The Abusive use of the term “Financial Planner“

Just about everyone who is involved in some small way in personal finance related business claims to be one. And that includes anyone from insurance agents to mortgage agents and bankers. Even loan shark call themselves financial advisers. One of the grouses we all have is the fact that unqualified and uncertified people are claiming to be financial planning advisers and there is no enforcement to make sure people are not hoodwinked by non-professionals. This has created lots of confusion in the market place as to who and what financial advisers are.

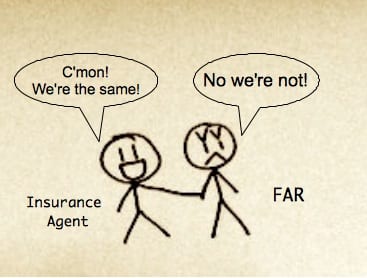

Financial Planners are not glorified insurance agents

The insurance industry has long established itself although only 41% of Malaysians are insured. This industry came into the country more than 100 years ago. Many agents started to either move into unit trust sector or include it in their portfolio of products offered by the 1990’s. About 15 years ago, financial planning industry emerged – and since then, it has been moving forward, albeit at glacial speed, from product based to needs based.

Fact is – Malaysian society is slowly evolving into one where financial commitments and goals in life are more complex and therefore need financial plans to cater to their expectations. It can no longer be a one-size-fit-all approach and product centered approach. Adding to the confusion are different designations used such as wealth planners, life planner, wealth adviser, estate planner – which is puzzling even to those in the industry. Some run at the mention of financial planning, afraid of being cornered into buying a batch of financial products they may not need. To them, insurance embodies all the financial planning they need and they do not see the need for anything more or anything else.

A good planner uses layman language

The big world of financial planning with its jargons can be overwhelming. Communication needs to be made simple and in bite-size. The use of analogy and everyday’s situation to illustrate a concept finds its way to the heart of a client. For example, a financial planner is an architect and interior designer who puts the elements in a house, in this sense, the client’s. The client tell how he or she wants to build the house, how it looks like and planner will construct it accordingly.

1 Malaysia, 2 regulators

Bank Negara oversees all matters dealing with insurance, while the Securities Commission looks at investment products and regulate financial planning activities. Which is good. Except that it poses a challenge for advisers in terms of certification requirement. A financial planner will inevitably include insurance and unit trust products in his plans for his clients and each of these industries need a different set of qualifications and training, not to mention continuous professional education for license renewal. In short, for a financial planner to develop a client’s financial plan and give advice on a host of suitable financial products, he needs to possess a string of certifications by both BNM and SC. There is no doubt that a single licensing framework should be harmonized to regulate the industry. This will reduce the cost of compliance and make it easy for practitioners to practise.

Got to be smart to stay afloat

A financial planner is multi-faceted in that he/she has to study the needs of the client and match those needs to the products available. This is tedious work and it involves a high level of knowledge in financial products and also some understanding on future trends in lifestyle, socio-economic and politics. The time spend in fact-finding, consultation, and in formulating plans would need to be compensated adequately and therefore a fee is charged for this advisory service. Now, not everybody sees the value of this fees, so the business model currently is a hybrid of fees + commission/incentive. As long as the awareness level is not there (the value of paying a fee just like an accountant or lawyer), financial planner will find it hard to make ends meet. But paying a fee actually removes the conflict of interest from pushing a clients product he/she doesn’t need. Nonetheless, client may also want to bear in mind that just because someone earns their income from commission does not mean they will do bad planning for a client. Product campaigns by definition have nothing to do with the needs of the customers – just try and motivate sales people to move a particular type of product for the commission and it compromised the belief in their ability to truly “put client’s interest first” when motivated by commission. So any advisory fee- even a small one, is a clear signal that a consumer values and recognizes the importance of objective planning advice separate from product information.

Challenges in the financial planning industry

We have yet to know if in the near future, Malaysia will follow the footsteps of countries like UK, India, Norway, Finland, Denmark and the Netherlands in banning commission structure for financial planners. Good or bad, it is a clear sign that if this happens, the ones who have adopted the advisory-based approach rather than product-based approach, will find it easier to adapt. It is also a sign that the industry is progressing towards a higher level of professionalism.