sinuses) and throat conditions, hernias, hemorrhoids, fistulae, hydrocele, varicocele, endometriosis including disease of the reproductive system, vertebro-spinal disorders (including disc) and knee conditions), cosmetic treatments, dental conditions, congenital abnormalities, pregnancy-related conditions, AIDS or sexually transmitted disease, self-inflicted injuries, drug addiction, mental or nervous disorders

- Pre-existing Condition – illnesses that a policy holder has a reasonable knowledge of on or before the effective date of insurance. Policy holder may be considered to have a reasonable knowledge of a pre-existing conditions if he or she had received or is receiving treatment, medical advice, diagnosis…and/or there is a clear and distinct symptoms and/or the symptoms of an illness would have been apparent to a reasonable person.

Also, do you agree that medical costs will carry one or more of the characteristics below:

- Most unexpected

- Most unavoidable

- Possibly long term & recurring

- Most impactful to retirement nest egg

How impactful, you asked?

For minor condition like cataract or appendicitis, the cost of such treatments may hardly dent your retirement nest egg. But what if major conditions like below hit you?

Medical costs have escalated around the world and this is no different in Malaysia. Medical inflation averages about 10% each year and is projected to rise due to advancement in medical technology.

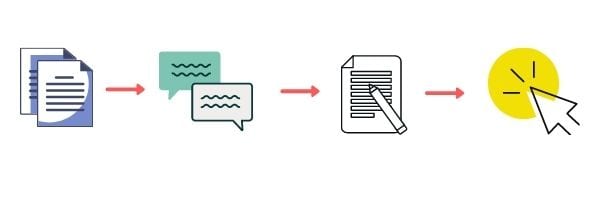

How to Apply for the Best Medical Card for yourself and Family, Fast

-

Obtain Quotations to Compare

Engage 3 to 5 insurance agents from top insurers to request for quotations, or alternatively, engage a single independent financial adviser to get the same quotations in one place

-

Get Advice

Compare the premium pricing among insurers’ quotations based on the coverage features you need while weighing the pros and cons of each options. Filter real advice from sales talk.

-

Complete Fact-Finding

Once you have decided on the best medical card option that fits your budget, the authorized intermediary will need you to fill in questionnaire declaring your lifestyle and health condition / history.

-

Submit Application

Together with your filled in questionnaire, submit your personal details online via the insurer’s portal to kick-start application. Underwriter may approve your application promptly or he may require you to do additional medical check or request more details on your medical history before offering you a standard acceptance offer, or conditional acceptance offer with loading or exclusion.

Procedures to Utilize a Medical Card

When you want to seek medical treatment due to illness/accident at private hospitals, you should try to go to a hospital that is covered by the medical card.

Hospitals that are covered by the medical card are also called Panel Hospital. Panel hospitals will be able to provide cashless hospital admission hassle free.

Of course, you still can get admitted to other hospitals, but you will then need to settle in full your medical bill upon discharge and then later file claim to reimburse the medical expenses from the insurance company, usually within 30 days.

Admitting to a panel hospital saves you these paperworks because the insurance company will pay directly the hospital provided a Letter of Guarantee (GL) is issued by the insurer to the hospital upon your hospital admission.

Bear in mind hospital may still need to charge you some deposits upfront to cover for items not covered by your medical card.

In order to minimize any unnecessary delays, it is the norm to follow some pointers below as part of the claims process:

- Before undergoing any non-emergency medical treatment, call the customer care helpline of your insurance company and confirm whether your doctor’s proposed treatment is covered in your medical insurance policy and whether your hospital of choice is panel hospital

- Request your doctor or specialist to fill in and sign your claim form. He or she may charge a small administration fee which may not be covered by your medical card

- If you are admitted to a non-panel hospital, remember to submit a written notice to your insurance company as soon as possible, or within 30 days of the treatment period if you are diagnosed with a condition or illness that is claimable under your medical insurance policy

- Attach all filled claims documents with the original bills and receipts, investigation or diagnostic reports if any, full doctor’s medical reports, physician’s cost summary of treatment and referral letter, if any.

Understand the Common Reasons your Medical Claims can get Rejected

Your servicing intermediary can assist you with the claim although there is really nothing stopping you from doing it yourself by submitting the claims using snail mail or walking into insurer’s servicing office.

Furthermore, most insurers also have their electronic portal (or app) to submit your claims paperless and you will be paid via direct online banking – it is much faster and convenient so check this option before you hastily submit a claim the manual way.

Claims Rejected?

Communicate with the servicing intermediary and review claim submission again before filing an appeal.

Seek advice from PIAM Information Centre and Ombudsman for Financial Services (OFS) if you opined that your claim has been unfairly rejected.

Standalone versus Rider Medical Card

What is the difference between a medical rider and a term (standalone) medical card?

Read below –

What You Should Know When Buying Standalone Medical Card Vs. a Rider and Make the Right Decision

Compared to guaranteed renewal clause in medical rider, some standalone medical cards have conditional renewable clause whereby – if you are hit with a long term/ critical illnesses, insurer will likely impose unfavorable terms & conditions like premium loading, coverage exclusion from the illness and even rejection at your next renewal cycle. Think of it like renewing your car insurance after a major accident.

On the other hand, rider medical card is confirmed to have “Guaranteed renewable” clause whereby as long as you pay for the policy on time, insurer is obliged to renew the policy (provided the lifetime claim limit, if any, has not been exceeded).

The question you need to ask yourself is this:

Am I getting this medical card today for short-mid term or for long term? And will I be able to upgrade to or rebuy another medical card in the future given my current health condition?

For both types of medical cards, cost of insurance or insurance charges, however, is not guaranteed. That means insurer can hike the insurance charges which may affect your premium directly or indirectly.

This scenario normally requires approval from central bank and it affects every policy holders having that medical card (does not discriminate or single anyone out)

Overseas Medical Treatment & Coverage

By the way, visitors to this page also frequently ask – “Can I buy a medical card which covers me in foreign countries?” or “Can foreigner buy medical insurance in Malaysia?”

The answer to the first question lies in the video below, while for the second question, the answer is YES, provided you at least have long term residency visa like MM2H visa. See more details in our other article – Retiring in Malaysia : Get the Best Health Insurance & Prevent Medical Costs from Touching your Retirement Nest Egg.

Do I even need an overseas medical card or health insurance coverage?

Answer = Yes if you have a rare medical condition that healthcare providers in Malaysia do not possess the expertise or equipment for treatment.

But then the next question is – how would you know that beforehand? You don’t, agree?

So by the time you realize this (the insufficiency of local healthcare services for your medical condition), you won’t be able to get yourself insured already for overseas medical coverage.

However, if you really have deep pockets and are concerned about the inadequacy of Malaysian medical expertise or want to have that options to be treated overseas, then this is for you. But then again, you could have probably gotten yourself a pure international medical coverage instead of a quasi-international medical card from any Malaysian insurer because some of them only offers coverage a pre-defined set of critical medical conditions.

Answer = No if you are not a globe-trotting executive or nomad. Even if you are on frequent business trips, as long as you are not outside of Malaysia for 90 days consecutively, you likely don’t need an overseas medical coverage.

No doubt that overseas medical card comes access to well-know global healthcare providers, with very high annual and/or lifetime limit (usually in US Dollar), not only to account for the cost of insurance but also travel-related expenses costs. And that comes with a cost in the form of higher premiums than a standard Malaysian medical card.

Can I use my Malaysian medical insurance overseas?

Aside from coverage in Brunei and Singapore (for some Malaysian medical card), all standard Malaysian medical cards do not offer direct (cashless) coverage for elective overseas medical treatment, although they may provide a value-added services such as a second opinion benefit.

For that matter, if you are hospitalized outside Malaysia for any emergency medical procedure, do not expect you will be reimbursed in full for your medical bill.

Insurers are not stupid; they will only reimburse you an amount that is up to what is defined in Malaysian Medical Association’s (MMA) Schedule of Fees when it comes to medical procedures, and what’s reasonable and customary for other medical expenses such as prescriptions and medical supplies.

see below as we explain more.

Insurance company will use this information to determine the amount they are willing to pay for a particular service in a particular area.

As an example, assume stroke treatment at a private hospital is around RM40,000, but when you were in United States, you had a stroke and it set you back for US$50,000 for an emergency medical procedure.

How much do you think your Malaysian insurer is going to reimburse you?

Now It’s Your Turn

Phew! We put A TON of work into this guide. So we hope you enjoyed it.

Now we’d like to hear what you have to say.

Which medical card feature that is the most important to you?

It is Annual Limit or Hospitals Room and Board rate?

Or something else.

Let me know by leaving a comment below.

Author: CF Lieu

CF Lieu is an independent financial adviser (IFA) with CFP qualification and licensed by the Securities Commission of Malaysia to conduct regulated financial planning activities.

Also check out, the best medical insurance for senior citizens in Malaysia

Get exact medical card price Malaysia HERE

Best medical card plan for family in Malaysia? Get your advice here

Hi Lieu, I was looking at some standalone medical cards like Generali Smartcare Optimum Plus, Allianz Medisave Infinite+ / Healthinsured, Hong Leong Medisaver. It is written that renewable is guaranteed, except if the product is withdrawn (which i assume can also happen in Life Policy of the Medical Rider?). There is also specific quote on no selective loading or exclusion due to claim the previous year.

I was reading your point that the risk of standalone medical card is the lack of guaranteed renewable as compared to Medical Rider.

If there are no risks of renewal until 80/100years old, does this mean that I can opt for such standalone medical cards if I have no interest in the Life Insurance, Critical Illness, Investment links etc.

I see that the standalone medical cards also have >2mil Annual Limits , and most criterias are comparable to Medical Riders.

Is there something I am missing? Thanks!

How do I reach you? Pls leave your hp no in my email. I need an unbias opinion on ease of claims for Msian medical insurance.

You can start here Kylie: https://howtofinancemoney.com/contact-details

Hi CF Lieu, thanks for all the work that went into this elaborate article. With all these medical cards, how frequently do they increase their premiums? Is it possible that a medical card from a particular company appears cheap (due to minimum quotable premium), however they keep increasing their premiums very frequently thereafter?

Thank you

Yes it is possible 🙂

Hi, i have learn alot form you and very much thanks for that.

Have you heard of Gathercare? Its a first medical cost sharing platform

Hello Mr Lieu,

Good day to you. Your comparison table is help us a lot. Thanks.

Appreciate if you can add guarantee renewable/non-cancelable in the comparison table. Maybe this is one of the important criteria for consideration.

Thanks

Welcome, thanks for your kind comment and feedback 🙂

How about MediSaver? They seem to have a quite good offer also. Could you comment on them pls?

My comment is:

1. Take your Medisaver brochure

2. Compare it against the comparison table above.

3. You get your answers 🙂

Hi Lieu,

My understanding is that rider medical cards attach themselves to a basic insurance plan. Although the medical card itself are guaranteed renewable, I believe it still depends on the basic insurance plan. If the basic insurance plan is only renewable up to age of 80, and the medical card literature states that it is guaranteed renewable until age of 100, I think still it will be void after age of 80, because the basic insurance plan that it was riding on has lapsed/terminated.

Please confirm my understanding.

practically, no basic plan has renewable age that is less than attach-able rider renewable age

I am considering on moving from the USA to Malaysia. 52 years old. But I have a pre existing medical condition. All private insurance companies will not cover me. So is there a way to get national healthcare and supplement with private? Please help. Thanks.

James, what medical condition and which private insurers which have rejected you so far?

I am considering on moving from the USA to Malaysia. But I have a pre existing medical condition. All private insurance companies will not cover me. So is there a way to get national healthcare and supplement with private? Please help. Thanks.

How about MCIS Life MaxHealth Plan ? Do you think it is also affordable and equally good with the other products as mentioned above ?

Are you looking for a ‘Yes’ answer? 🙂 Because it sure does sound like you are. Also affordability is subjective, no?

I just had a mild heart attack brought on by hypertension.Prior to this, i have nvr been ill. I do not have other medical conditions. Is there any mefical card that will accept me as my angiopladtic set ne back by 15k in in non privy hospital wic made me realises too the big differences in private n public

having hard time understanding this part of your sentence: ‘angiopladtic set ne back by 15k in in non privy hospital wic made me realises too the big differences in private n public’

Can you rewrite?

Hi , it means i went to a semi govt hospital and had to pay from my own pocket RM15k for angioplasty n hospital inpatient expenses

I see, did u now try to get a medical card for yourself?