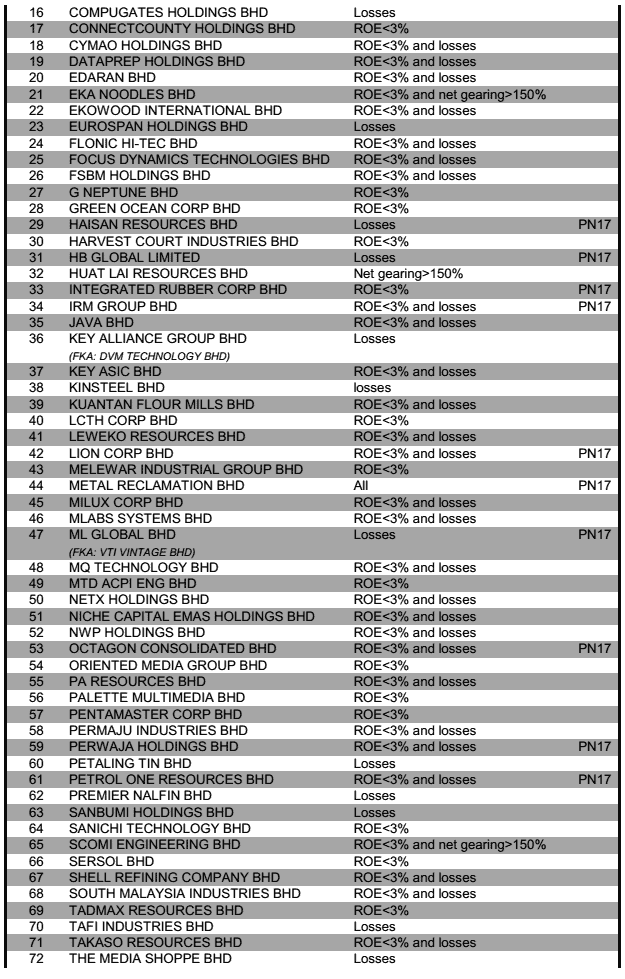

It is common sense not to invest in stocks or warrants of PN17 or GN3 companies unless you want to increase the odds of losing your hard-earned money – which in that case, going to Genting probably gives you more thrill. Apart from that, it is equally prudent to not invest into companies with one or more of the criteria below.

-

Balanced sheet shows too high leveraged (net gearing > 150%)

-

Operating losses for 3 consecutive years (3 Years Negative Earnings Before Interest and Tax)

-

Low return on equity (5-Years Average ROE < 3%).

Some counters I could relate to are XOX (a really small telco, I wonder anyone you know is using XOX? I don’t), Utusan Melayu (no surprise there!), Lion Corp, PentaMaster, Perwaja Holdings, and Takasa Resources.

Which of these you invested in before? 🙂

Source: Phillip Capital Management (PCM), EPF-Restricted Stocks List