I have three words to share for a gradual but surefire change to your financial situation this year, regardless of your current situation: Now, 20-Mile-March, and Defy. Have you got three minutes?

1. NOW

The power of NOW is immense. Don’t get me wrong, I think the original book with the title – The Power of Now (which stresses the importance of living in the present moment and avoiding thoughts of the past or future) is great but the same does not apply for instant gratification money matters.

Like buying gadgets on credit. Splurging money on vacations which you’ve yet to earn.

If we can, instead, plan for personal financial improvement now. Build children education fund now. Accumulate retirement nest egg now. Save and invest now. Get protection from financial calamity now. Plan a financial road map now. Free ourselves from all excuses why we can’t start all these now, and muster enough willpower to actually commit to doing it.

Appoint your spouse or family member as your accountability partner. Make a bet that if you fail do commit to any of these things, you will do something which you hate. Like washing the dishes or cleaning the toilet for a month.

Don’t say someday. Another time. That is equivalent to NEVER.

Small efforts compound over time. All these things will snowball and add to your worth. Stop always chasing for the highest return in investment or the magic pill to get rich. Chance are you are quite rich by your mandatory pension fund (EPF in Malaysia) although it just gives 5-6% return per year. See what I mean that it’s not the instrument with highest return makes the most of your monetary worth?

2. 20 Mile March

Let me tell you precisely what this term means.

It is the practice of consistently hitting prescribed targets, day after day, year after year, regardless of the prevailing conditions. For an individual, the common personal financial improvement could mean increasing the previous year’s savings (reinvested) by 10% every year, regardless of the business cycle affecting your company,industry or business. Inflation will always be there, commitment will increase but just set the goal nonetheless. In good years of business, stick to 10% so you don’t overextend yourself. Perhaps take a vacation to reward yourselves if you’ve got extra. In bad years, give it everything you’ve got to get that 10%. Just make it happen.

This sound like contradicting the conventional wisdom of saving more during the good days, but in the long run, when most people don’t see the fun in their lives, they stop doing that something preventing them from having fun.

LIKE What I wrote? Get notified when I write something like this, and get free financial knowledge while at it.

In a nutshell, it is to avoid getting burned out, distracted by the next new shiny toy, or demoralized by a setback. Otherwise, this will leave an unending trail of un-achieved resolutions in their wake.

How this term was coined, full story HERE – Jim Collins, author of Great by Choice

3. Defy

If you perceive that the world is reasonable or fair, you’re going to be depressed and disappointed most of your life.

However, the world does, actually, make a lot of sense. But in a way you don’t expect. We all know by now that working hard is not enough. Being smart is not enough. Desperately wanting stuff is not enough. Your instincts and upbringing may tell you otherwise. Sorry but the sooner we can accept that these are wrong, the happier we will be.

The thing that will hold us back the most from personal financial improvement, throughout our entire life, will be ourselves. We will know what to do. We will want to do it. And yet we will find ourselves failing, and we don’t seem to know why.

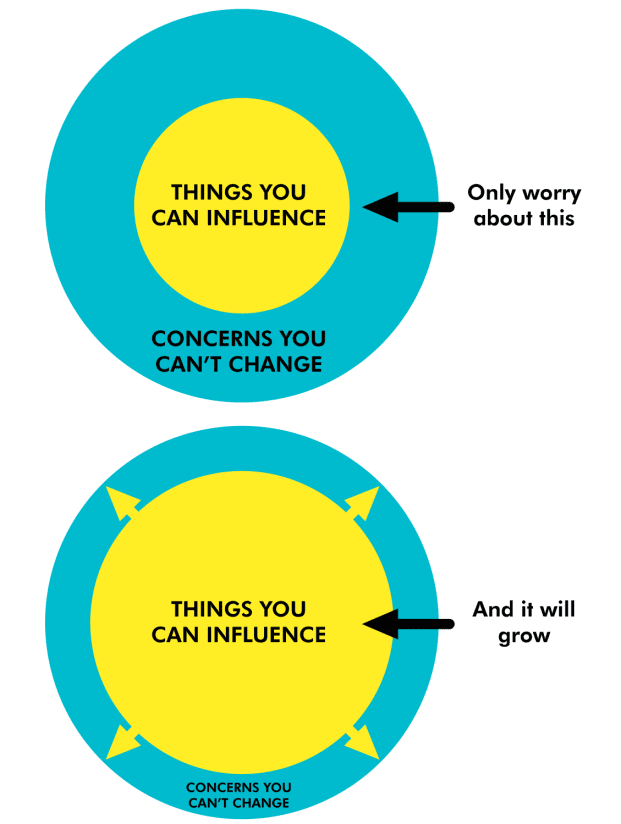

People reflexively points the finger to the world when this happens: “inflation is killing”, “the economy is bad”, “company gives bad increment”. Externalizing leads only to denial and pain. It is a vicious cycle. What we need to do – all we ought to do – is look inside ourselves, and ask what, if anything, we could be doing differently. If we are sure that the issue outside our power to influence , like how the market sways daily, then drop it, and move on.

We will then be able to channel our productive energies into things that truly improve our lives.

Inspired by original post by Oliver Emberton – 3 Words of Advice for the young and ambitious